Chief Executive Officers (CEOs) of banks across the country have urged the Economic and Financial Crimes Commission (EFCC) to review its policies on Post No Debit (PND) on suspicious accounts, invitation of bank workers for interrogation, including CEOs, and acceptance of soft copies of bank statements for investigations.

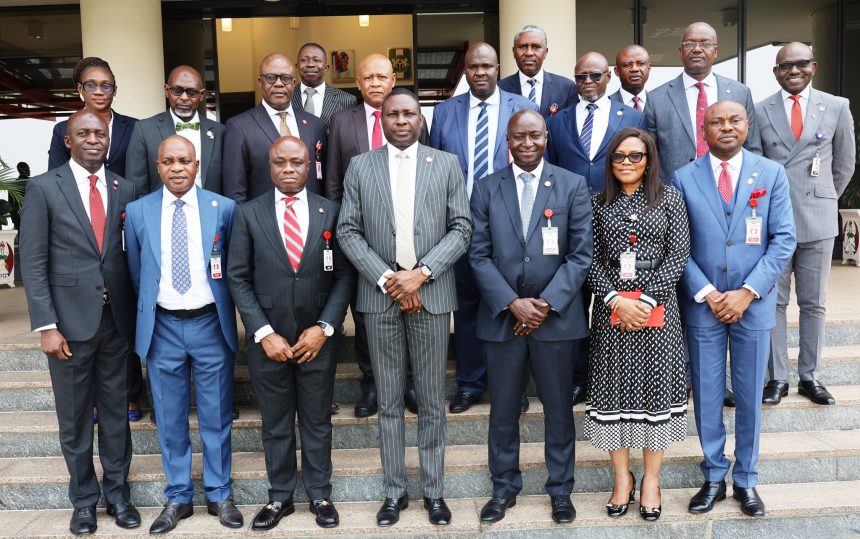

These were some of the requests made by the Body of Bank CEOs, under the auspices of the Chartered Institute of Bankers of Nigeria (CIBN), when it paid a courtesy visit to the EFCC Headquarters in Abuja on Tuesday, February 20, the EFCC said in a Wednesday statement.

Managing Director of Standard Chartered Bank, Lamin Madang, who led the group, commended EFCC Chairman, Ola Olukoyede on his appointment and admitted that he is succeeding in rebranding the image of the anti-graft commission.

“Let’s start by congratulating you Mr Chairman for your appointment as the Executive Chairman of the EFCC. We commend your leadership for the efforts to rebrand the image of the EFCC as an institution that embraces professionalism while prioritizing the humane approach in the conduct of your operations.

“We also commend the Commission for your proactive stakeholder engagement, religious leaders, youth, traditional rulers in the collective fight against corruption. This demonstrates a firm commitment to mobilize and foster widespread participation in the anti-corruption crusade,” he said.

He further commended “the Commission for the significant progress that you have made in combating corruption as evident in your adherence to international conventions and protocols aimed at proactively deterring corrupt practices through effective policies and inclusive stakeholder participation. We also note and commend the Commission’s outstanding achievement in securing a total of 3785 convictions in 2022 which stands as the highest number attained by any law enforcement agency in the world.

“Additionally, we commend and acknowledge the Commission for your continued dedication, as evidenced by the records 1688 convictions recorded between January and September 2023. This remarkable accomplishment reflects the Commission’s unwavering commitment to holding justice and the rule of law in Nigeria.”

Madang, who led CEOs of Polaris Bank, Premium Trust Bank, Citi Bank, Globus Bank and Jaiz Bank, to the meeting called on the EFCC to review its policy on Post No Debit (PND) on suspicious accounts, invitation of bank workers for interrogation, including CEOs, acceptance of soft copies of bank statements for investigations, among other requests.

Reacting, Olukoyede explained that the EFCC was always mindful of operating within the ambit of the law in its operations and no bank CEO would be invited for any meeting if there was no need for it.

“We are committed to a mutually beneficial relationship with you all. All our efforts are geared towards growing the economy,” he said.

He charged bank CEOs across the country to always abide by extant regulations and rules in their practices as effective means of tackling economic and financial crimes and other acts of corruption.

Olukoyede frowned at sharp practices, compromises and unethical practices in the banking sector stressing that ethical reorientation of bank workers is imperative in sanitizing the sector.

“I think the essential thing is for you all to play by the rules. Banking fraud affects the economy considerably. We are ready to work with any bank executive that plays by the rules because that is the only way of growing the economy,” he said.

He assured the CEOs that the Commission would work together with them in a way that would encourage mutual trust which will help banks and businesses to grow the economy.

“We will work together, we don’t want to see any bank go down, we don’t want to see any business destroyed, especially when you are set up to create wealth and employment and that is what we need in Nigeria.

“You help businesses to grow, why should any government want to bring banks down? But there are enterprises that are set up to destroy the system, to destroy the economy. We will not allow those ones to survive,” he said.