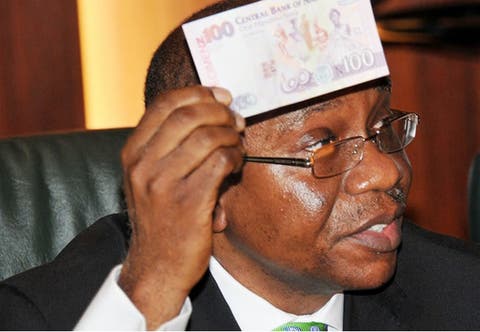

The Central Bank of Nigeria (CBN) has decried the activities of speculators in the foreign exchange market as the Naira took a Plunge to N465 to the dollar on the parallel market on Mondayafter exchanging at an official rate of N460 to the US Dollar on Thursday.

While giving it’s report on Monetary, credit, foreign trade and exchange policy guidelines for 2020/21, the CBN identified declining revenue from crude oil and challenges caused by COVID 19 as reasons for the poor performance of the Naira in the FX market.

The report noted that the Naira sold at N430 per US Dollar when the CBN commenced sales of FX to Bureau de change operators in September 2019.

The report further stated that the viability of the external sector is expected to slump due to the declining value of Nigeria’s external reserves and rapidly decreasing FX earnings.

See Also: Zamfara: Bandits Killed 11,000 Breadwinners, Left 22,000 Widows, 44,000 Orphans – Arewa Youths

“This development, in addition to exchange market pressures, emanating from speculative activities in the BDC and I & E segments of foreign exchange market, is expected to exert pressure on the naira exchange rate,” the report noted.

It added that increased risk aversion behaviour by foreign investors will impact negatively on the inflow of capital into Nigeria as they seek a more stable business environment or safe havens.

The entire fiscal projection for 2020 will affect the ability of the Federal and State Governments to carry out developmental policies, impede public investment in critical infrastructure and lead to a much higher debt profile than 2019.

The report also stated that the persistence of COVID-19 may force the government to increase fiscal policy responses to provide succour for the public.

The financial sector is however expected to remain strong through 2020 due to its stability and accommodating monetary policies.

Premier League

Premier League