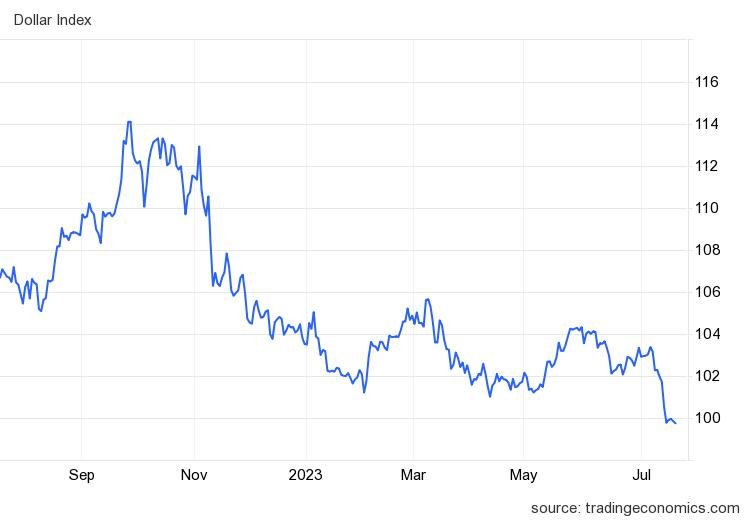

The dollar index held below 100 on Tuesday after losing more than 2% last week and sinking to its lowest levels in fifteen months, as softer-than-expected US inflation data raised hopes that the Federal Reserve may be close to the end of its current monetary policy tightening cycle.

Nonetheless, the US central bank is widely expected to raise interest rates by 25 basis points this month, while traders scaled back bets of further rate increases this year. Market pricing also suggests that the Fed could start cutting rates next year.

On the data front, a report showed that US consumer sentiment hit a near two-year high in July. Investors now look ahead to US retail sales, industrial production and housing data this week, as well as corporate earnings reports from major US firms. The dollar held at over one-year lows against the euro and sterling, while it recouped some losses against the Australian and New Zealand dollars and the Japanese yen.

Also worthy of note is the fact that the yield spread between the Australian 10Y treasury and the US 10 treasury dropped 19.81%, while the 10 year bond market on the other major currencies were markedly up against the US10Y. This divergence should be monitored as it could be an early sign of demand coming into the AU10Y treasury and consequently the Australian dollar, if the spread closes.

Premier League

Premier League