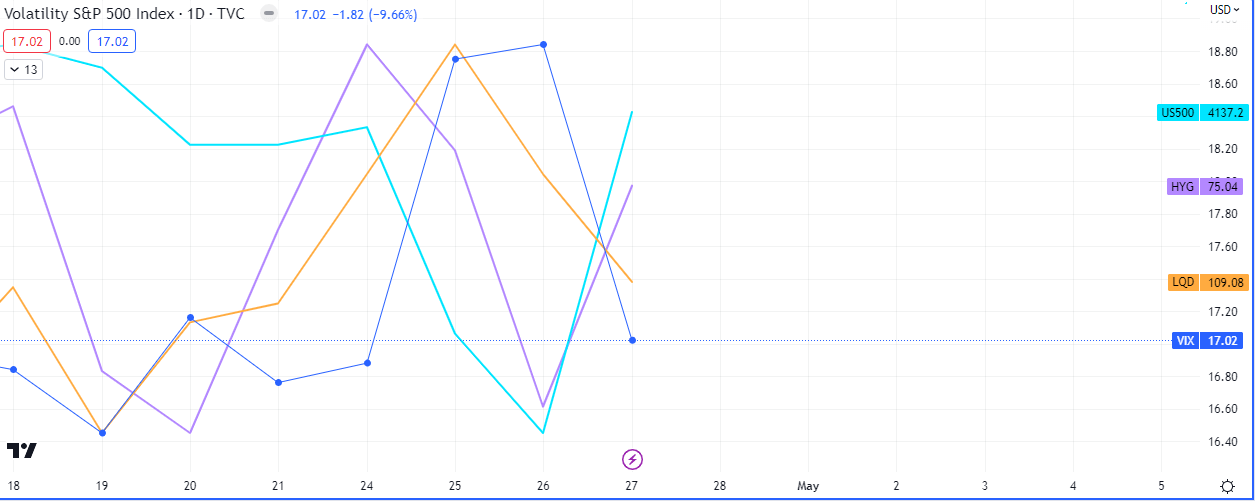

It was a day that tilted more in favor of a slight risk on sentiment. Volatility continued it’s multi-week decline into bearish extremes, closing -9.6% on the day, while bonds saw a lack of demand, led by the short end of the curve.

The key closes were as follows;

VIX -9.66%

DXY +0.03%

LQD -0.37%

HYG +0.33%

$SPX +1.80%

$NDAQ +2.38%

$DOW +1.39%

YEN -0.37%

EURO -0.14%

AUSSIE +0.57

BITCOIN +3.70%

WTI +0.62

BRENT +0.68%

US30Y +1.32%

US10Y +2.14%

US02Y +3.11%

The key events were the spike in volatility, the drop in investment grade corporate bonds in tandem with a rise in high yield corporate bonds, which were bullish for equities.

The $NDAQ led the gains as dropping volatility and a sideways dollar enabled the equity markets to go bid.

Also noteworthy was what was going on in the world of corporate bonds.

Investors bought more high yield riskier corporate bonds than investment grade bonds, on a day with declining volatility. This was a bullish brew.

The oil benchmarks were mostly sideways and closed up by +0.62% and +0.68%, after 2 weeks of declines.