The Volatility Index ($VIX) is the ticker symbol and the popular name for the Chicago Board Options Exchange’s CBOE Volatility Index, a popular measure of the stock market’s expectation of volatility based on S&P 500 index options.

It is calculated by combining the weighted prices of the index’s put and call options for the next 30 days. Needless to say this index is important in gauging the situation and balance of buyers and sellers in the equity markets.

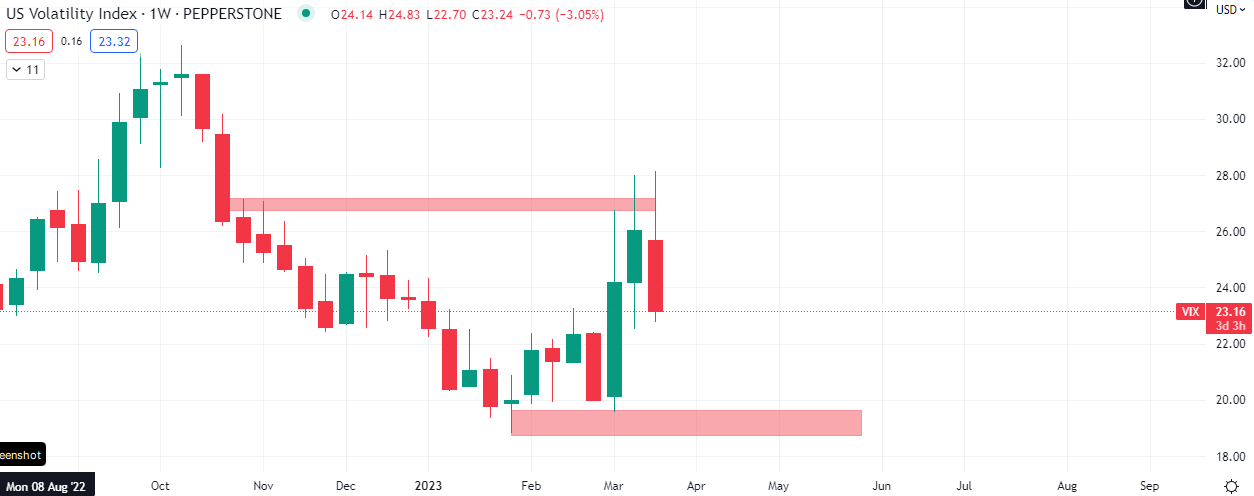

Last week the close of the $VIX signaled a likely spike in volatility in the stock market, however it also indicated a possible decline in volatility based on the market structure. A ‘balance area’ was formed, for lack of a better word. A major bearish imbalance will be formed if this week’s close is lower than it’s open, while a slightly tamer bullish imbalance will be formed if the close is higher than the open. The number to watch on the $VIX is 25.310

The likely direction for the next 3 weeks for the main US stock indices, $SPX, $NDAQ, $DOW and $RUA, will be decided this Friday. The Tech heavy $NDAQ which has been buoyed by great performances from the likes of $MSFT, $AAPL and $NVDA., may retreat by as much as 10% if the bearish narrative of $VIX plays out.

At the moment the stock market has seen a continuation of the ‘recovery’ from last week, catalyzed by the bank bailouts spearheaded by the US Federal Reserve. Due to the fragility and ‘ponzi-like’ nature of the financial system as is, this is surely only a stopgap that will have to be readdressed sometime in the near future.

The most important economic number to watch this week is the FOMC, expected out tomorrow, Wednesday. The previous number is 4.75% and the forecast is for a rise to 5%. The Fed’s hands may however be tied due to the amount of stimulus they have pumped into the banks over the past two weeks.