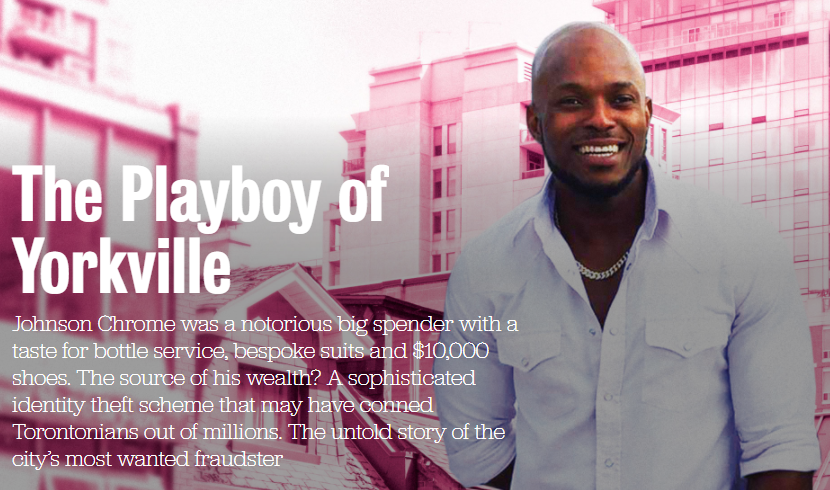

Johnson Chrome was born Adekunle Johnson Omitiran on January 31, 1980, in the Oshodi slums of Lagos, Nigeria. His father, Gbadebo, was a travelling businessman from southwestern Nigeria. When Chrome was a boy, Gbadebo left Chrome’s mother, a Fulani woman from Nigeria’s north, and at one point allegedly had as many as six wives. Gbadebo studied at the University of Exeter in the U.K. and later found his way to Toronto. Chrome’s mother was left to raise him and his brother and stepbrother, with the help of her father, who took the family in. Chrome didn’t respond to interview requests for this story, but sources in Nigeria say he spent much of his childhood on the streets, getting shooed away from the local markets by vendors, who didn’t want a poor kid hanging around. According to one childhood friend, he wasn’t a troublemaker and had no criminal record. He later attended Lagos State University, and in 2003, when he was 23, his father brought him to Toronto.

Chrome enrolled at York University, where he studied economics and lived modestly in a basement apartment near campus. Less than a year later, police believe, he entered the world of fraud. In January 2004, Canada customs intercepted a suspicious parcel destined for Chrome’s apartment. The package had come from Nigeria, and it was heavy enough to qualify for inspection. Inside, officials discovered 36 envelopes addressed to various people in the U.S., each containing a counterfeit cheque for roughly $10,000. The intended recipients had placed ads online selling various items; fraudsters, posing as brokers, wrote letters explaining they wanted to buy the item, but their buyers had already written a cheque for more than the asking price. Would the recipient be so kind as to deposit it and wire back the difference? In most instances of the scam, the intended target is skeptical and ignores the letter, but inevitably, some obey the enclosed instructions. By the time the bank catches on and cancels the transaction, the account holder is on the hook and the scammer is in the wind, a few thousand dollars richer. These kinds of frauds are so popular in Nigeria that they’re now known globally as 419 scams, which refers to the section of Nigeria’s criminal code pertaining to fraud. Police claim that Chrome’s job was to mail the letters from Canada, bypassing the suspicions of U.S. Postal Service officials.

Toronto police set up a fake FedEx delivery to Chrome’s address. When he signed for the parcel, they arrested him and charged him with defrauding the public. Ultimately, however, the Crown decided they would be hard pressed to prove that Chrome was aware of the parcel’s contents, and the charges were withdrawn.

Chrome reappeared on police radar in 2006, when he walked into a Royal Bank on Bathurst and, using forged documents under the name Glen Lee, opened a chequing account. RBC eventually realized that the account was fishy, and police arrested Chrome. He pleaded guilty to fraud under $5,000 and received a 12-month conditional discharge, which effectively wiped his record clean after the sentence was over. By 2007, he’d obtained Canadian citizenship.

