Palantir Technologies ($PLTR) is a public American company that specializes in big data analytics. Headquartered in Denver, Colorado, it was founded by Peter Thiel, Nathan Gettings, Joe Lonsdale, Stephen Cohen, and Alex Karp in 2003

$PLTR is enjoying an artificial intelligence-fueled uptick today after Bank of America analysts raised their price target on the popular data analytics company. According to BofA analysts, $PLTR is in a “unique position” to capitalize on the “rising AI opportunity.”

Palantir’s advantage in the space is apparently the result of “its experience working with the government and highly regulated industries and the company has received more inbound interest in the last few weeks than in all of last year, all related to the recent launch of AIP (Artificial Intelligence Platform),” said Plantir CEO Alex Karp.

$PLTR is up a staggering 144% year-to-date, currently trading around $15.55 per share from $6 at the start of 2023. This comes largely from the Denver-based company’s growing presence in the AI field.

The company’s recent AIP launch represents a novel use of machine learning and AI in data integration.

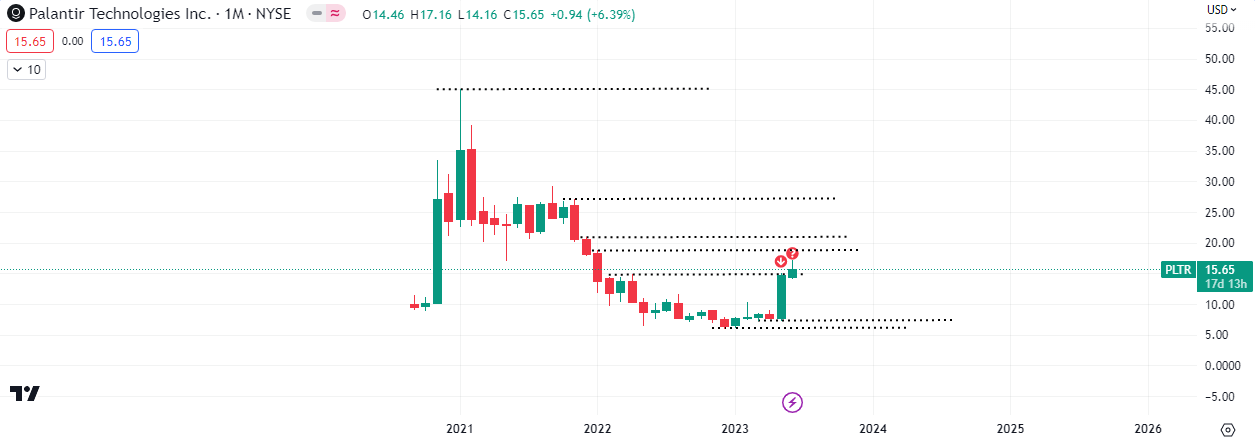

Chart

The share price for $PLTR surged in May but could not close above the high of April 2022. Consequently, the close for this month is important, as it could be the reversal to liquidity at $7 or the continuation to $20. A close below the open of this month, $14.46, then the reversal to $7 is likely, however a close above the open send this higher next month.

This coming Friday’s close is also worth watching, as we have a range of $14.44 to $11.45 on the weekly to consider for support or resistance. A close below this weeks open sends price to $11.45, while a close above makes the range a support level.