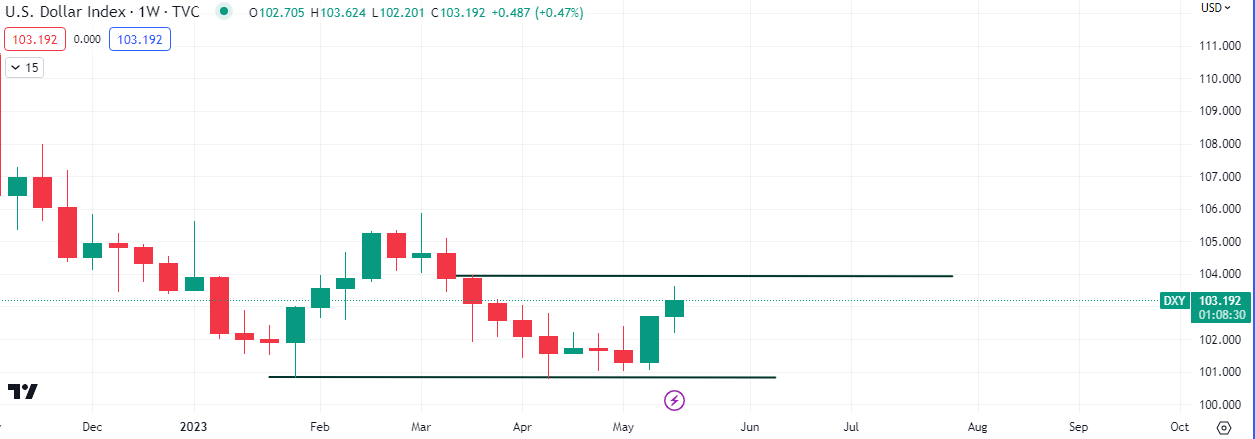

The US dollar closed higher for the second week in a row despite the ongoing de-dollarization by some countries, led by China.

Bloomberg repored that the use of Chinese yuan in foreign-exchange swaps underwent the second-largest quarterly surge at the end of March, as more countries transacted in the currency.

In the first quarter, swap line balances accounted for 109 billion yuan, or 20 billion more than the previous quarter, according to cited data from the People’s Bank of China. That’s equivalent to $15.6 billion.

These are arrangements that allow central banks to exchange one another’s currencies, guaranteeing to return the money for the same exchange rate at a future date, with interest.

The yuan’s increased use may also indicate a global de-dollarization swing, as many central banks are moving away from reliance on the greenback. That’s after the US weaponized the dollar against Russian aggression, incidentally deterring other countries from relying on it too heavily.

The dollar index ($DXY) closed +0.47% higher, adding to the +1.40% gains recorded last week. The focus of investors has shifted away from inflation since cool CPI numbers came out last week, leading some to believe that the main market driver has changed.

The headwinds though bearish, don’t seem to be deterring the uptick in demand for the dollar as seen in the chart above.

Some of the key closed for this week are:

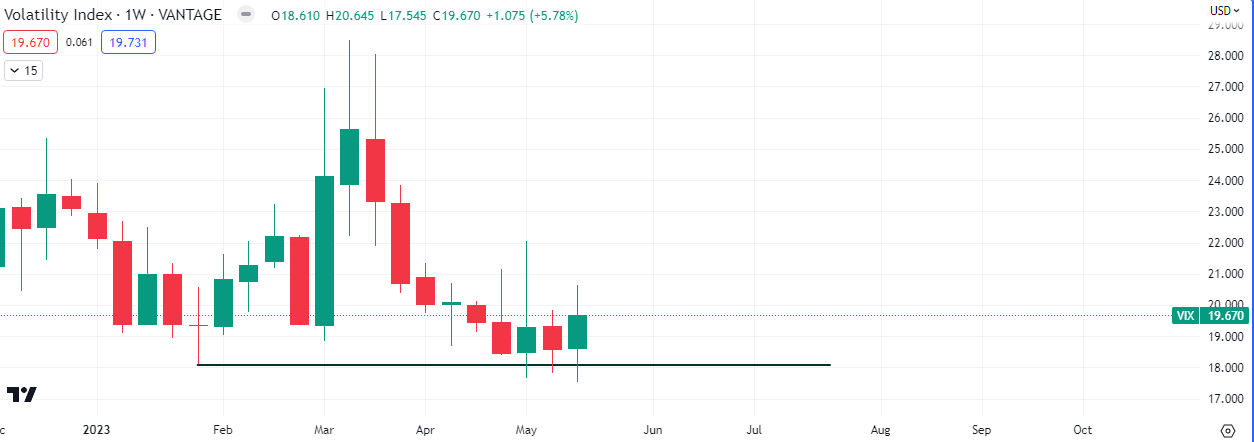

$VIX +5.78%

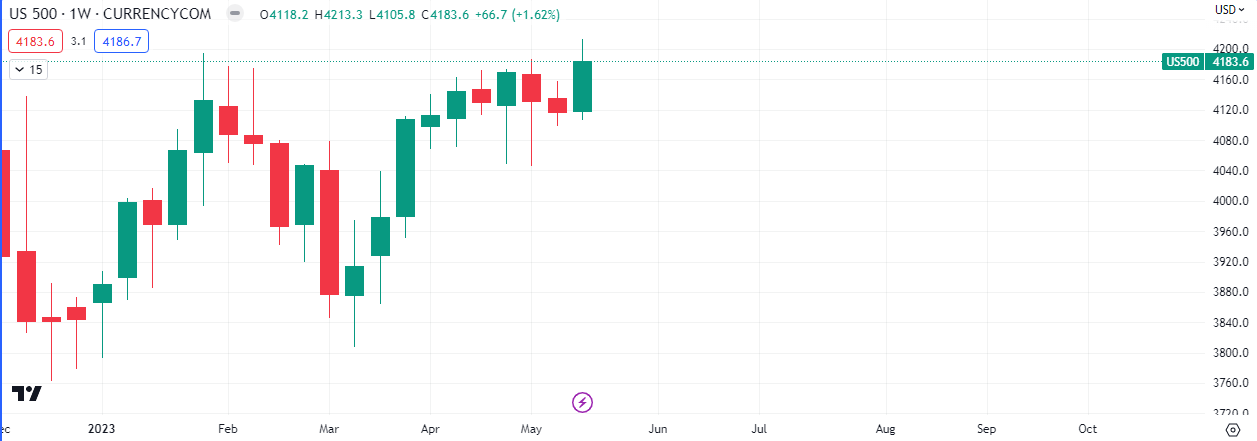

$SPX +1.62%

$NDAQ +3.55%

$DOW +0.40%

The $VIX remained range bound despite an increase of 5% on the week. The effects on the equity markets were muted at best as it counteracted the US dollar effect.

The $SPX managed to close higher in spite of a strong dollar, although the range bound $VIX’s weekly bearish gap fill was in favor of a bullish equity market.