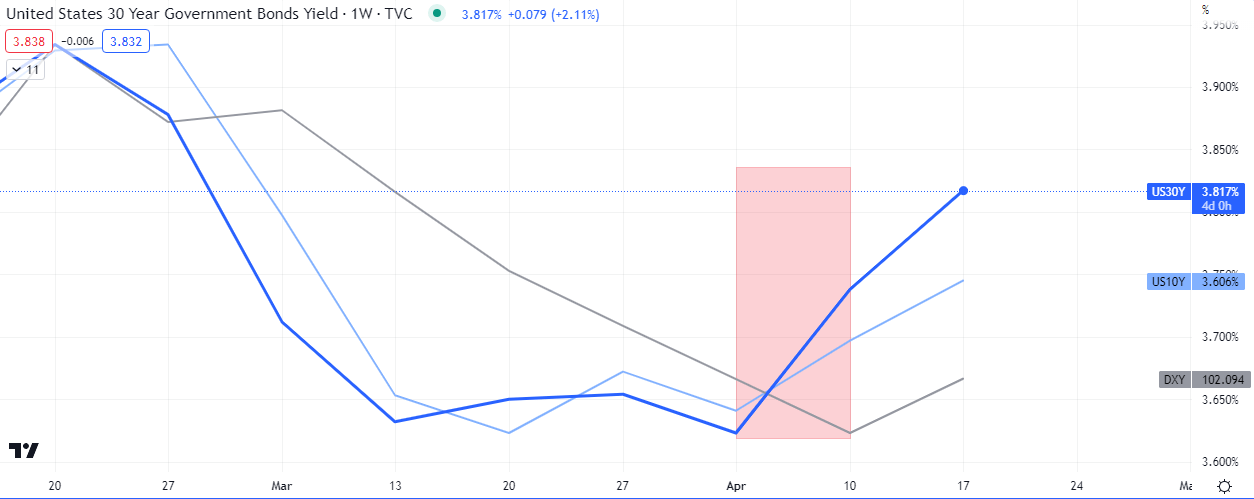

US Dollar bulls maintained the rally of the greenback to the tune of +0.5% on the day. Last week’s massive jump in yields on the 30Y and 10Y US treasuries, +3.17% and +3.05 respectively, were early warnings of a change, albeit a temporary one, in the growth narrative coming out of the US economy.

The marked area shows where the divergence between the ‘growth indicators’ (US30Y&10Y) and the Dollar Index. The yields had been dropping throughout the month of march, spurring dollar weakness which continued into early April.

