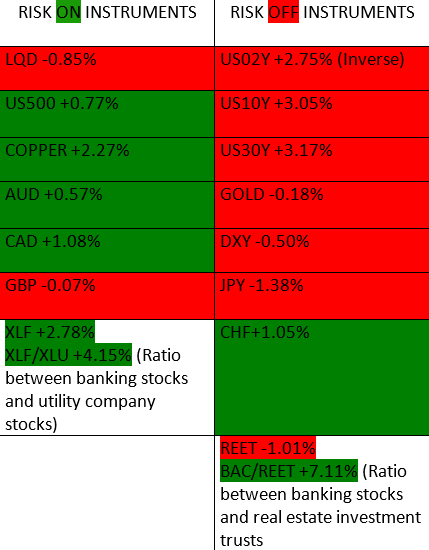

Risk ON Risk OFF Table for 04/17/2023

On the board today we have a mix of closes with a stronger tilt towards a Risk ON sentiment from Friday’s close. Although it was not an absolute tilt it was still a considerably strong tilt towards an increase in risk appetite among investors.

As we stated in our earlier article here, in March, we expected volatility to drop off and lead to an rally in equities and commodities. That trend has continued well into the middle of April, however some dollar strength is on the horizon and this may shift the sentiment soon.

$SPX, $NDAQ and $DOW all posted gains for the fourth consecutive week as market volatility ($VIX) kept loosing steam. It looks like investors are buoyed by the recent dovishness of the Federal reserve and they expect them to scale back their quantitative tightening program due to the bailouts the apex bank has been forced to start to curb the banking crisis.

Copper ($HG1!) closed the week higher by +2.27%, the Canadian dollar closed up +1.08% on the back of strong economic data last week. We also saw massive improvements in banking stocks which led the financial index up by a whopping +4.15% against the Utility stock index and +7.11% against Real Estate Investment Trusts.

Gold is currently flirting with it’s all time high, although we did see a small pull back on Friday’s close.

It is important to point out that the higher the yields of bonds, the less attractive they are to investors, so the increases recorded last week were negative for government debt.

The Swiss Franc managed to post a gain of +1.05% and was the sole gainer in the risk off basket of instruments.

As the new week commences, investors will be watching what happens with the US Dollar closely, as well as volatility. The VIX has had 3 consecutive bearish weeks and may be approaching extremes.

For more understanding of risk on and risk off sentiments, please read this article.