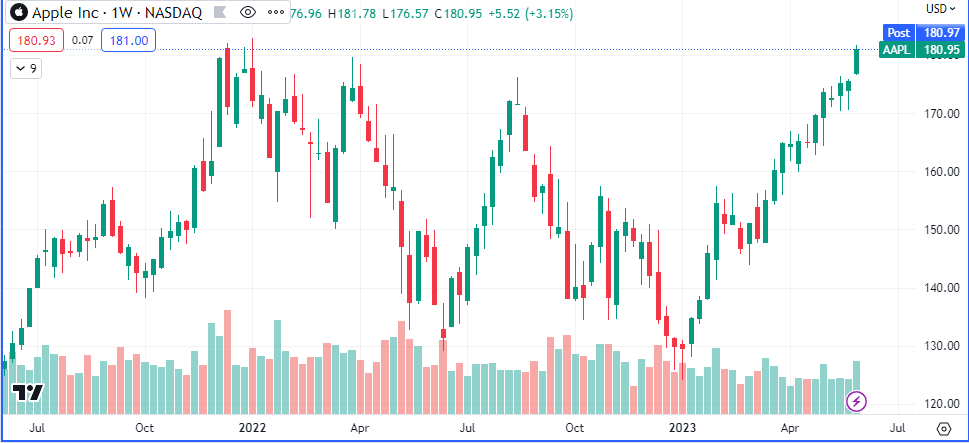

It was a rather quiet trading week but the implications of the positioning of some asset classes has some potentially volatile ramifications for the coming month. With $AAPL set to join $NVDA in the all time high club, questions about underlying headwinds like rising rates and recession arise again

The Non farm employment change came out as follows;

- US nonfarm employment m/m 000s / UR %), wage growth m/m %, May, SA:

- Actual: 339 / 3.7 / 0.3

- Consensus: 195 / 3.5 / 0.3

- Scotia: 225 / 3.5 / 0.3

- Prior: 294 / 3.4 / 0.4 (revised from 253 /3.4 / 0.5)

- Two-month revisions: +93k

US job growth strongly beat consensus yet again.

Economists and other market participants keeps wishing for weak reports but keeps getting routinely beaten on estimates of job growth. Consensus has underestimated payrolls in all but one month since the start of last year. The sum total of this underestimation bias amounts to missing about 1.9 million of the jobs that have been created over this time and so we’re dealing with a sizeable bias.

The key closes of the week are as follows;

