Consumer spending in the US took a hit as shown by the release of the CB Consumer Confidence. The market had forecasted an increase from 106.0 to 108.5, but the number came out at 102.9. This downward surprise saw the dollar lose some of the ground it had made over last week, coming into today’s trading session.

The key economic releases from the US for the rest of the week are as follows;

Wednesday- US ISM Manufacturing PMI

Thursday- US Unemployment Claims

Friday- US ISM Services PMI

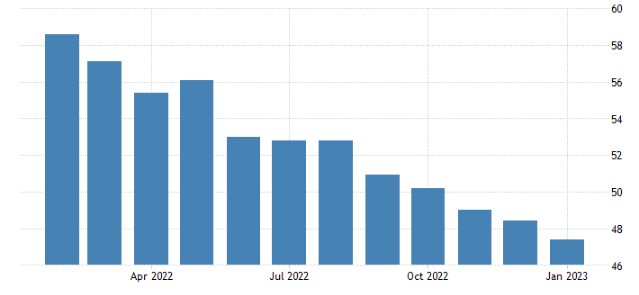

The ISM Manufacturing PMI has come out negative consecutively for the last 3 months. The consensus is expecting a slight improvement in today’s release, with the previous at 47.4 and a forecast of 47.9.

Investors will be watching this release closely and any surprise in the expected slowdown in contraction, would have marked effect on the strengthening US dollar. The indicators measured in the survey include New Orders, Backlog of Orders, New Export Orders, Imports, Production, Supplier Deliveries, Inventories, Customers’ Inventories, Employment and Prices. A reading above 50 shows expansions while a reading below 50 indicates contraction.

Any strong surprise to the upside will increase speculation of higher than expected FED rate hikes in the coming months.

Equities and Oil

The $SPX look likely to retest last week’s low if bullishness persists in the US dollar and volatility keeps increasing. Yesterday’s trading saw the $VIX decline by -1.19% and a continued drop in the Puts-Calls Ratio. With the latter being a bullish indication inline with the possibility of a rally of the lows of last week in $SPX.

The US treasuries yields, 02Y, 10Y and 30Y, are still rising. If the Yen, Swiss Franc and US dollar resume their rallies, we may see a strong risk off environment in the market place.

Oil prices ran higher on news of rather big improvements in China’s PMIs. Manufacturing, non manufacturing and Caxin manufacturing all came out positive at 52.6, 56.3 and 51.6 respectively.

Oil traders will be keen to see the inventory numbers for crude oil, gasoline and distillates today. From a glance at the oil futures market, we can see that we are still in a bearish phase in the oil market, as more futures traders are still purchasing further out contracts. This ‘contango’ has been going on for a while and this, along with dollar strength, has kept oil benchmarks suppressed and likely heading to $73 in the short term.