According to police, Chrome also developed another elaborate, highly profitable scheme, one that encompassed mail theft, identity theft and credit card fraud. First, they allege, he would intercept mail at condos in Toronto, typically buildings without concierges or front desk staff. He’d enter the mailroom with a set of bump keys and try locks until one popped open, then repeat the process, scooping up as much mail as he could carry. Later, he’d open the mail, find bank documents, and record the target’s name, address and financial information in a notebook. He would call the banks and impersonate the cardholder, trying to extract additional information, and update each profile in his notebook as he went. As he honed his scheme, he’d learn his victims’ dates of birth, phone numbers and email addresses. In many cases, he knew what car his victims drove, where they worked, and the names of their loved ones.

With that information in hand, he’d call the bank’s customer service number and, armed with enough intel to ace the security questions, request a new card. A day or two later, he’d stake out the condo building, wait for the mail carrier to make their drop, enter, and steal the envelope containing the new card.

Next came the spending spree. Often, Chrome would withdraw cash at an ATM or purchase prepaid gift cards. Chrome’s scam was labour-intensive—hustling for a few thousand dollars at a time—but therein lay its brilliance. Banks, though they won’t admit it, tend not to waste their time chasing small sums, which they can quickly reverse. It’s painstaking work for the police to chase down each reported fraud; Crown prosecutors roll their eyes at the complicated paperwork; and judges are often loath to dish out heavy penalties, since the crime is non-violent and the ultimate victim is almost always the banks, which can write off their losses. Despite their best efforts, police say, Chrome was able to continue his operation in plain sight—and no one could do much about it.

Chrome’s girlfriend from Nigeria, Olubukola “Bukky” Jegede, soon followed him to Canada. They married and eventually had three kids. By all accounts, Chrome was a devoted father, taking his kids to the park, the movies, and to church every Sunday. The family moved often—presumably to keep police from knowing his whereabouts.

Somewhere along the way, Chrome began using his middle name, Johnson, and sometimes went by Jay. As money began to flow in from his frauds, he explained to some friends that he worked for a moving company. Chrome also sent cash back home to set up a liquor store business for his mother in the Oshodi area. He later built two houses in the residential area of Abule Egba, in the north end of Lagos, and put his mother in one of them.

He spent lavishly on himself, too. In April 2007, using stolen credit cards, he dropped $5,000 on stereo equipment at Bang and Olufsen near Bay and Bloor, and bought 10 pairs of designer shoes at Davids down the street. When police raided his Lawrence West apartment, he ran to the bathroom clutching his phone, which he tried to hide in the garbage can. On it were photos of a residential construction project back in Lagos, plus images of a shipping container housing a car, a flat-screen TV and building materials—many of which are hard to come by in Nigeria. They seized $140,000 of personal property, including clothing, watches and jewellery, plus five TVs, a washing machine and $17,000 in cash. But they didn’t find the evidentiary treasure trove they were looking for: the notebooks, credit cards, receipts and stolen mail that they hoped would convince a judge of the mammoth scope of Chrome’s operation. They began to suspect he kept a stash house for the most damning material.

They eventually found enough evidence from ATM security footage to lay 53 charges. Chrome pleaded guilty to a handful of charges in exchange for getting the others withdrawn, and he got off with two concurrent sentences of six months’ house arrest, once again avoiding significant jail time. And so began a game of cat and mouse between the police and Johnson Chrome that would last nearly a decade.

In august 2007, Chrome and his wife bought a three-storey detached house with a two-car garage in a sleepy Brampton subdivision for $442,000. Later, according to police, he invested his funds into more real estate, eventually putting a down payment on a $3.4-million five-bedroom, custom-built McMansion with a three-car garage, backing onto a golf course in a tony section of Kleinburg.

