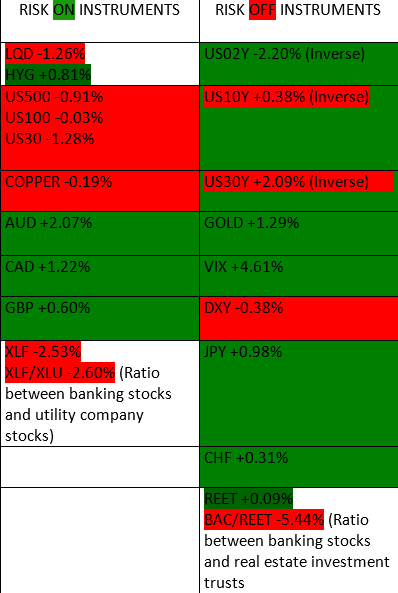

Risk Table for the week (05/08/2023)

On the table today we have a mix of closes with risk off tilt. There are some clues we can gather from some of the closes and the resultant spreads that occurred on Friday’s close.

US Equities, Copper and Financials all closed lower, thus showing a slight aversion to risk, at least on the week. With the demand on the dollar index’s weekly chart still looming, the risk off narrative could gain momentum this week.

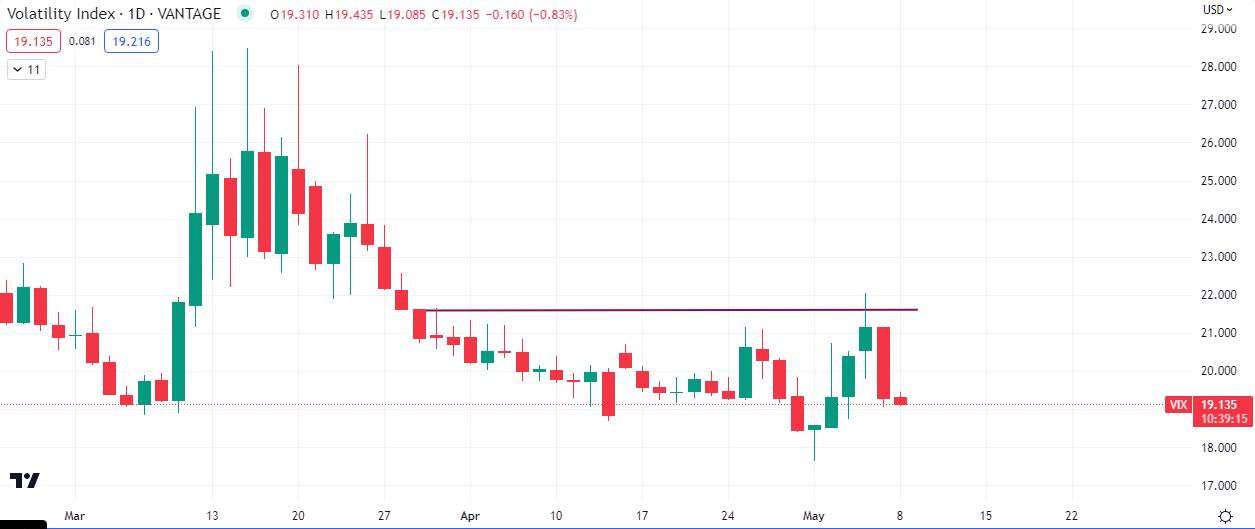

A counterweight to the risk off narrative is the situation on the the volatility index.

Although $VIX closed 4% higher on the week, it tapped into liquidity last week and price got rejected, setting up a likely drop to the 17.000 area. This would be quite bullish for equities in the short term.

Spreads of the week

Spreads to consider going into the week are for the following instruments

EURUSD: Closed higher by +0.01 on the week and should close lower in the direction of the risk on basket, which closed lower

CADJPY: Closed higher by +0.18% on the week and should close lower relative to the risk on basket.

AUDJPY : Closed higher by +0.91% on the week and should also close lower relative to the risk on basket of assets.

These currency pairs basically diverged on the week at Friday’s culmination if trading, and are likely going to test the lows of last week if the right mix of factors align to spur a markdown.