Stocks kept kicking up today even as Investors are waiting to see whether the Fed will stay on course to the projected 3 rate cuts in 2024. With inflation dropping, the odds of rate cuts went through the roof again as investors are more ‘optimistic’ about cuts.

Luxury stocks led losses in Europe this morning. Gucci-owner Kering SA warned about declining sales and worries about high-end consumer spending slowing down drastically in China. The shares slumped as much as 15% with LVMH, Christian Dior SE and Burberry Group PLC also shedding points.

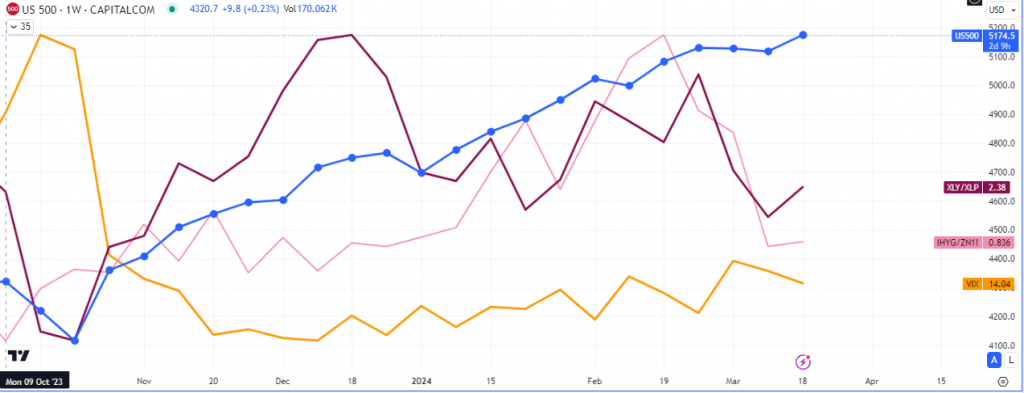

In a similar narrative, the last few weeks has seen more institutional money flow towards 10Y treasuries than high yield corporate bonds and more toward consumer staples than consumer discretionary, as seen in the comparative line in the chart below. These can be interpreted as risk off flows at a glance but since we are supposedly approaching a quantitative easing phase, with cuts expected, we may see the spread close with a rise in demand for high yielders and consumer discretionary stocks.

Alternatively a hawkish surprise by the Fed may fit into the narrative in the chart below.

A spike in volatility could see equities marked down into that risk off background, with the demand for 10Y bonds and Consumer staples (defensive stocks).

Turn on notifications for more updates.