Wednesday’s trading session was dominated by plummeting oil prices and the FOMC. The Federal reserve increased rated by 25bps as expected by the consensus and we saw a drop in the dollar index as a result.

Some of the key closes were as follows;

DXY -0.70%

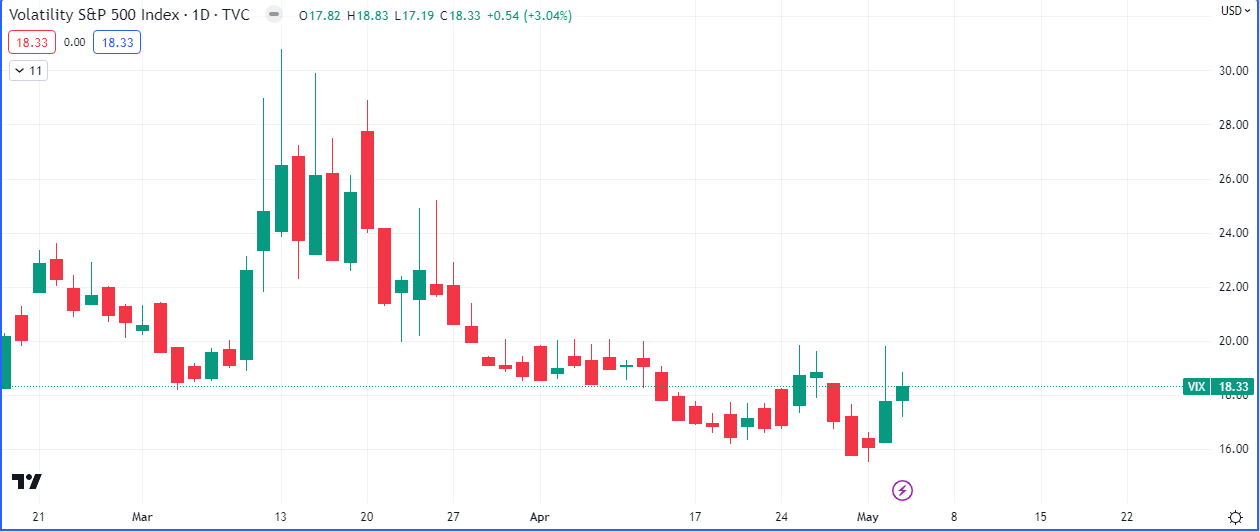

VIX +5.57%

SPX -0.90%

NDAQ -0.61%

DOW -1.00%

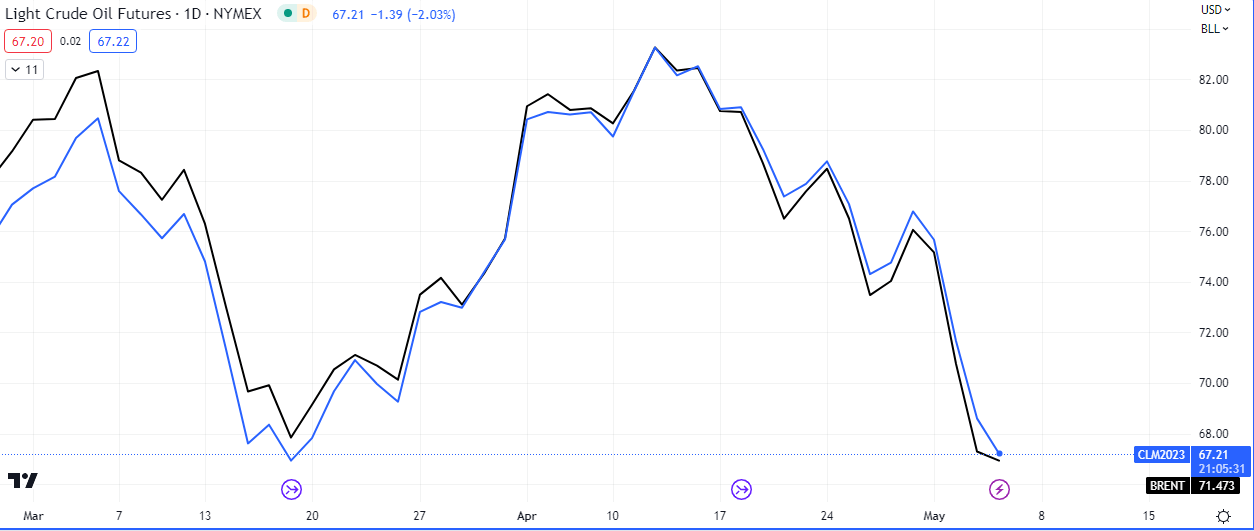

WTI -4.27%

BRENT -4.36%

EURUSD +0.55%

CADJPY -.125%

Yen +0.92

Gold +0.68

The mix of closes points to a risk off scenario with a surge in prices on the Yen, which strengthened against the USD, and a major drop on the oil benchmarks.

Having cleared all the gains made on the back of OPEC supply cuts last quarter, oil is now trading at it’s lowest price since December 2022.

Volatility also spiked for the second day in a row, after a long period of selling pressure that has buoyed stocks for weeks.

With volatility rearing it’s head, a break of structure to the upside of the April’s high will have bearish implications for equities.

Premier League

Premier League