Nvidia ($NVDA) has surged to become the world’s most valuable listed semiconductor company as a major supplier of chips and computing systems for artificial intelligence.

$NVDA designs and sells GPUs for gaming, Cryptocurrency mining, and professional applications, as well as chip systems for use in vehicles, robotics, and other tools.

The tech giant also develops AI tools. The software layer of the NVIDIA AI platform, NVIDIA AI Enterprise powers the end-to-end workflow of AI. Accelerating the data science pipeline and streamlining the development and deployment of production AI.

This company has been on my radar for months and my outlook was discussed here.

In this month alone $NVDA and SoftBank teamed up for generative AI and 5G/6G applications at data centers in Japan. The tech company, led by it’s CEO Jensen Huang, are working with WPP to develop generative AI content engine for digital advertising.

$NVDA and MediaTek also teamed up to provide AI cabin solutions for connected cars.

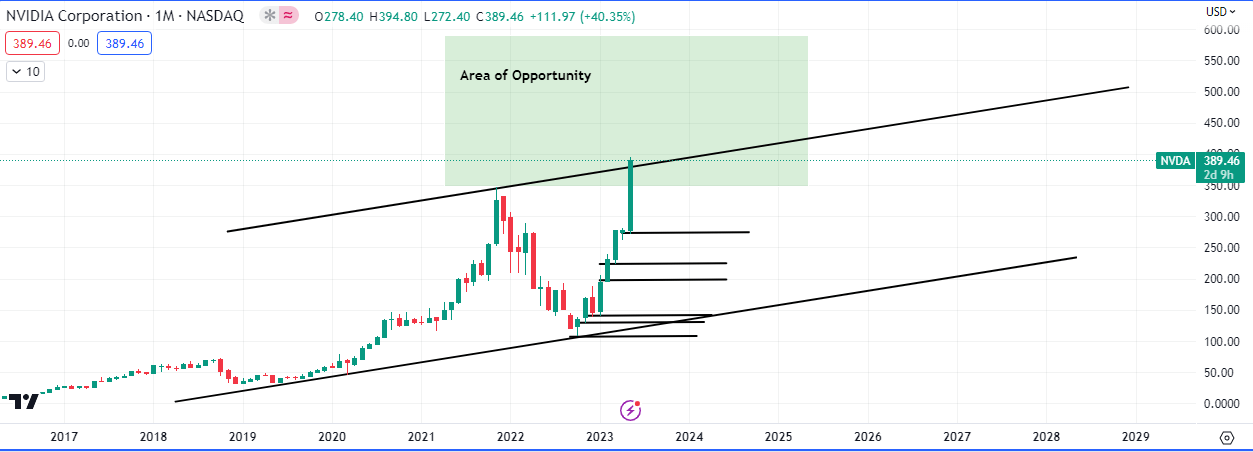

As discussed here, the price for a large institutional profit take will be around $595/share. Pullbacks into the range can present opportunities to buy towards $395.

It is good to keep in mind that there are gaps left unfilled $307 and $208, a fill could happen sooner or later.

All in all the stock looks healthy and both short term and long term opportunities exist in the current situation.

Other Considerations

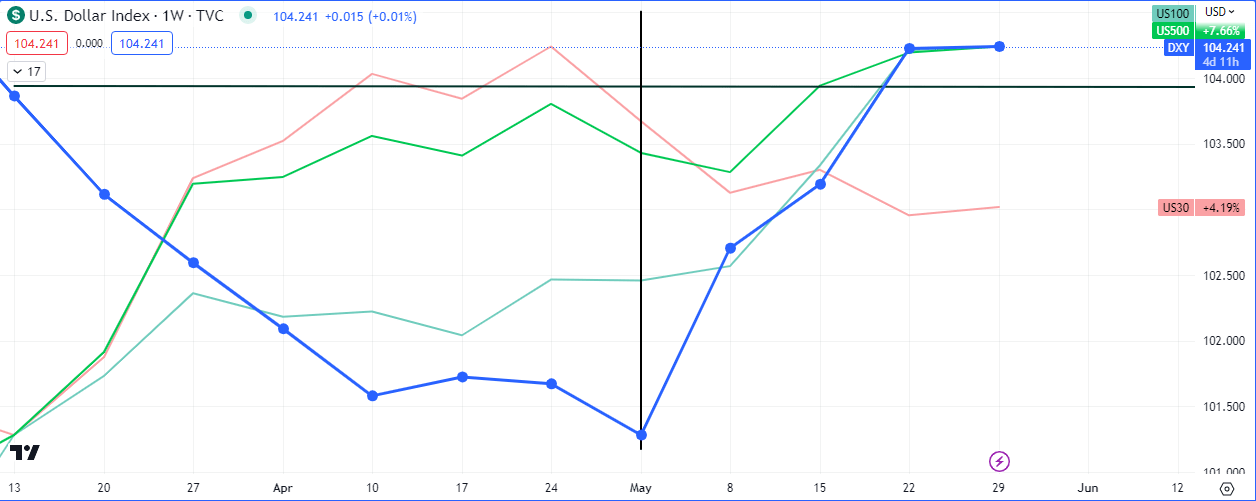

The US dollar and the equity markets have been moving in the same direction, which could mean we are approaching a late steepening phase in the market, if the other factors confirm this.

The spread in the chart above will close with either $SPX and $NDAQ dropping to the mean and $DOW rising into the mean. Hence further dollar strength at this juncture would affect the $SPX and $NDAQ more. Since $NVDA is listed on the $NDAQ, I’ll be watching what occurs there.

Follow this page for updates on this stock.