The day’s trading in the US equity markets was within a tight range as volatility $VIX and the US dollar both closed lower.

The key closes were;

WTI +0.93%

BRENT +1.04%

VIX -0.82%

USD -0.38%

$SPX +0.10%

$NDAQ -0.20

$DOW +0.20%

US02Y -2.29%

US10Y -2.29%

US30Y -1.72%

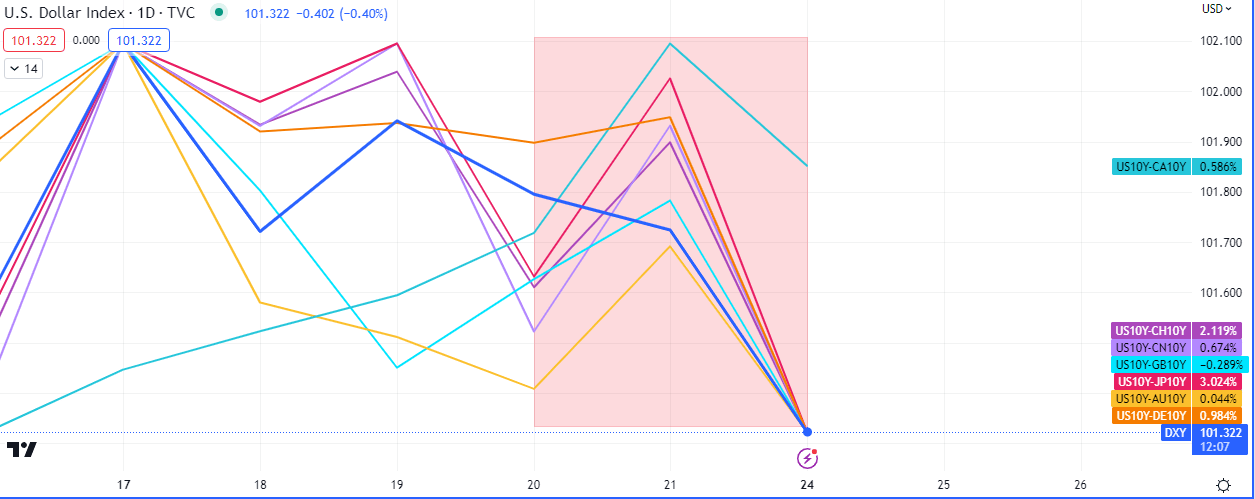

The drop in yields was a slight improvement for the US government debt market. However the yield differential of the US is in the negative versus China, Switzerland, Australia, United Kingdom, Japan and Germany.

Friday closed with the dollar index closing lower but the US10Y closing higher versus a wide range of it’s peers.

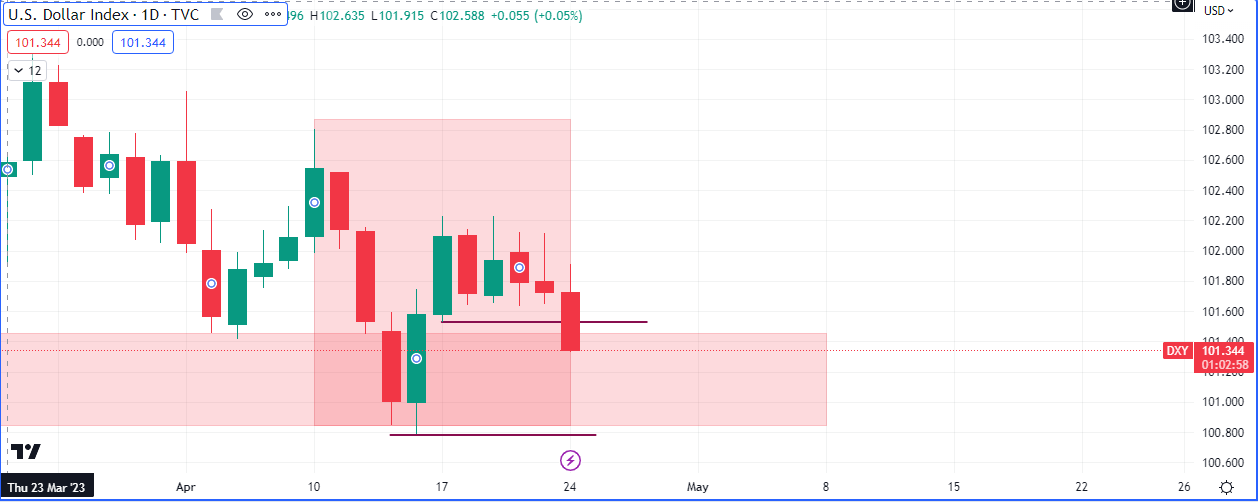

The most important close of the week so far is the daily close below support created on the 18th of April. This opens up the likelihood that the low of the month of April will be swept, before a markup on the weekly.

The gains recorded on the oil benchmarks today are still within a resistance given the last week’s bearish close.

The futures market for both gasoline and crude oil are in a slight backwardation as demand for the current month’s contract is in positive territory. This is not in support of the bearish structural narrative.