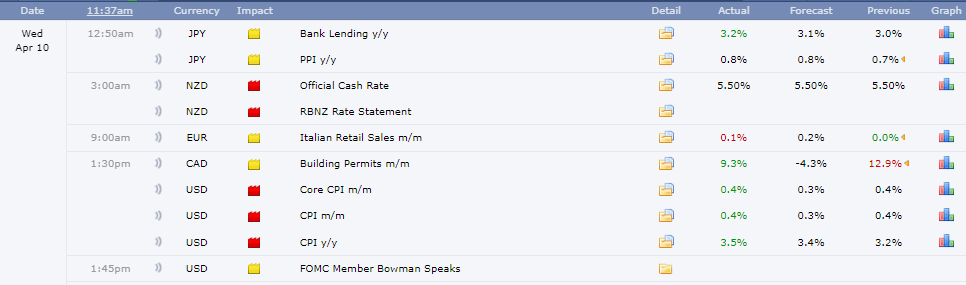

Treasury yields remained elevated a day after a very high CPI inflation reading catalyzed a bruising Wall Street sell-off, tanking hopes of a June rate cut by the Federal Reserve.

$SPX, $NDAQ and $DOW all sold off sharply in the New York session, after data showed U.S. consumer prices increased more than expected in March, leading investors to deduce that the Federal Reserve may delay the long awaited rate cuts. The S&P500

FOMC minutes of the central bank’s March meeting showed officials were still concerned that progress on inflation could have tripped up and a longer period of tight monetary policy might be needed to tame the pace of price increments.

Projections for cuts have are now around 40bps compared to the 150 bps expected earlier in the year, consequently the S&P500 closed -1.14% lower on the day.

Turn on notifications for more interesting updates.