“We actually think that the yen’s going to strengthen over the next three, six, 12 months because the trade deficit is going to turned into a trade surplus, especially for goods and services, because tourism is going to keep booming here.” John Vail, chief global strategist at Nikko Asset Management, discusses the Japanese yen, central bank policy and the stock market. He speaks with Shery Ahn and Haidi Stroud-Watts on “Bloomberg Daybreak: Asia.”

Key Charts

The Japanese stock market Index (Nikkei225) is arguably the highest valued stock index in the world at the moment. The index is currently trading towards a 34 year high record fueled by many years of an ultra dovish stance by the Bank of Japan.

Several big investors, like Warren Buffet, have been aggressively betting big on the world’s third largest economy, and they are reaping the rewards, however there are some cracks showing.

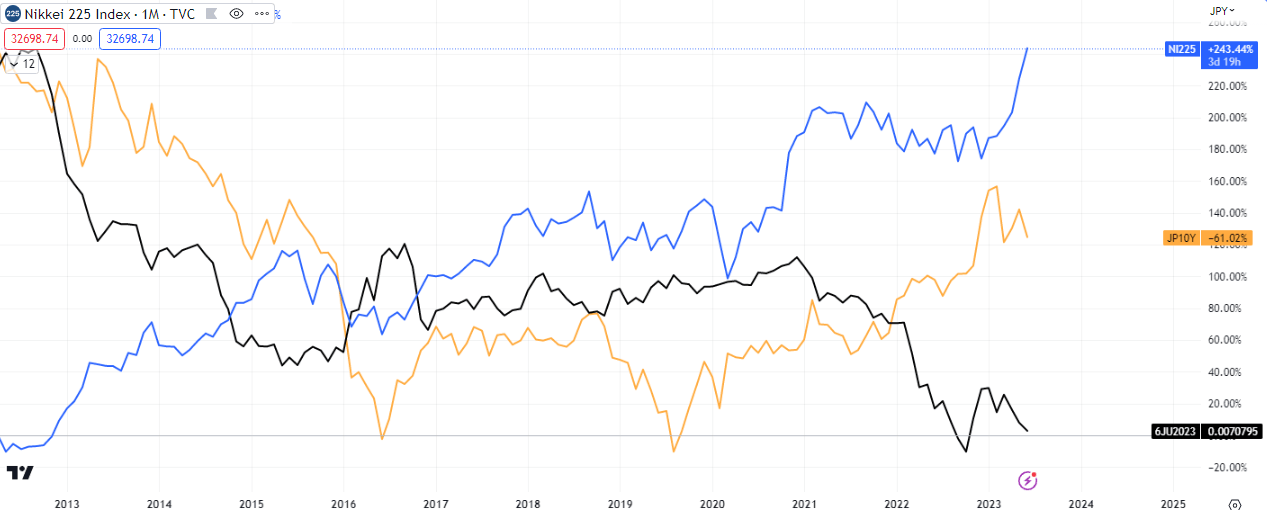

This chart shows the overall situation with the the Nikkei225 as well as the Japanese Yen and it’s 10 Year Treasury market. The currency has a rather tight positive correlation with it’s 10 year bonds and a negative correlation with it’s equity market.

From 2020 the Nikkei225 and the Yen have parted ways as expected but for every spread there is the inevitable close of the spread. We can expect the Nikkei to drop toward the mean and the Yen to rise in tandem. What makes this even more compelling is the fact the the 10Y treasury has been rallying since 2022 while the Yen has not, despite the positive correlation.

The Carry Trade and Oil

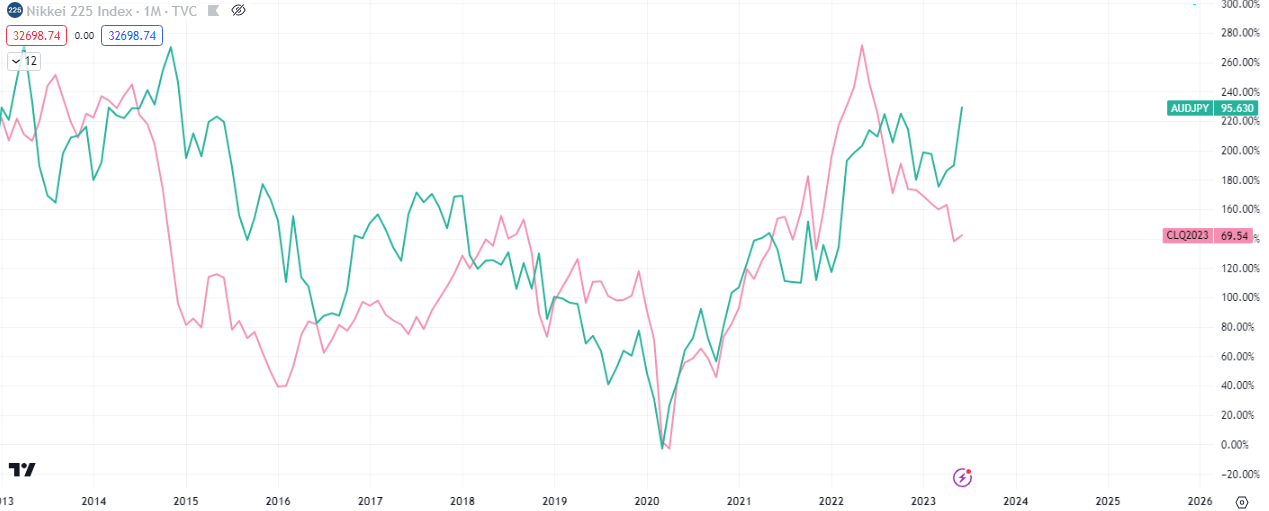

Other related markets to watch are oil and the Aussie-Yen Yield. The oil market is key because Japan import over 90% of it’s energy need, however with the country deciding to bring their idling nuclear reactors online, it is possible that negative correlation with oil may reduce over time.

The currency pair AUDJPY has been rallying for months as a massive risk on sentiment prevailed in the general market. Flows to the Aussie, which has a high yield, could slow down drastically if a risk off sentiment commences, with the Yen been one of the main beneficiaries of this potential situation.

Premier League

Premier League