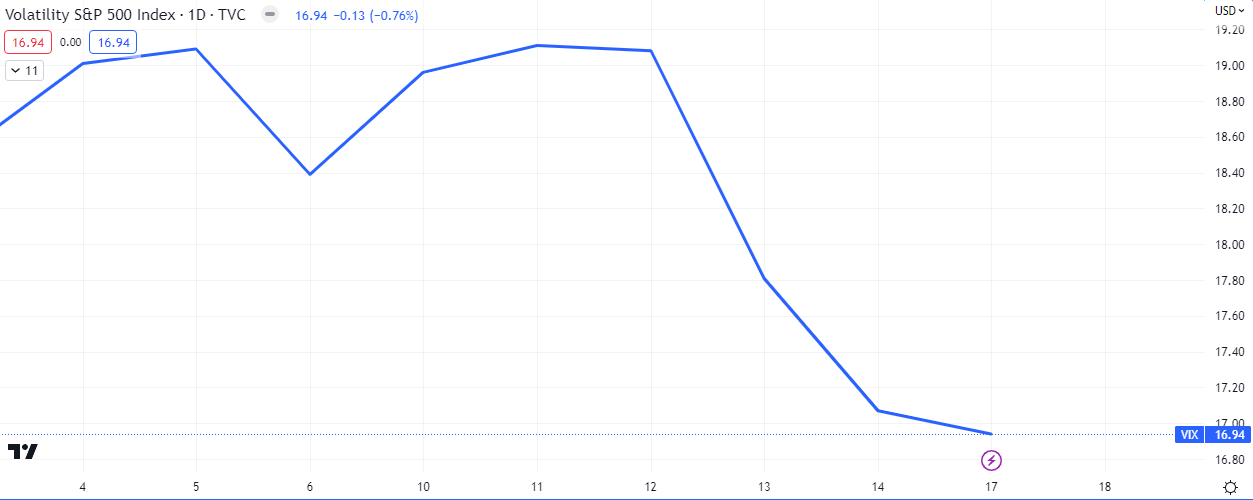

Volatility it’s multi-week decline, as we explained here last month. The ‘Fear’ index may still have some way to go lower, although as we approach extremes, the probability of a turn up is increasing.

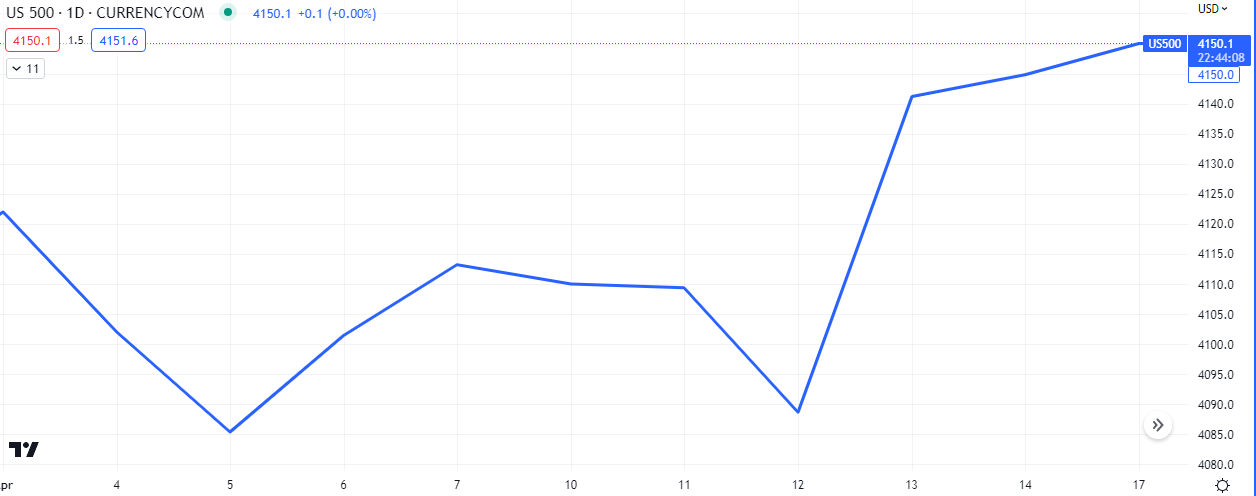

The $SPX managed to reverse intraday loses to record a modest gains of +0.13%, despite pressure from a resurgent Dollar. $NDAQ closed lower by -0.14% while the $DOW closed modestly higher at 0.11%.