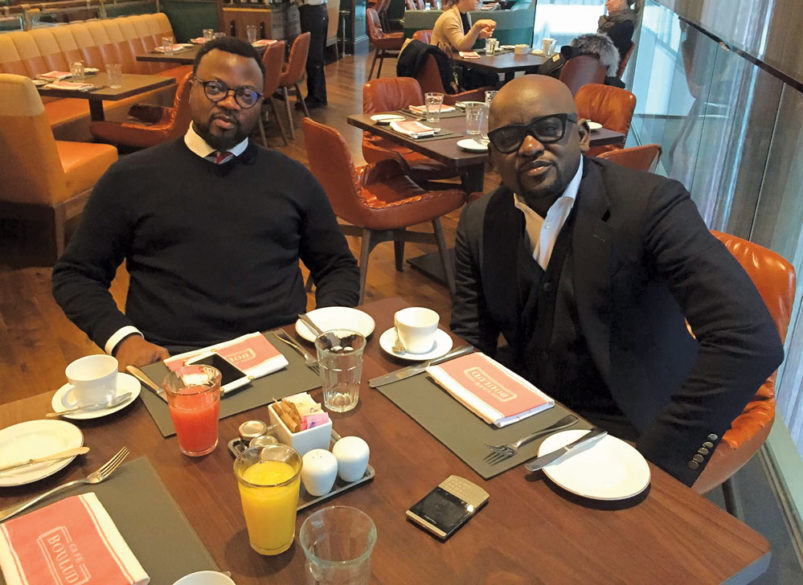

Like any successful businessman, Chrome learned to delegate. Police say he teamed up with a fellow Nigerian named Mickie Noah, who would allegedly make ATM withdrawals and request new cards and PIN changes as part of Chrome’s operation. Noah had grown up in even poorer circumstances than Chrome, and over time he’d developed a similar appetite for luxury. He mocked Torontonians’ lack of sartorial derring-do. “Downtown, they think they’re stylish, but they all wear black,” he once posted on Instagram. Noah had a predilection for bright jackets, wide-brimmed hats and oversized Iris Apfel glasses. He shopped at Holt Renfrew and Via Cavour, stocking his closet with monk-strap shoes, vibrant ascots and jaunty bow ties. He also shared Chrome’s fondness for cigars—Cohiba robustos were his particular weakness—which he often enjoyed next to his friend on Yorkville’s best-situated bench.

Chrome gradually aligned himself with other associates. Andrew Afolarin was a confidence man, smooth on the phone and able to sweet-talk anyone into just about anything. Afolarin liked to hire white Torontonians as his subcontractors, believing they’d invite less suspicion in the banks because of their skin colour. A man named Gee Salaq was purported to be a specialist in account-takeover fraud, especially against U.S. residents. Police suspect that over time, Chrome also developed sources inside Canadian banks, who would provide cardholder information in exchange for a kickback.

In March 2008, Chrome went to the Bay and bought $586 worth of fragrances using a fraudulently obtained TD Visa. He also used stolen credit cards to buy a $355 belt, a $6,500 Omega Deville Co-Axial watch, a pair of $820 sneakers and $610 Louis Vuitton driving shoes. In September 2008, he pleaded guilty to three more charges of fraud under $5,000 and received a conditional sentence of 12 months, which again meant no jail time beyond the minimal time served. He later applied to have his bail altered so that he could fly home to Nigeria twice, to attend his grandfather’s funeral and later to deal with the estate. The judge allowed it.

Two years later, in August 2010, police believe that Chrome tried to purchase $21,000 worth of furniture from Martin Daniels Interiors using a stolen Mastercard, plus $8,200 in ceramic tiles, perhaps for his housing project back in Lagos. Once again, they raided his home. Along with the usual plunder of watches and suits, they found mailbox keys for a building on Rathburn Road in Mississauga, and lists of various tenants of that building, plus their financial information.

It was the smoking gun they hoped would make charges against Chrome stick. Over the course of their investigation, police compiled evidence suggesting that Chrome had compromised 162 bank accounts, allegedly dinging BMO for $274,000 and CIBC for $82,000. The resulting charges fell under several court jurisdictions across the GTA. One major count related to York Region, so the file was sent there and was misplaced. When it was recovered and sent back to Toronto, where the bulk of the alleged frauds had taken place, the case had been pending for so long that the courts stayed the matter. Again, Chrome was spared significant jail time.

