Some measure of selling pressure emerged on the $NDAQ throughout the Frankfurt and London today after three consecutive days of gains. The index’s futures market $NQ1! is currently down 0.23%, with the ADP Non Farm Payroll and Preliminary GCP q/q coming out later today in the US session.

Futures tracking the S&P 500 and the Nasdaq dipped on yesterday as investors remained cautious in a data-heavy week, awaiting hints of the state of the economy and the U.S. Federal Reserve’s interest rate trajectory.

Multiple data points, including the Non Farm Payrolls, are set for release this week which will have important ramifications for the direction of the US dollar

Wall Street’s rally this week has been on a drop in monthly job openings, along with gains in mega-cap stocks.

However, the rising 10-year Treasury yield (US10Y), dragged on growth stocks on Wednesday, with Tesla ($TSLA). A while ago we explored some of the technical reasons why $TSLA may drop back below $100 here.

Further weighing on sentiment, China defended its business practices after U.S. Commerce Secretary Gina Raimondo said American firms had told her it had become “uninvestible.”.

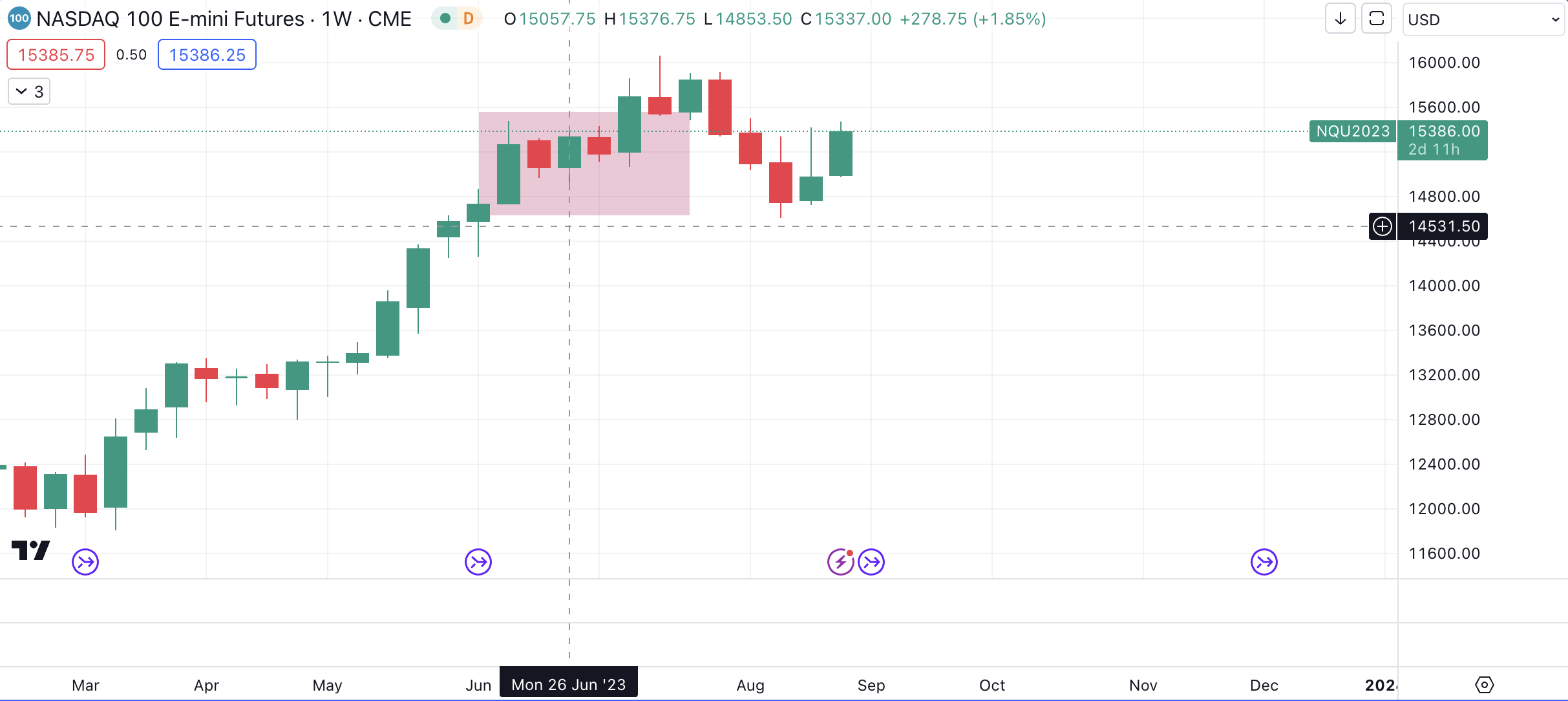

Although the US equity indexes remain bullish, there are few things contrarians could watch out for

Last week’s high may still overturn the week and close out bearish which could begin a multi-week decline towards the key buy levels of 2023. However should price close higher than its open we can expect a powerful rally to recommence but we will still watch out for possible exhaustions at the highs of 3 and 4 weeks ago as there are a lot of sell orders there.

Follow our trail on the Nasdaq here, here, here and here.

Premier League

Premier League