Qatar National Bank QSC, the largest Arab bank, acquired a 12.5 percent stake in Lome, Togo-based Ecobank Transnational Inc. (ETI), marking its first acquisition in sub-Saharan Africa.

QNB bought 1.77 billion Ecobank ordinary shares and 732.3 million preferred shares, according to a statement published on the Nigerian Stock Exchange newswire today. A 12.5 percent stake in Ecobank is valued at about $230 million based on the firm’s current market capitalization, Bloomberg calculations show.

The Qatari bank is expanding abroad as domestic competition in its home market of 2 million people reduces the profitability of lending. The lender’s net interest margin dropped to 2.9 percent in the second quarter from 3.2 percent in the first quarter, data compiled by Bloomberg show.

“This is creating future growth options,” Jaap Meijer, the head of equity research at Arqaam Capital in Dubai, said in a phone interview. QNB is “building on their Middle East and Africa platform. Ecobank is the only one that gives you a platform in many countries.”

The Qatari lender, which operates in 26 countries, bought 97 percent of Egypt’s Qatar National Bank Alahly for $2.45 billion last year. South Africa’s Public Investment Corp. is Ecobank’s biggest shareholder with a stake of more than 18 percent.

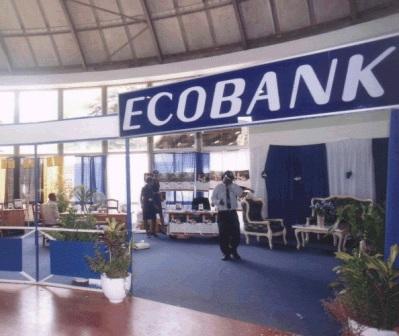

Ecobank is the second largest lender in Africa, with assets of more than $23.4 billion as of end June, the company said Aug. 11. It operates in 34 countries including Nigeria, Rwanda, and Congo, according to its website.