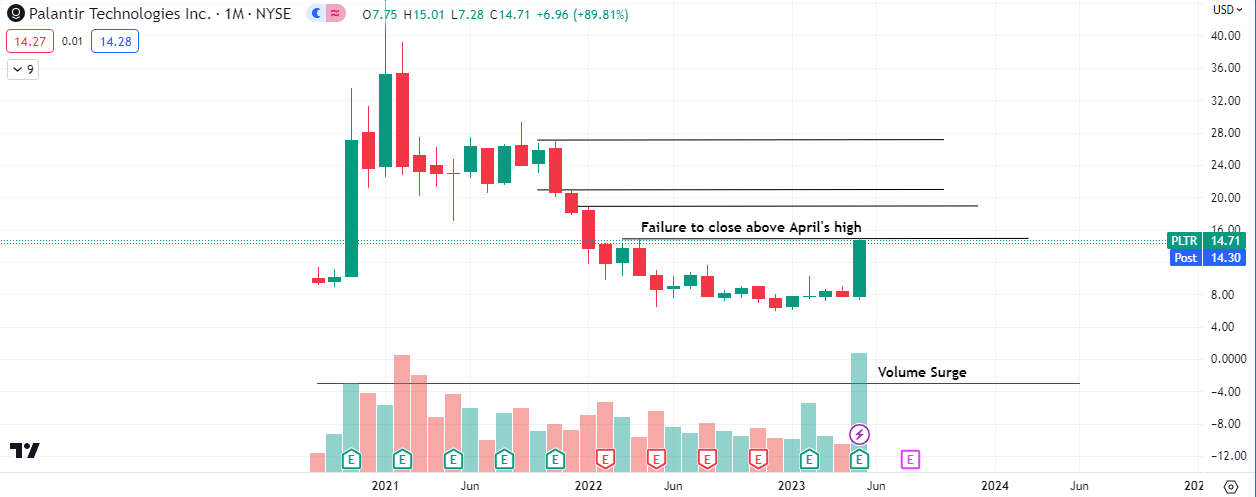

$PLTR failed to close above the critical resistance level of $14.86, established in April 2022. The key level was discussed earlier today in this article.

The month of May saw the share price of the tech company, which develops data fusion platforms, rally from $7.28 to $15.01, on the highest volume seen in years.

While the stock still has bullish potential, the following outcomes are probable;

- A bearish close in June should lead to a lower retest of $9.94 or $8.33 before the run up continues

- A bullish close in June should take price higher to test resistance at $18.84

Aggressive short sellers could look into the lower time frames to begin selling on fulfillment of whatever their price and volume criteria are.

More conservative folks could wait it out to see how Q2 closes out before engaging.

The most important thing to note is that the current tech rally is going against evidence presented by the macro economic data available. However these could change, therefore a shorter term view of liquidity may present clearer directional guides as the situation evolves.