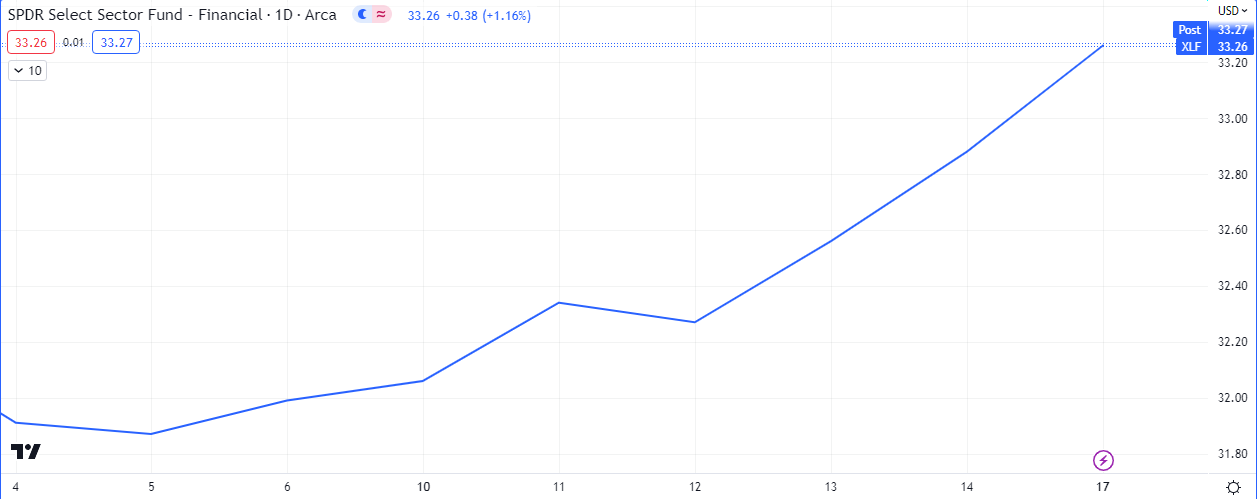

From gloom to bloom, banking stocks continue their sharp recovery, closing the day up +1.16%.

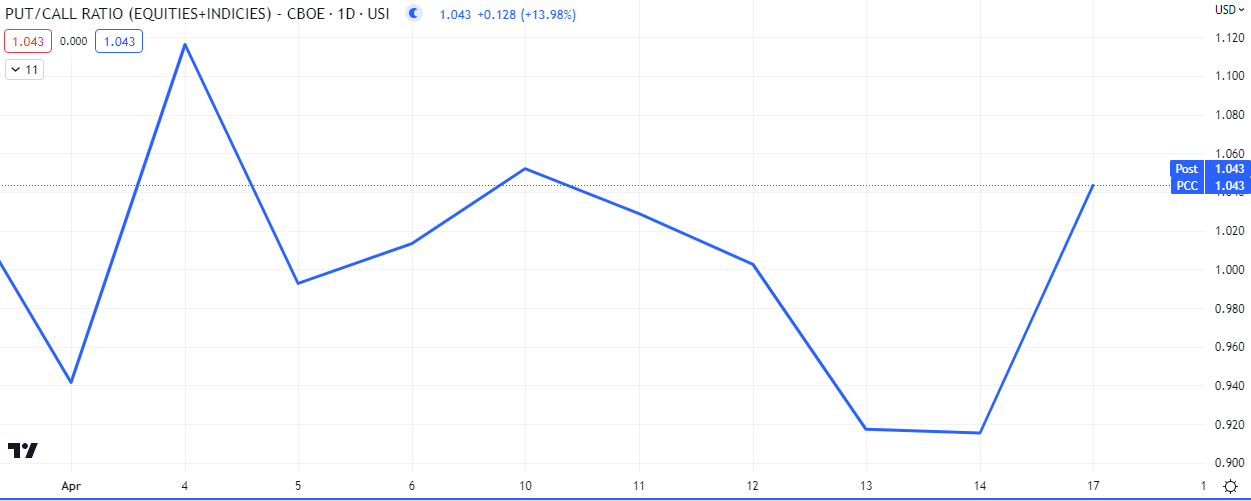

We observed that investors were buying lots of put options, the PC ration closed over 13% higher on the day.

