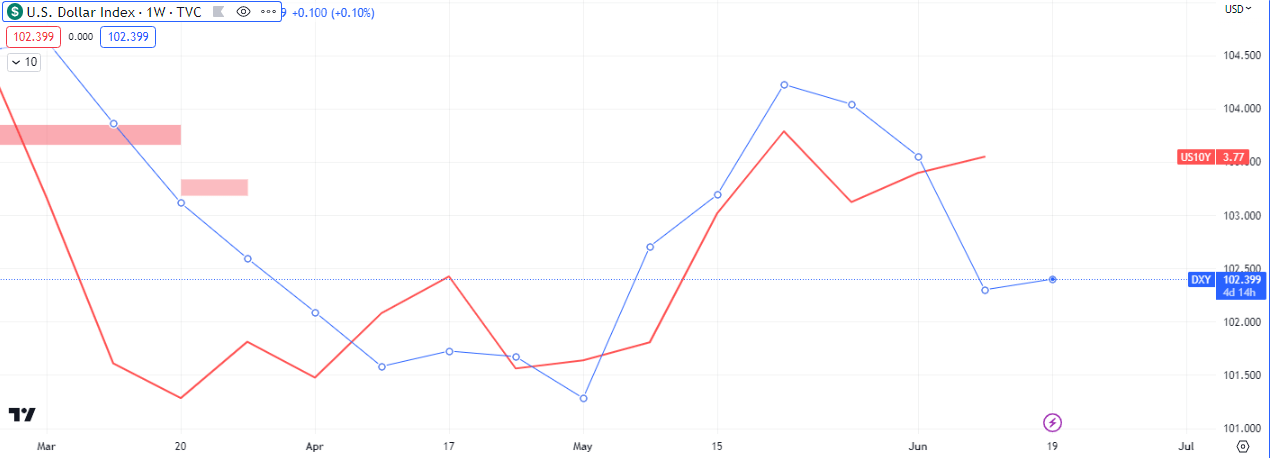

The USD (greenback) continued it 3 week losing streak as the dollar index ($DXY) kept dropping during last week’s trading sessions. A rate hike pause and a surprise in the CPI caused a bit of uncertainty in the market during the week but dollar bears were relentless.

The $DXY closed bearish on Friday as the powerful multi-week risk on sentiment we called here in March, continued on, relentlessly.

With the US 10Y treasury rising last week, we can begin to anticipate demand coming back into the dollar, in the medium term. Last week’s bullish close added to the the narrative, as that range can now act as support going into this week.

The risk on sentiment kicked in tandem with some hawkishness in the central bank policies of some key commodity currencies. The Aussie (AUD) closed higher by +2.28% last week, while the Looney (CAD) finished up +1.43%.

$SPX also closed higher +2.61% as buyers on the $VIX could find no purchase and Oil closed higher $2.5% on renewed hopes of a China resurgence.

Technically the target for this week’s uptick on the daily chart for $DXY is the gap fill of last week Thursday’s open.

Premier League

Premier League