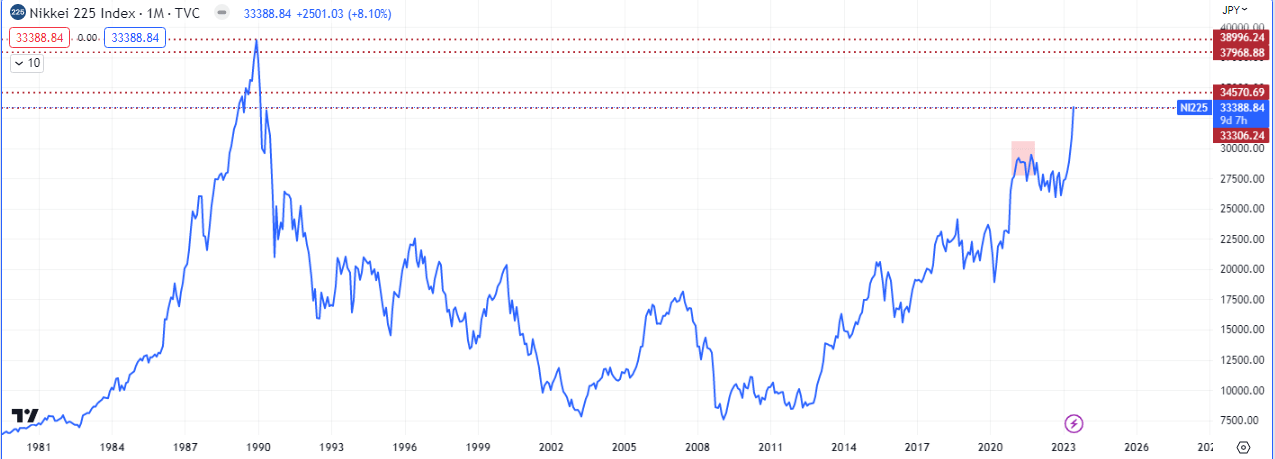

Japanese stocks have been climbing up to the moon, up nearly 28% this year. In a previous article, I discuss the situation on the Japanese Yen and the 32 year old record high being approached now on the NIKKEI225.

Billionaire investor Warren Buffett’s Berkshire Hathaway traveled to Tokyo and increased his investment in five of Japan’s trading houses.

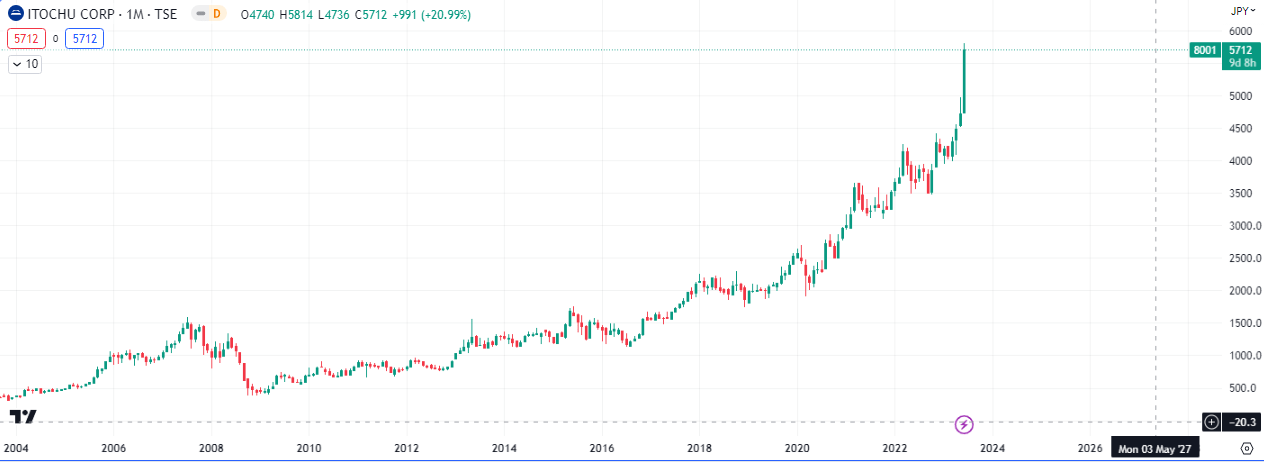

A press release from the company Monday detailed that Buffett has further increased his stake in the trading houses, Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo, indicating that the billionaire is more comfortable deploying capital in Japan than in China or Taiwan.

Berkshire said its stakes in trading houses Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo were raised to an average of 8.5%. This comes after Buffett flew to Tokyo in April and announced he boosted his stakes in the trading firms from 5% to 7.4%.

“Berkshire Hathaway’s intention continues to be to hold its Japanese investments for the long term. Depending on price, Berkshire Hathaway may increase its holdings up to a maximum of 9.9% in any of the five investments,” Berkshire wrote in the press release.

Berkshire noted Buffett “will make purchases only up to an ownership of 9.9% in any of the five investments” and “will make no purchases beyond that point unless given specific approval by the investee’s board of directors.”