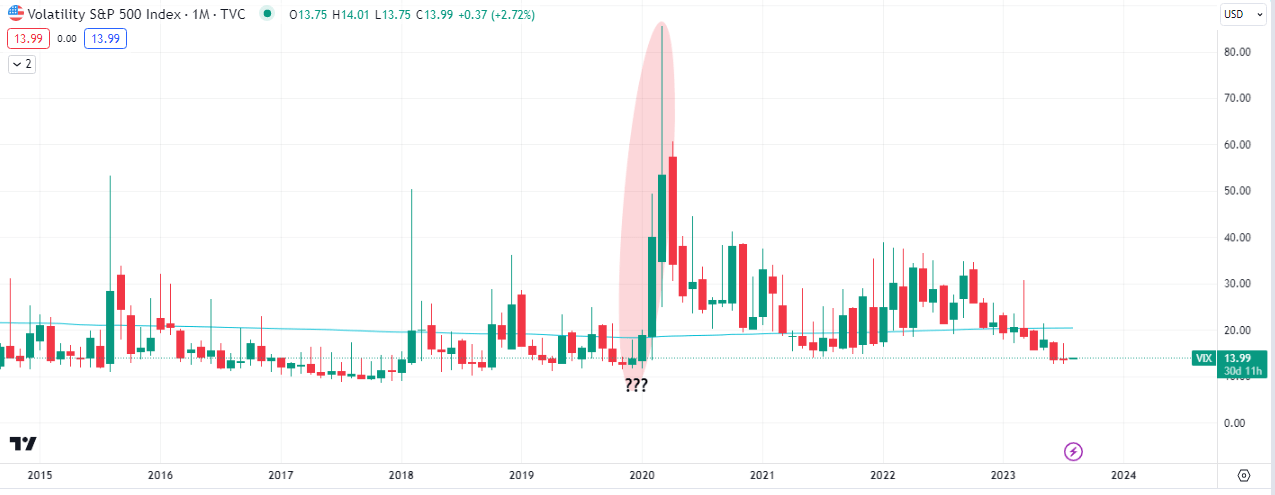

The volatility index has been on the decline most of this year and is currently trading at the low of February 2022. So far the price action over the past two weeks suggests that it is still going lower, although now seemingly in ‘over-sold’ territory.

Given the bearish close from last month’s pin bar, the odds are in favor of a continued decline, which favors stocks. However two other prices will take center stage in the coming months; January 2020 and December 2019.

Both of these levels were areas where a vast amount of buying came in as governments started churning out stimulus during the pandemic. Any inability to close below 11.75 and 11.71 followed by a higher close the next month, increases the odds of a volatility spike. The buying spree seen in stocks looks set to continue as short sellers continue to get decimated, but it’ll be wise to keep one’s eyes on the $VIX for potential turning points for pullbacks.

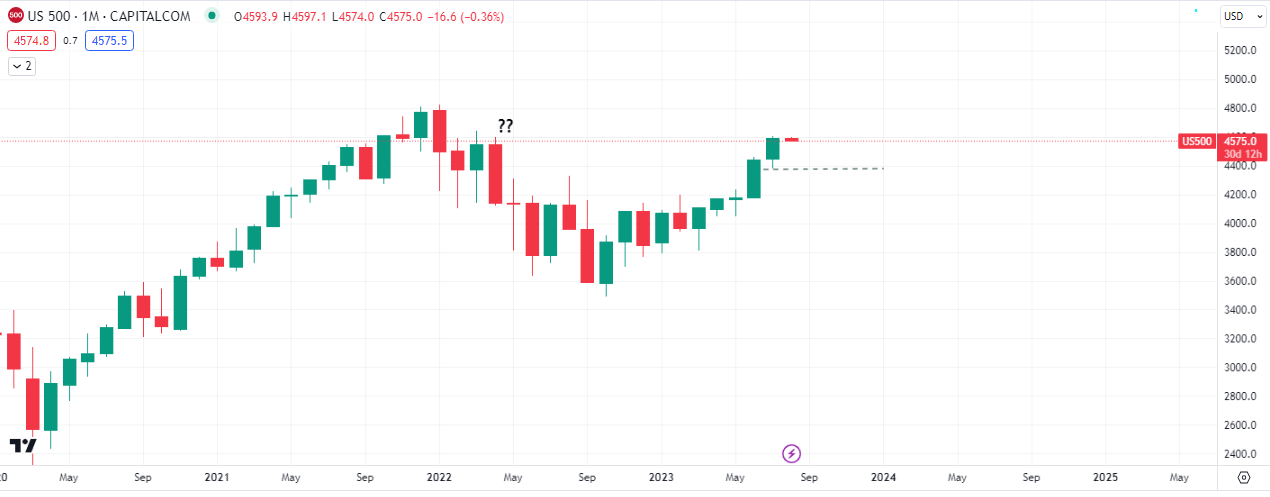

The $SPX is in an uptrend but could not close above the high of April 2022, leaving the possibility of a pull back to low of July or even June 2023 on the table.

It is noteworthy to point out that the risk on faltered last week with AUD, CAD, GBP and EUR closing lower on the week, while the $SPX closed higher on a declining $VIX. This is a mixed narrative with a spread that should close this week with stock receding.

Late last year and earlier in the year we called the rally in equities by watching the $VIX, we are still doing that and the current situation calls for some caution until we get a clearer picture on the the direction of volatility.

Premier League

Premier League