Investors have been piling into defensive sectors in spite of the general drop in volatility and a marked increase in risk appetite.

Today’s market price action more of the same sort we have witnessed over the last six months, with risk on flows dominating a market gripped with uncertainty.

Risk on assets closed the day slightly higher, with US Dollar Index slipping -0.34% as the yields on the US 10Y and 30Y treasuries receded slightly following over a week of rallying. The yield differential between the German 10Y treasury and the US 10Y treasury also declined, adding to the weakness in the greenback, with the current price action pointing to a likely retest of Monday and/or Friday’s lows this week.

US Equities posted modest gains;

$SPX +0.06%

$NDAQ +0.07%

$DOW -0.04%

Some big names also lost some ground although volatility ($VIX) continued it’s slide to post a decline of -0.59%.

$GOOG -1.22%

$META -0.44%

$MSFT-0.15%

$NVDA +2.46%

$TSLA -1.46%

$AMZN -0.43%.

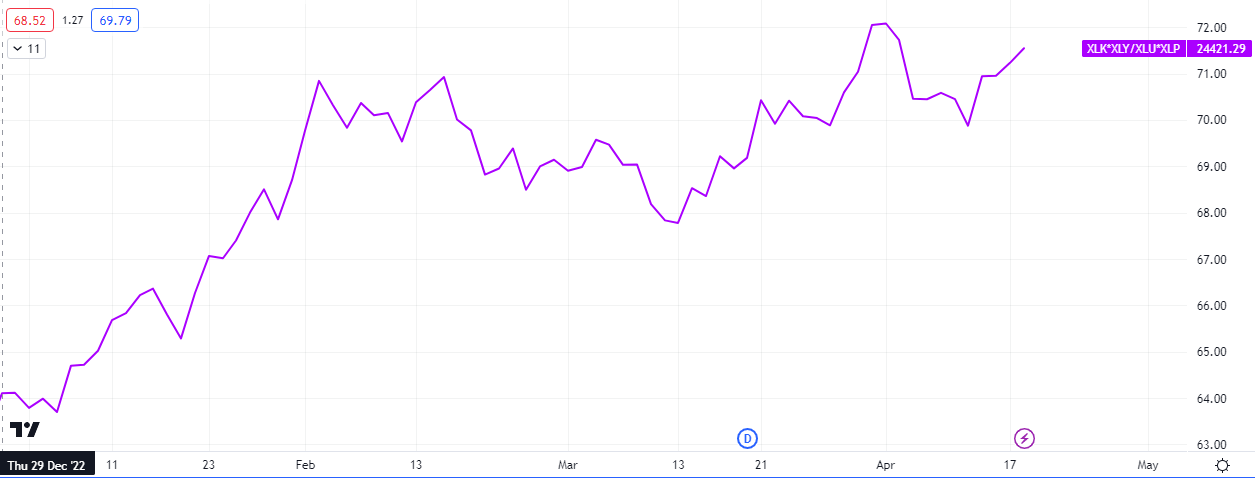

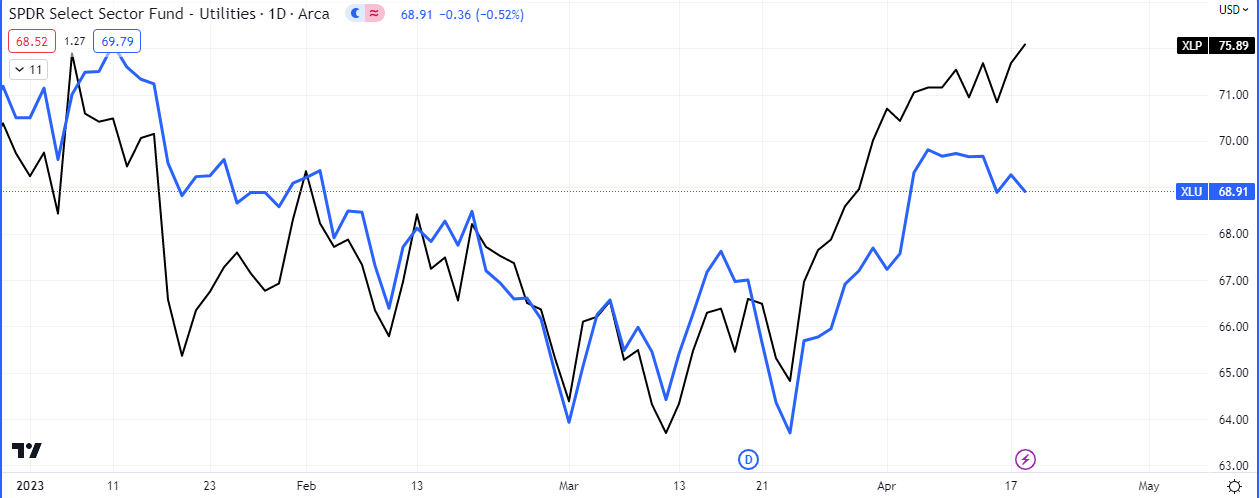

The ration measuring the offensive indexes (Tech and Consumer Discretionary) versus the defensive indexes (Utilities and Consumer Staples), is showing a flow towards the riskier growth stocks.

The defensive stocks have, however, been on an incline since march. While banks and energy stocks are bouyant, a retreat by investors into reliable but lower yielding sectors like healthcare, telecoms, utilities and staples shows no sign of slowing down, with telecoms outperforming the market by 6% this year, so far.

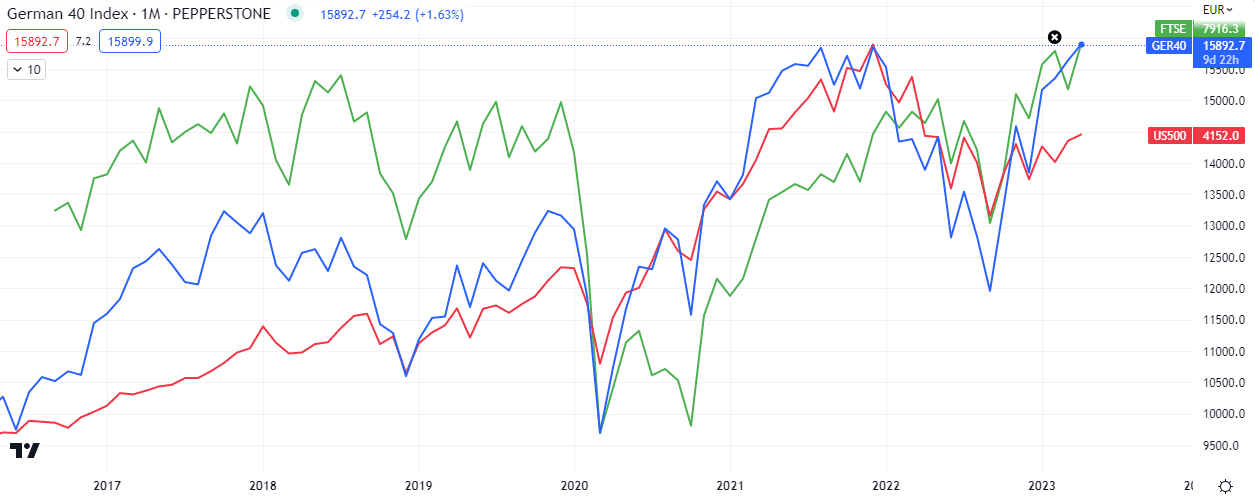

