“First of all, you have got liquidity surplus in the banking industry; … there is over N1.3tn or so sitting in banks and belonging to government agencies. Now basically, they (these funds) are at zero percent interest and the banks are lending about N2tn to the government and charging 13 to 14%! Now, that is a very good business model, isn’t it? Give me your money for free and I lend it to you at 14%; so why would I go and lend to anyone?”

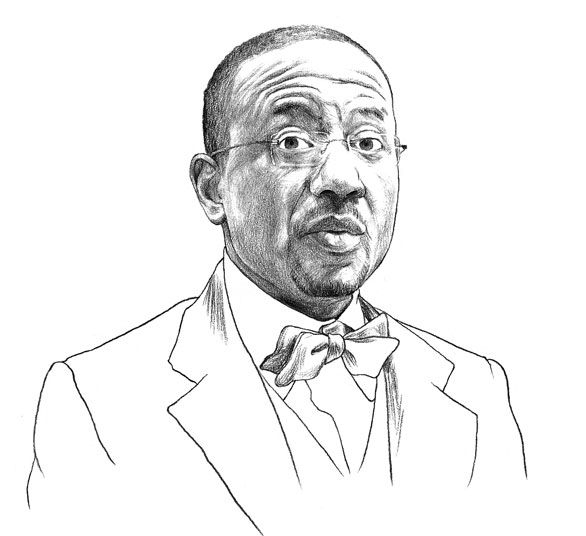

The above text, which corroborates views regularly canvassed in this column, is surprisingly from an address to journalists by none other than Lamido Sanusi, Governor of the Central Bank of Nigeria after the recent two-day Monetary Policy Committee (MPC) meeting in Abuja, last week.

The statement is in defence of CBN’s attempt to contain harmful credit expansion with the introduction of a 50% Cash Reserve requirement on all public funds domiciled in commercial banks! Prior to this development, the prevailing requirement was 12% reserve for all deposits!

Evidently, larger cash deposits create liberal opportunities for banks to leverage on these deposits to expand credit and increase public and private sector spending, which may inadvertently instigate an injurious rise in the price level of goods and services.

Thus, the latest requirement for higher cash reserves is really an admission that the existing 12% CRR has failed to contain the discomforting inflationary push.

However, some critics may regard the higher cash reserve requirement by CBN as inappropriate, since it would further reduce the already inadequate credit to a cash beleaguered real sector.

This column has consistently drawn attention to the obvious reckless strategy of banks lending so-called surplus funds at atrocious interest rate to the same CBN, which inexplicably instigated the excess cash in the system in the first place.

Thankfully, Sanusi has finally recognised that “If you want to discourage such perverse behaviour, part of it is to basically take away some of this money, and therefore, reserves requirement is suppose to make sure that the excess liquidity in the banks’ balance sheet, is evenly distributed”. The critical question, however, is how CBN can satisfactorily monitor banks’ compliance with the new directive. In the absence of strict compliance, surplus cash will still persist in the system and inflation will still remain untamed with disastrous consequences for the economy!

The CBN Governor’s fear that even the higher reserve requirement may not adequately cage inflation is probably also embedded in his warning that “if spending continues, and we are concerned about the liquidity conditions, we foresee in the nearest future, continued increase in the CRR (Cash Reserve Ratio) across the board… .” In other words, if surplus cash deposits persist in spite of the new measure, CBN would further increase its oppressive interest rate benchmark beyond 12%, and ultimately instigate interest rates to the real sector, to about 30%! However, what options other than further increases in Monetary Policy Rate, are available to control excess money supply?

We had consistently decried the foolhardiness of government’s borrowing back its own cash deposits in the banks, at extortionist interest rates (see www.lesleba.com for “Will you Borrow Back Your Own Money and Pay 17% Interest? … Ask Cbn!”, 27/12/2004 and “MPR Hike: Failure of CBN’s Monetary Framework”, 01/08/2011); we advised that it would be more businesswise, for ministries, departments and agencies to domicile their monthly naira allocations with the CBN itself. Obviously, it makes no sense, as Sanusi rightly observed, to borrow back your own non-interest-yielding savings at a cost, even though a similar borrowing strategy applied also to Nigeria’s external borrowings!

If our advice had been adopted in 2005, the perennial issue of excess funds would have been eliminated with hundreds of billions of naira savings. Indeed, a move was made to domicile all government funds with CBN under former President Olusegun Obasanjo’s tenure , but intense pressure from beneficiaries of the free cash tradition quickly killed this initiative!

Consequently, Sanusi’s new directory of 50% CRR for government deposits, is clearly an uneasy half way measure, and critics may wonder why the CBN Governor cannot in his characteristic style, take the bull by the horns, and demand that all government funds should be banked with the CBN! Without a doubt, such intervention will lead to a significant contraction in the cash available, and it will become possible to better control inflation in the system; regrettably, however, if government still remains actively in competition with the real sector in the market for long term loans, cost of funds may not fall.

Ultimately, an enduring solution to the high cost of funds and unyielding inflation is to tackle the root cause of excess liquidity; i.e. first recognize that excess cash is the direct product of CBN’s monthly substitution of naira allocations for dollar revenue, and secondly, to ensure that beneficiaries of the federation pool receive dollar certificates for their share of monthly dollar revenue. Such an arrangement would immediately finally eliminate the perennial burden of excess liquidity and its train of adverse consequences.

In its place, lower single digit rate of interest will become available to the real sector, with a minimal socially and industrially supportive rate of inflation in tow! The naira will become extremely stronger, and eliminate any remote possibility of subsidizing fuel prices, thus achieving the erstwhile impossible task of benignly deregulating the downstream sector. The resultant trillions of naira fuel subsidy savings can then be ploughed into social infrastructure and positive welfare programs.

Furthermore, purchasing power of all income earners will improve and stimulate increasing consumer demand, which industrialists and entrepreneurs would hasten to satisfy profitably, with the prevailing low interest rate and stronger naira. For now, I sincerely congratulate Lamido Sanusi for his bold step in the right direction; however, my abiding hope is that, shortly hereafter, the CBN Governor will be on the same page with the position of this column on this matter also.

SAVE THE NAIRA, SAVE NIGERIANS!!