So far in 2023, there has been some cause for optimism from investors regarding the equity markets. January saw a continuation of October and November 2022’s rally which had been dampened by a red month in December. We are currently trading above December’s high on the S&P500.

In this report, we take a look at the positioning of some key markets participants in the metals and bond markets to get an idea of what we can expect in the equity markets this quarter.

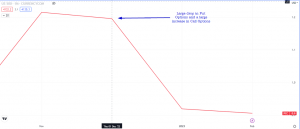

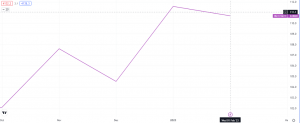

In December 2022 we saw the year close with an increase in call options and a decrease in call options. In October and November, we saw a large increase in calls and a decrease in puts. The month of January 2023 saw a reversion back to the latter scenario with a huge spike in call options versus a large drop in puts.

The Put-Calls Ratio is a good indicator of the positioning of traders in the options market as it shows us some risk-hedging activities by investors.

We also saw an outflow of capital out of Staples stocks (XLP) into Discretionary stocks (XLY) in January, signifying a move from defensive stocks into growth stocks.

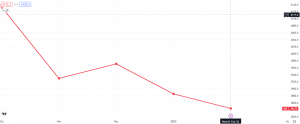

The dollar was weaker in December and January, continuing in the downtrend from previous months and further strengthening equities as some inflation fears and Quantitative tightening eased up a bit.

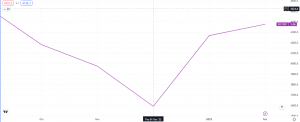

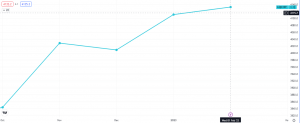

January also saw a continuation of strength in industrial metals and weakness in precious metals, at least in terms of the ration for Copper versus Gold. December was a pullback from November’s uptrend.

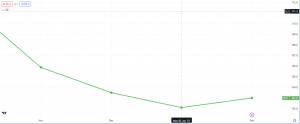

January also saw inflows into High Yield Corporate Bonds and outflows from US 10 Year Treasury Bonds.

Volatility was in-line with the narrative as we saw a drop in the VIX in January, continuing the downtrend from November. The fear index showed a ‘lack’ of fear from investors. We can expect the VIX to turn up in the event of a market selloff as investors use it to hedge downside risk inequities.

Some other observations include the fact that the high beta currencies like the commodity-linked currencies, AUD and CAD, also closed higher on the month in January.

We also saw names like Alphabet (GOOG), Microsoft (MSFT), Apple (AAPL) report earnings. Microsoft had a positive surprise 0.027 (1.16%) between the forecast and actual, while Alphabet and APPL reported with negative surprises.

Given some of the short term bullish footprints identified we can deduce that price depreciations on low volume, with the aforementioned values pointing upwards in the intraday timeframes, could produce rallies back towards 4300 on the S&P500. We may take a look at other factors like the situations with the different sectors and the Federal Reserve’s QT program, to get further insights as the situation evolves.

*This is for educational purposes only and is not financial advice.