Stocks in Europe are much higher in share price relative to their US counterparts. European manufacturing activity looks set to contract, as the latest forecast for the PMIs is pointing towards a further drop. The latest increase of the European Composite PMIs from 47 to 54 may be cooling off since it was spurred by services

The finance sector, the banking sector included continued it’s recovery, which has been on since the Federal Reserve began to bailout the ailing money houses, XLF closed up +0.30% on the day.

The recent economic data hasn’t been good. We passed the phase where “bad news” was considered good news for stocks. Bad news is now, actually, bad news as the Fed hesitates to halt its tightening process despite higher rates pressuring markets significantly. It’s remains unclear if the Fed can ensure a soft landing, preventing another disastrous recession

The market is not ready for higher rates for a more extended period, and the Fed must provide the pivot soon, or else.

More panic selling could break out if the economy worsens, as we may see a deeper recession than previously anticipated

Credit Suisse Analyst Andrew Garthwaite pointed out that “Recession risk has increased even further and is not priced in.”

He noted that the signals from the real money supply, lending conditions, the yields curve and tightening, all leading indicators are flashing red.

On the other side of the risk on asset spectrum, Bitcoin ($BTC) clawed back the gains lost yesterday to the tune of over +3%, as investor risk appetite stayed healthy.

As the rest of the week unfolds, how $VIX and the US Dollar react at the extremes of price structure they have reached will determine a lot.