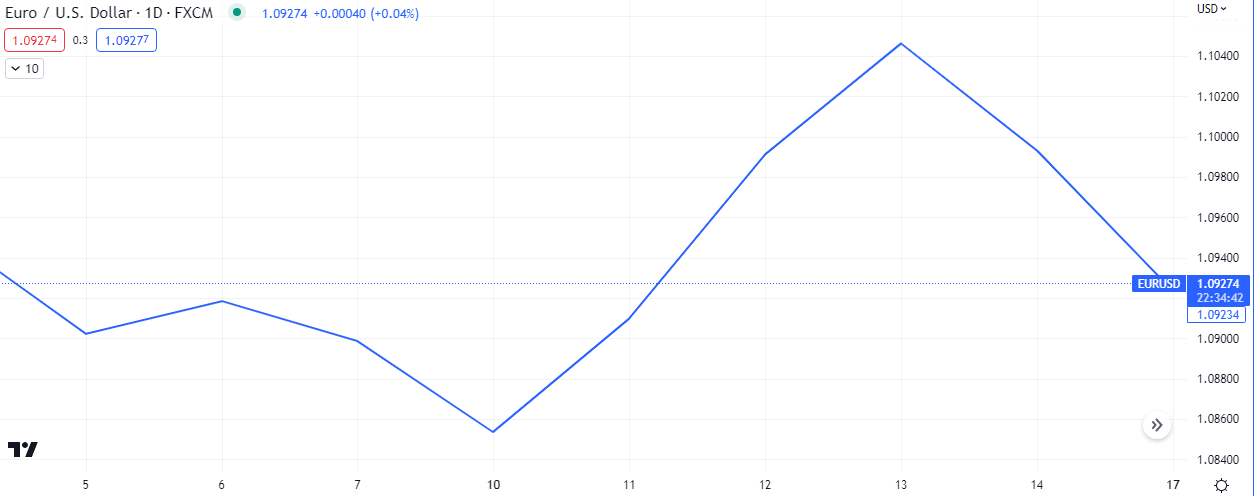

The Euro bore the brunt for the dollar strength, declining -0.63% on the day.

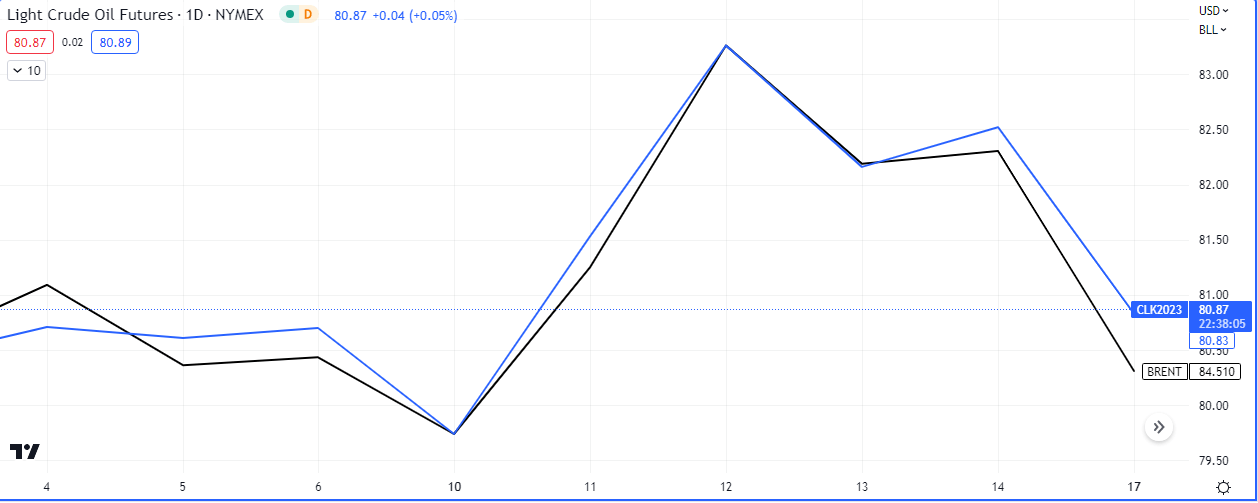

The oil benchmarks, WTI and BRENT, closed lower, -2.05% and -1.86% respectively. We learned that another 1.6 million barrels in oil was drained from the Strategic Petroleum Reserve, it will be up to OPEC+ again to offset the relentless oily gloom.

It remains to be seen if the dollar’s strength will run out and let the risk on flows continue, for now the greenback is throwing it’s weight around.