03/06/2023

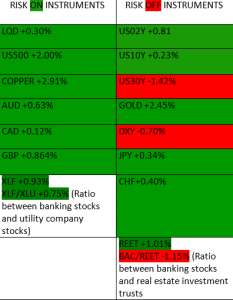

On the board today we have a mix of closes from Friday with what, on the surface, looks like a tilt towards a risk ON scenario. The high beta currencies closed higher but so did the low betas. Corporate bonds also closed higher and so did the government bonds.

The negative closes, however, hint at a possibility of a ‘flattener’ due to the fact the US30Y closed lower while the shorter duration bonds closed higher. This may be an indication of a slow down in the US economy as investors saw lower yields on the 30Y and higher yields and demand for the 2Y bonds. This is sometimes a sign of a developing flight to safety.

BAC/REET ratio also closed in the negative, indicating that there was more demand in real estate investment trusts than in financial stocks at the close of last week. This is also a sign of risk aversion.

With the VIX and DXY having a bearish structure going into this week, the risk ON narrative is likely to continue as long as the intraday values and price action continue to agree.

Key economic events to watch in the US this week are:

- Tuesday- FED Chairman Powell’s Testimony

- Wednesday- ADP Non-Farm Employment Change – Previous 106k, Forecast 195K

– FED Chairman Powell’s Testimony

– JOLTS Job Openings – Previous 11.01M, Forecast 10.61M - Friday- Average Hourly Earning M/M – Previous 0.3, Forecast 0.3

– Non-Farm Employment Change – Previous 517K, Forecast 207K

– Unemployment Rate – Previous 2.4%, Forecast 2.4%

Although the USD remains bullish, the Non-Farm Employment Change forecast shows a negative expectation and that could lead the trading sentiment of the USD downwards leading up to Friday.

Click HERE to read up in the article with the definition of Risk ON and Risk OFF.