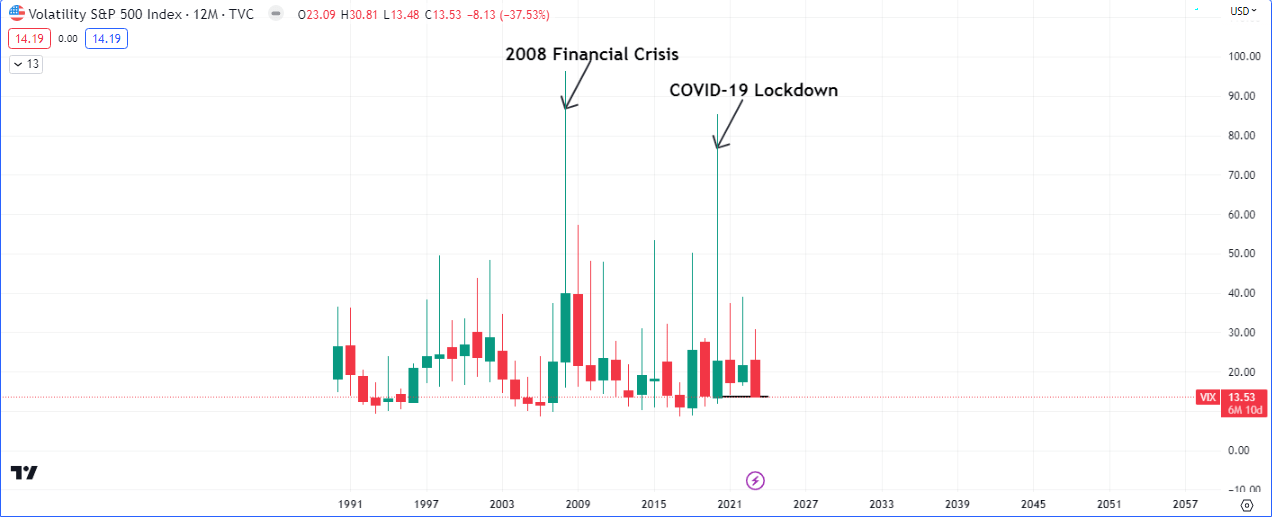

The $VIX has finally reached a major level and something big is inevitably about to happen. The ‘measure of fear’ is now trading at the lows made during the COVID-19 pandemic. Not more than a ‘block’ away are the lows made in the 2008 financial crises as well!

In the chart above we can see that price is trading near the lows of the range, which has acted as support for 30 years. If classical oscillatory realities are to be considered, we can expect the next decade, yes 10 years, to be pretty bleak for stocks in general.

That’s a pretty bleak projection, for the bulls at least. There are some key closes that need to occur first.

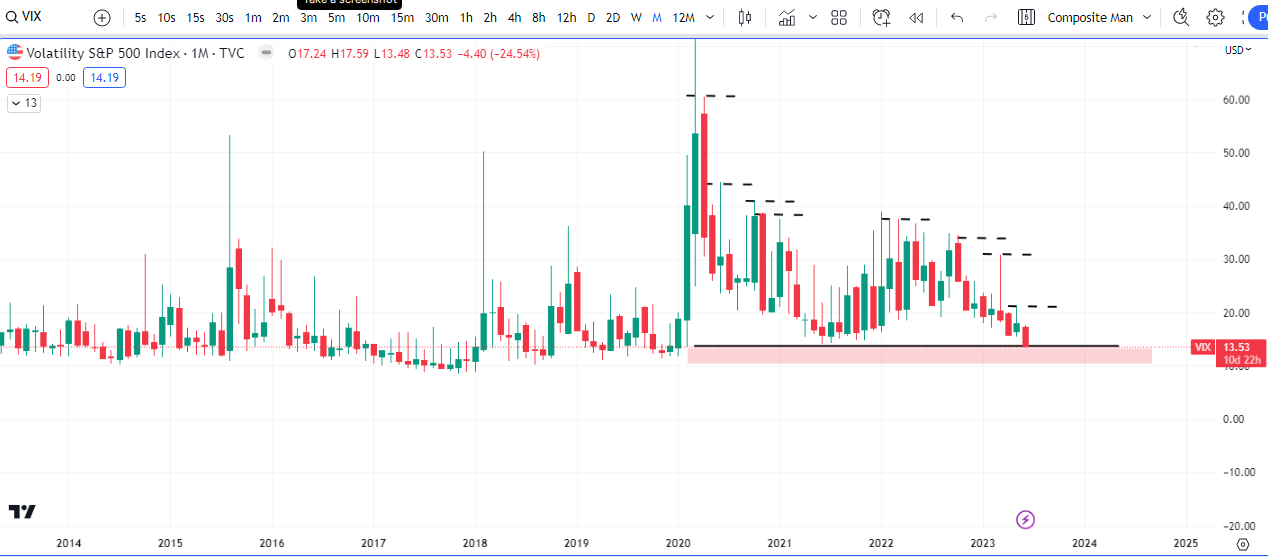

The Monthly and Quarterly Close

This month’s close, which also coincides with the close of Q2, is crucial in determining likely momentum. If the close is higher than the lows of December 2019, January and February 2020, and July closed bullish then we may expect a spike in volatility that could last for a while if it gets past the resistances.

It is this fractal narrative on the monthly that will play out on the yearly. This will weigh down on $SPX, $NDAQ, $DOW and $RUA. It may be part of a broader risk off narrative if the Yen and US dollar also start to strengthening, in tandem with a a strong inflow into US treasuries.

When we called the risk off sentiment here in March, the $VIX was one of the key elements in our projections and it was in synch with a strengthening of the Copper and the commodity currencies like the Aussie (AUD) and Looney (CAD). This risk on sentiment looks likely to shift to risk off if $VIX finds support here.