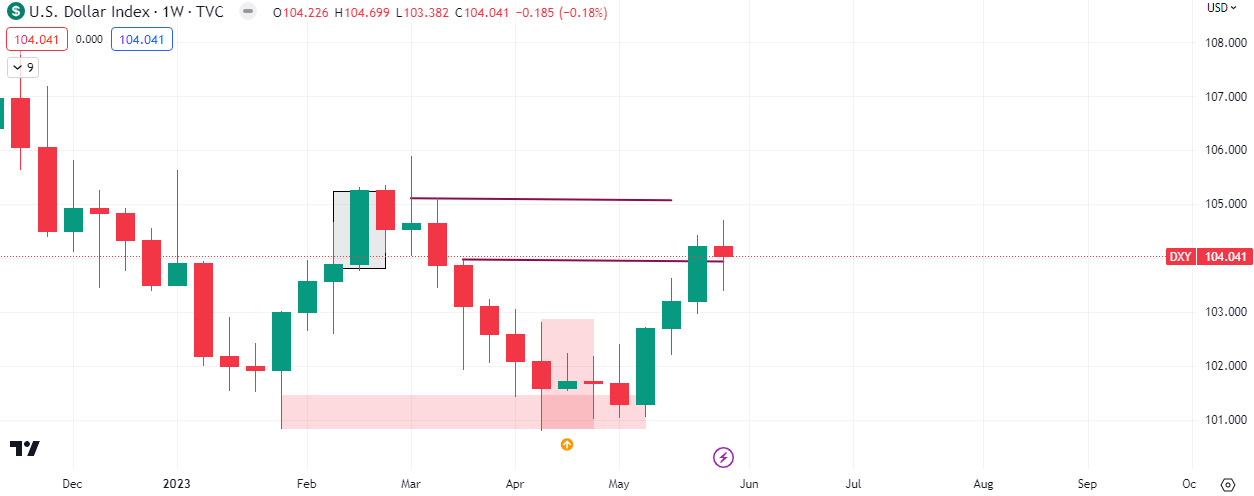

$DXY -0.18%

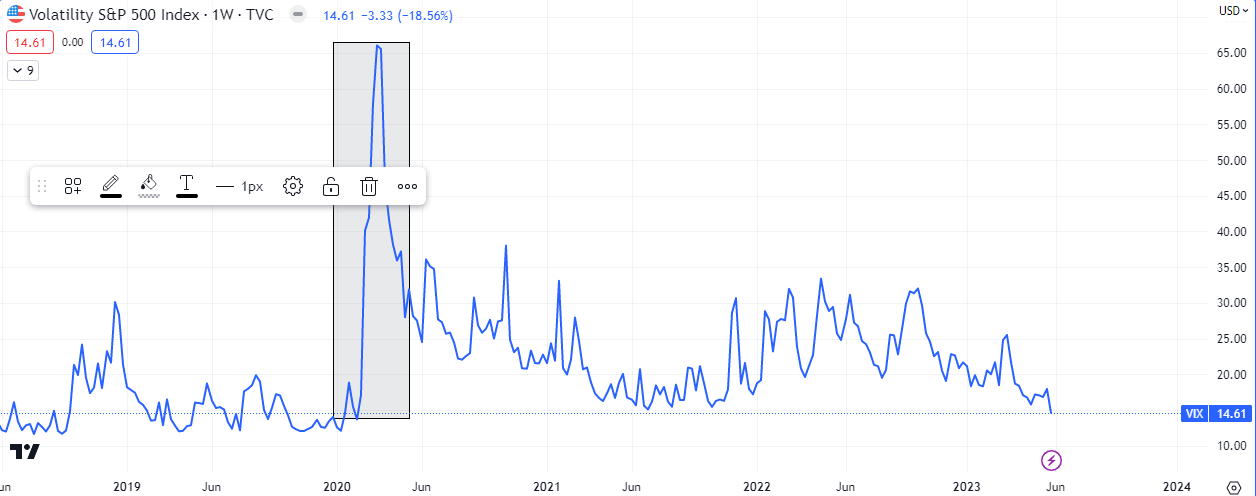

$VIX -9.79%

$WTI -1.38%

$BRENT -1.31%

Gold +0.06

$SPX +1.70%

The risk on sentiment continued this week.

The next draw on liquidity for the dollar index is close but we still expect higher prices till the next resistance. All eyes on the FOMC minutes later this month.

The volatility index looks oversold so a spike may not be a surprise. However the weekly has been able to close below support but the daily did not. leaving next week Monday and Tuesday susceptible to spikes.

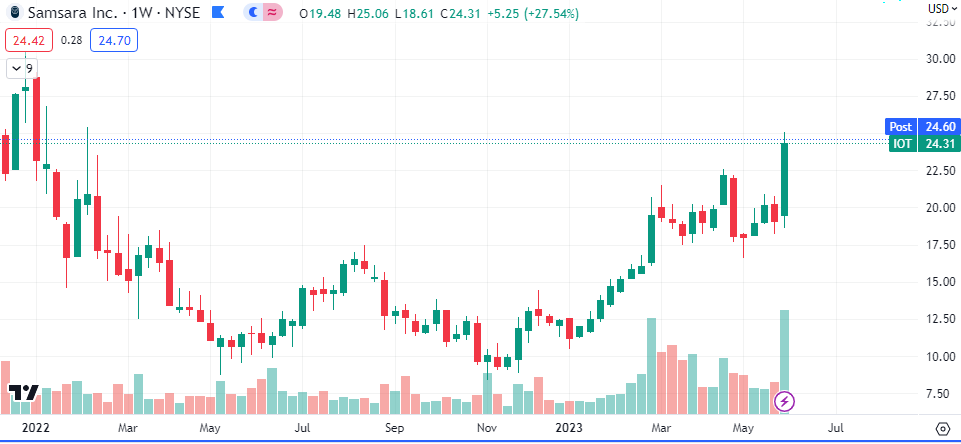

Top Percentage Gainer of Note

Shares of Samsara touched a 52-week high on Friday, a day after the company reported first-quarter financial results and offered guidance for the second quarter and full year.

At 1:56 p.m. ET, the company’s stock was trading 30% higher, at $24.78 a share. Volume at the time topped 15.7 million shares, above the stock’s 65-day average volume of about 3.4 million.

Earlier in the session, the stock hit a 52-week high of $25.05 a share.

After the bell Thursday, the cloud company reported a first-quarter loss per share of 13 cents on revenue of $204.3 million.

The company said it was expecting second-quarter revenue in a range of $206 million to $208 million and full year 2023 revenue in a range of $866 million to $874 million

Samsara, Inc. Class A (IOT) is currently at $24.45, up $5.44 or 28.62%

- Would be highest close since Feb. 9, 2022, when it closed at $24.47

- Would be largest percent increase on record (Based on available data back to Dec. 15, 2021)

- Snaps a two day losing streak

- Up 96.7% year-to-date

- Down 16.75% from its all-time closing high of $29.37 on Dec. 27, 2021

- Up 111.69% from 52 weeks ago (June 3, 2022), when it closed at $11.55

- Would be a new 52-week closing high

- Up 181.03% from its 52-week closing low of $8.70 on Nov. 9, 2022

- Traded as high as $25.06; highest intraday level since Feb. 10, 2022, when it hit $25.42

- Up 31.82% at today’s intraday high; largest intraday percent increase on record (Based on available data back to Dec. 15, 2021)

$AAPL $1 Away From All Time High

$AAPL is currently approaching it’s all time high. How it breaks will determine a lot about how deep any pullbacks will be and how far the trend will continue.