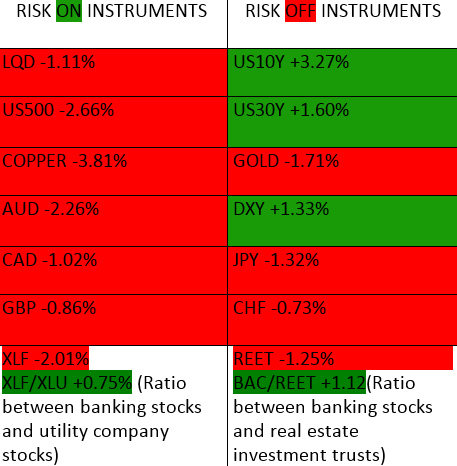

On the board today we have a mix of weekly closes from Friday’s close on the February 3, 2023, with a clear tilt toward a Risk OFF scenario. It is important to note that the assets listed in the table are in different phases in their actual market structure, therefore some are going through pullbacks, breakouts, accumulations, distributions, mark ups and mark downs. It can get complicated when trying to view the market holistically, even when you have narrowed your focus to one key data point. However closes are important due to the fact institutions deal at the closes, so they are still worth noting despite variability in structure.

From the board we can see that the risk ON assets had a torrid time last week, with US stocks and the copper market leading the losses. US dollar strength continued in earnest and we could be in for more of that, depending on how the economic data releases pan out.

The dollar effect on commodities is something to watch in regards to how it affects copper and oil. The strong US dollar and bonds, should they continue, will likely weigh down on commodities. The expected rate hikes will also likely continue to strengthen the greenback.

The weakness observed in the Yen, Swiss Franc and Gold were not in favor of a classical risk off scenario, so we will be watching out for what happens in those markets early this week.

Although finance stocks bled with the general market, we observed that the sector gained some strength relative to the Utilities sector and Real Estate Investment Trusts. This may be a precursor to some early institutional rotations back into risk stocks, so will be watching how that situation evolves relative to stocks and currencies.

We will be watching the US economic numbers coming out of the US this week to see if the ‘good news conundrum’ continues as we head towards the next FED meetings.

Click HERE to read up in the article on how to use Risk ON and Risk OFF in your trading and investment.

Premier League

Premier League