03/13/2023

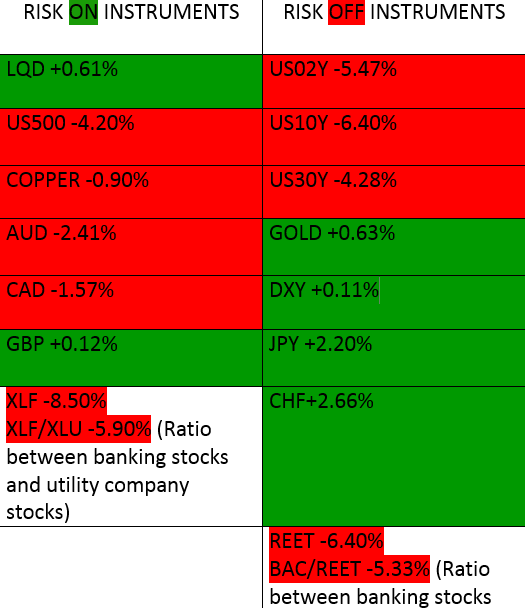

On the board today we have a mix of closes from Friday that is not tilted in any particular direction. However there are some things to take note of that could be useful.

We have a strong drop in US treasury yields as well as in most of the risk on assets except corporate bonds and the British Pound.

BAC/REET ratio also closed in the negative. Real estate investment trusts were weak but the financial sector was much weaker, as witnessed with the closure of $SIVB last week.

Volatility ($VIX) closed the week bearish and the expectation for this week is that it will continue lower, and this should strengthen equities to a certain degree. On the other side of the coin is the fact that the dollar index is bullish, which should weaken equities

Key economic events to watch in the US this week are:

- Tuesday- CPI M/M – Previous 0.5%, Forecast 0.4%

CPI Y/Y – Previous 6.4%, Forecast 6.0%

Core CPI M/M – Previous 0.4%, Forecast 0.4%

The expectations of the consecus are for a lower M/M and Y/Y and unchanged core CPI, this points to some measure of optimism that inflation is heading lower.

Spread of the Week

$XLF – GBPJPY

With the routing that happened in the finance sector last week, it was a bit surprising to see the British Pound close 0.12% higher on the week. The general expectation is for GBP to close lower than last week’s open, this week.

Click HERE to read up in the article with the definition of Risk ON and Risk OFF.