By the time Trotter and Kelly, of the Toronto fraud squad, held their bankers’ synod in 2016, Chrome had become a mythical figure in the financial industry, a kind of perverted folk hero who stole from the middle class and spent it on himself. Trotter and Kelly told the bankers that if police were going to solve their fraud problem, they’d need help. They wanted to determine if Mr. O really was as prolific a fraudster as the bankers assumed. They operated under the assumption that he wasn’t involved at all, then set out to determine whether these instances of fraud were in fact linked. They called their investigation Project Royal, and recruited help from the York Regional Police, the Canadian Anti-Fraud Centre, the Canadian Border Services Agency, Canada Post, and the Financial Transactions and Reports Analysis Centre of Canada. They told the assembled bankers that they needed images of people making withdrawals using fraudulently obtained cards. They asked for dates, amounts, times of transactions and records of phone calls made requesting PIN changes.

A few days later, they caught a break. Representatives from a bank in the Niagara region got in touch with video images from an ATM camera of a Nigerian man in his 40s, later identified as Adedayo Ogundana, making cash withdrawals using a stolen credit card. On one date he wore a grey hat with a black brim. On another, he wore the same hat and a hoodie with “NBA” written on it. And on another date, he wore a green Pharrell hat. He’d been charged before, which enabled police to obtain a search warrant on his North York condo; they raided it on December 13, 2016. Ogundana wasn’t home—he was out purchasing prepaid gift cards at the time—but inside his condo and car, police found a collection of credit card numbers scribbled on small scraps of paper. They also found the hats and clothing Ogundana had worn in the bank’s surveillance footage. When Ogundana finally returned home, police arrested him and obtained a search warrant for his cellphones.

On Ogundana’s phone, police came across an intriguing lead: short text messages from someone listed as “Jay,” containing what appeared to be random names and associated credit card numbers. Police thought that Jay could be Johnson Chrome, and they received judicial authorization to view the records for his number. Soon, they’d established his daily routine: he’d start the day in Yorkville, head northwest of the city until the early afternoon, stop in at the same area of North York where his wife and kids were living, and then return to Yorkville.

Police appealed to fraudsters they knew for more information about identity theft networks in Toronto. Criminals typically don’t rat on each other, but in this case, there was no such omertà. Flashiness only invites police attention, and Chrome and his buddies were daring the police to sniff around. Trotter and Kelly followed the trail, combing through their social media accounts, which were teeming with photos of lavish dinners, fancy clothing, expensive cigars and luxury vehicles. And nowhere was there any evidence of any sort of employment. Even better, the accounts helped Trotter and Kelly piece together the group’s social relationships—without having to sit in a car with a telephoto lens.

A few members of the public divulged crucial leads, including the fact that Chrome kept a condo in a high-rise near the Hazelton Hotel. Trotter and Kelly canvassed the area, asking retailers about Chrome; most people remained tight-lipped. Still, tips kept trickling in, and police soon learned that Chrome drove a black Jaguar. They tracked down his unit number, then applied for a search warrant.

On April 24, 2017, Trotter, Kelly and four other cops, all of them in plainclothes, set up outside 155 Yorkville Avenue, the former Four Seasons. It was a straightforward stakeout, but something was off. There were a number of people hanging around, not doing anything exactly, and trading glances with the police. Trotter and Kelly called various agencies to check if there was anyone else on the case. There wasn’t. Then they sent one of their plainclothes officers to sit down beside one suspicious-looking woman and strike up a conversation. Within minutes, she explained her plan to marry Justin Bieber. It all clicked: Bieber was staying in town, and the people hanging around were paparazzi and wild-eyed autograph hunters.

