Earnings updates started trickling in today and the US Dollar gained and DXY retested 102.0 as the yield curve flattened, although volatility ($VIX) continued it’s multi-week slide south.

DXY +0.22%

VIX -2.32%

$SPX -0.13%

$NDAQ -0.15%

$DOW -0.27%

EURO +0.44%

US stocks finished relatively flat after a choppy trading session as participants digested earnings releases, with the earnings of $TSLA being one of the more interesting talking points. $TSLA, the giant EV maker slid -2.02% as it’s operating margins slumped in Q1.

Some of the talking points on the earnings call were;

- Revenue $23.33B, missing Est. $23.35B, and up 24% Y/Y

- Adj. EPS 85c, missing Est. 86c, down 21% Y/Y

- Total GAAP Margin 19.3%, missing Est. 21.2%, and down a whopping 977bps from 29.1% a year ago

- Free Cash Flow $441M, missing Est. $3.24B

- Tesla Expects to Remain Ahead of L-T 50% CAGR on Production

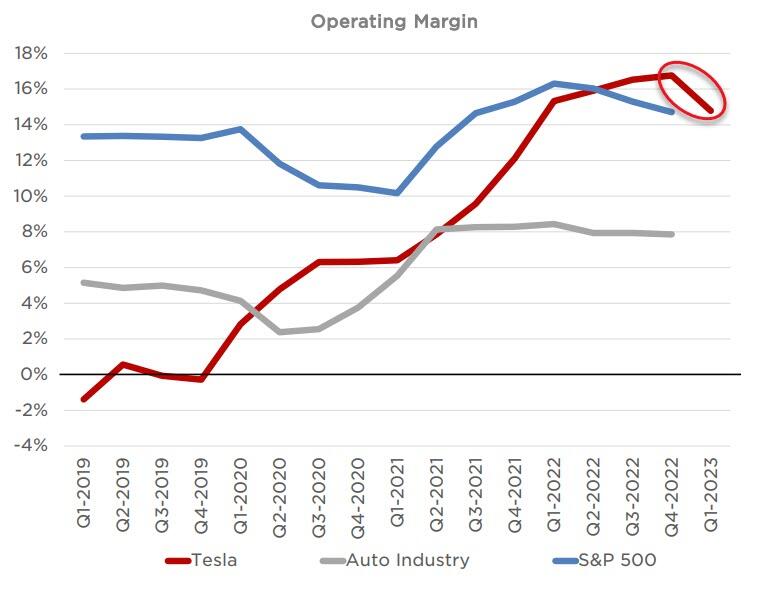

Focusing on the margins, it is clear that the price war for market share came at the expense of margins, which dropped sharply; operating margins also slumped, if not as much as total, and dropped to 11.4% from 16.0% Q/Q and from 19.2% Y/Y.

CEO Elon Musk opened the call by saying that the company’s operating margin is at the highest level in the industry despite some macro challenges. Musk also reiterated that vehicle orders are still in excess of production. He also noted the energy storage business had its best quarter ever and is likely to generate more gigawatt energy storage than the automotive business.

CFO Zach Kirkhorn noted automotive gross margin was impacted by one-time warranty costs and margin drags from new factories in Austin and Berlin. In terms of margins for the rest of the year, Kirkhorn did not issue specific guidance, but said cost reductions in Austin and Berlin as they scale up should factor in. Commodity price improvement in Q2 is anticipated. He also said that in general Tesla is looking for mid-20s margins for all parts of the business.

Shares of $TSLA fell 4.33% in after-hours trading to $172.76 after shedding 2.02% during the regular session. The 52-week high for Tesla is $364.08.

The oil benchmarks, WTI and BRENT fell -2.28% and 2.26% respectively, while Copper shed -0.35%. Gold which has an all time high of $2070 closed the day $1994, losing -0.51.

With the BRICS nations, led by China, Russia and other major oil producers buying up the precious metal as a back-up for the Petro-Yuan, the likelihood of a continuation beyond the all time is likely at some point.

Although China is currently the largest producer and buyer of gold in the world, central banks around the globe have gone a record breaking buying spree of the precious metal. As many countries shift from using the dollar as their reserve currency, demand for gold has spiked and is at the highest level in 60 years.