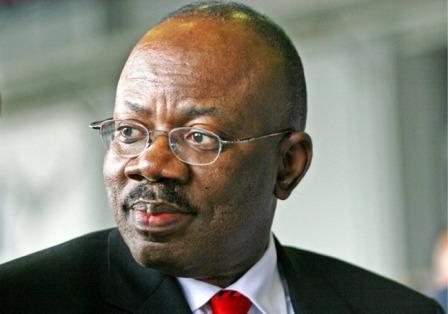

The Chairman of Zenith Bank Plc, Jim Ovia, has described how he established Zenith Bank with only N20 million in 1990 and built it into a foremost financial institution that now boasts over $4 billion shareholders’ funds.

He made this known in an interview with Zain Asher on a CNN programme, Marketplace Africa.

Ovia said, “I started Zenith Bank with N20 million in 1990. That is about $5 million at the exchange rate of N4 to a dollar thereabout. At the same time, 20 years later, Zenith Bank shareholders fund was $4billion. From $4 million to $4 billion, you can do the maths, it will give you some thousands percentage in returns.”

He encouraged young people in Nigeria to remain “focused and determined” in order to exploit the opportunities in the country to their advantage, adding “This kind of returns, you don’t it even in God’s own country, America. You don’t get it in Europe. You don’t get it in Russia. You can get them in Nigeria.”

The bank chairman noted that Zenith Bank is committed to helping young and budding entrepreneurs grow.

He added that the bank would always provide loan facilities especially for them if they meet the “risk acceptance criteria” which assesses viability of the project, return on investment and character of the individual.

My Lagos Success Story – Jim Ovia

Read the full interview below:

I started Zenith Bank with N20 million in 1990. That is about $5 million at the exchange rate of N4 to a dollar thereabout. At the same time, 20 years later, Zenith Bank shareholders fund was $4billion. From $4 million to $4 billion, you can do the maths, it will give you some thousands percentage in returns.

To the young people out there who want to make it like you made it, what is the secret?

They should remain focused and determined. This kind of returns, you don’t it even in God’s own country, America. You don’t get it in Europe. You don’t get it in Russia. You can get them in Nigeria.

Challenges along the way

They will always experience adversity or challenges in any business initiative, either it is in Europe or America. There has to be those, but those are the areas where many people really give up. Just don’t give up in Nigeria. What we were doing at that point in time (was that) we would build our own roads to our branches if we’re building branches in some cities or towns where the roads were not good enough. We have also bought power plants, generating sets to power electricity into our building. We have also dug boreholes to supply water to the building. When we do all these, what I personally call it is BYOI – Bring Your Own Infrastructure or Build Your Own Infrastructure. Those are challenges and anyone that ever ran a business in Nigeria will know that.

During the recession, non-performing loans was a major issue for Nigerian banks. How is Zenith Bank reducing that?

All banks in the world have non-performing loans.

…Particular during the recession in Nigeria, it got quite dicey for a lot of Nigeria banks

During recession in Nigeria, just like in any other economy, there will be slowdown in payment of those loans, not that those loans are terribly bad or completely written off, are lost. Businesses did slow down, so repayment programmes equally slowed down. They just slowed down, and you’d reschedule those loans. Instead of five years, it becomes seven years or eight years (to repay), but they are not terribly bad that they are written off. They are not lost.

There are different classifications of loans in banking. I will say most loans in Nigeria may have been substandard, but not necessarily lost. As the economy continues to improve, repayment continues to be released.

Have you used this period of recovery to re-evaluate how you assess whether or not a borrower is likely to repay?

Oh definitely! You will always know and always continue to re-assess, whether there is economic recession or economic boom. You do that consistently and constantly at all times. That is what you do.

How difficult is it for a young, budding entrepreneur to walk into Zenith Bank and get a loan?

The individual must meet what we call risk acceptance criteria. When he does meet such criteria, he will get a loan. But if he doesn’t qualify, if he doesn’t meet the criteria, whether he is young or old, he is not going to get a loan. And it is even more likely that a young 30 or 34-year-old that has met the right acceptance criteria in terms of, one, viability of the project, two, return on the project, and, three, character (will get a loan). Character is a major reason why we lend or don’t, the character of the individual in terms of KYC. You have to know who the individual, but more importantly, the viability of the project and the viability of the loan in terms of the return on assets. That, first of all, is critical for us.

Watch video:

The Founder/Chairman of Zenith Bank Plc, Mr. Jim Ovia, speaks on how he started Zenith Bank in 1990. He also details the strategies employed over time that have made Zenith Bank the largest bank in Nigeria. #ZenithBank rt https://t.co/I1g12crQxt

— Zenith Bank (@ZenithBank) March 26, 2018

Premier League

Premier League