Eventually, police spotted Chrome walking toward them. With so many Beliebers in the vicinity, Trotter didn’t want to cause a scene. Instead, he quietly approached and whispered his real name, “ ’Kunle.” Chrome turned, said “Yeah?” then made eye contact with Trotter and bolted. Trotter gave chase. Someone was unloading produce from a parked truck onto a cart; as Chrome ran past it he toppled the cart into Trotter’s path, spilling fruit and eggs across the sidewalk. Trotter hopped over the mess, but got tangled up in a bicycle and wiped out. Two other officers ran after Chrome, but he got away. Another officer stayed with the car while Trotter and Kelly entered the suspect’s apartment.

Chrome’s 600-square-foot condo was spartan, with a stunning view to the southeast. According to police, the moon dust watch, a few credit cards and two cellphones were on the counter. In the bedroom was an open safe, containing $39,200 in cash. They lifted up the mattress to reveal his massive footwear collection. Two closets were filled with bespoke suit jackets, watches, dress shirts, cologne and sunglasses. There were four bottles of moisturizer worth a total of $2,000. They found paperwork that they knew would help refute a defence lawyer’s argument that Chrome didn’t live in the condo. In the closet drawers was the evidentiary jackpot: 37 credit cards not in his name, rows and rows of stolen mail from more than 20 buildings in the GTA, plus 16 notebooks containing the names and addresses of some 5,000 GTA residents, including a widow named Doreen Affleck and an accountant named Wayne Haymer. Finally, they’d found the stash house.

Johnson Chrome was on the run. The next day, he called a friend who worked as a bespoke men’s clothier in the Yorkville area. They’d met years earlier at the old Four Seasons bar, and Chrome trusted him. Chrome’s friend had made clothing for the Toronto lawyer Peter Brauti and suggested Chrome speak to him. Brauti eventually convinced Chrome to turn himself in. On April 27, Brauti called the police and said, “I think I have a guy you’re looking for.”

Police had learned their lesson: fraud doesn’t get the court’s attention. So they gave it a spotlight. On May 9, 2017, Trotter and Kelly held a press conference announcing the details of Project Royal. They arranged a dazzling showcase of Chrome’s shoes, watches and cologne, plus a healthy stockpile of wine and liquor. They brought in racks to display his suit jackets. Trotter and Kelly spoke to the media at length about Chrome’s alleged activities, spelling out the broad nature of the crimes. They had prepared a slide show of his associates, emphasizing the claim that this was not a lone wolf operation but instead a major syndicate perpetrating fraud on a massive scale. Though none of the allegations have been proven in court, police have laid 14 charges against Chrome and another 14 against Ogundana. A warrant has been issued for Noah and Salaq, but they’re on the run, probably in the U.S.

The day of the press conference, Project Royal was a lead item on the evening broadcasts. The news even resonated back home in Nigeria. The overwhelming reaction among Nigerians I spoke to was anger and frustration at another native son going abroad and falling into a life of fraud. At the same time, there’s a faction within Nigeria that’s proud. They see fraud perpetrated on Westerners as payback for the years of colonial rule that laid waste to their country, infecting it with corruption and widespread dysfunction.

Later that month, a judge granted Chrome bail with a series of conditions, one of which was that he not possess a cellphone, since it was his alleged business tool. Six weeks later, in late June, Chrome walked into an appliance store in Vaughan clutching a cellphone. Using a credit card, he had purchased $60,000 in appliances, presumably for his custom home in Kleinburg. Chrome asked the sales clerk for a refund on his deposit in cash, which raised the clerk’s suspicions. Two days later, police confronted Chrome, who was standing beside a U-Haul truck, talking on his phone. One officer approached from the front; Chrome saw him and turned to run, but encountered another officer who’d approached from the rear. His only words: “Oh, shit.”

Chrome was placed in jail for violating his bail conditions, though he could be let out again before his case goes to trial, which will likely take place in 2018. According to police, the Crown’s case is strong: they have evidence of Chrome’s broad network and his criminal proceeds, plus an epic history of failure to respect the court’s orders. Recently, there have been a few fraud cases where the accused receives a penitentiary sentence, which means at least two years. But the Crown is fighting gravity: many of Ontario’s prisons are already overpopulated, and there’s a limited desire to add non-violent criminals to the mix. It’s possible, even likely, that Chrome will escape serious punishment once again.