It was a strong week for the Japanese Yen as some of the risk off sentiment, we noted from Friday’s close, last week, played out this week.

The Yen strengthened on the week and even the US dollar was not spared, at least in the short term.

So far this week, the Asian session stands as follows;

JPN225 +0.88%

AU200 -0.51%

JPY +0.07%

AUD -0.96%

USDJPY -0.21%

AUDJPY -0.97%

CADJPY -1.01%

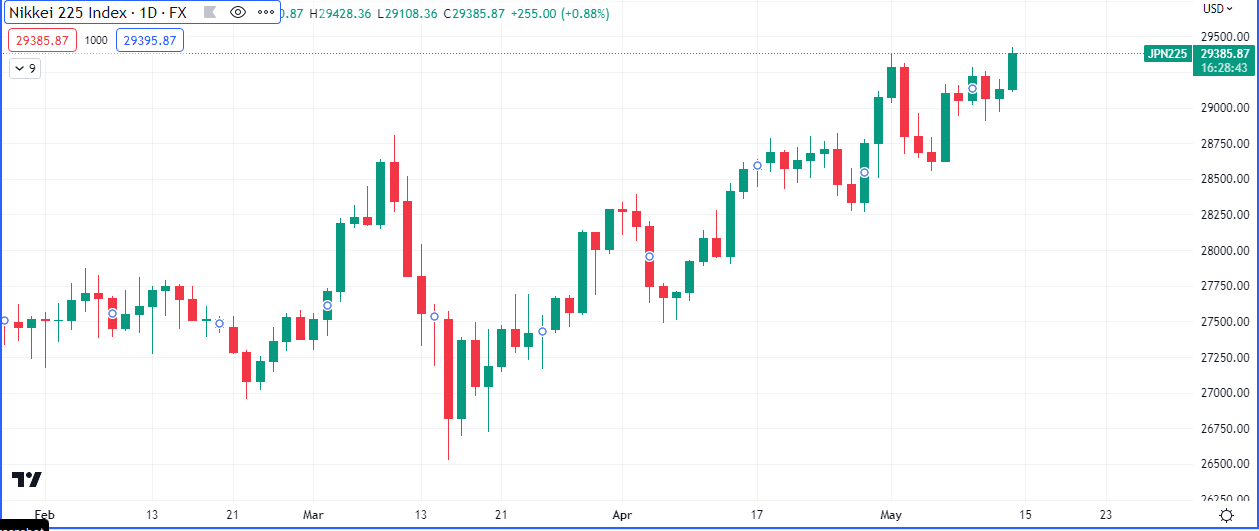

The Japan stock index (Nikkei 225) retested the high of the month of May in the session, early Friday. It is currently up +0.88%, with Wednesday’s rejection of lower prices being the last support level on the daily timeframe.

The Risk Off Effect

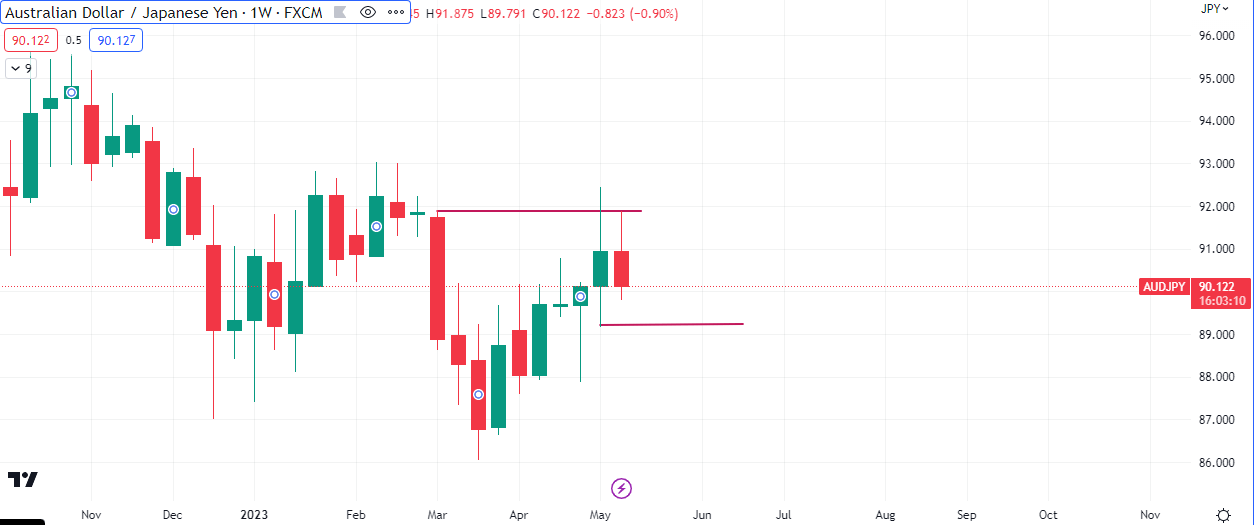

Our spreads of the week were found on the commodity currencies at the closing bell last week. The Canadian dollar and the Australian dollar looked overpriced relative to the yen.

The carry trade can be strongly reflected in the flow of capital between the highest yielding currency, compared to the lowest yielder. The currency pair AUDJPY, shows that the retest of the highs of march, which occurred last week Friday, has caused a price rejection, which could cause a multi-week markdown on this pair as well as CADJPY.