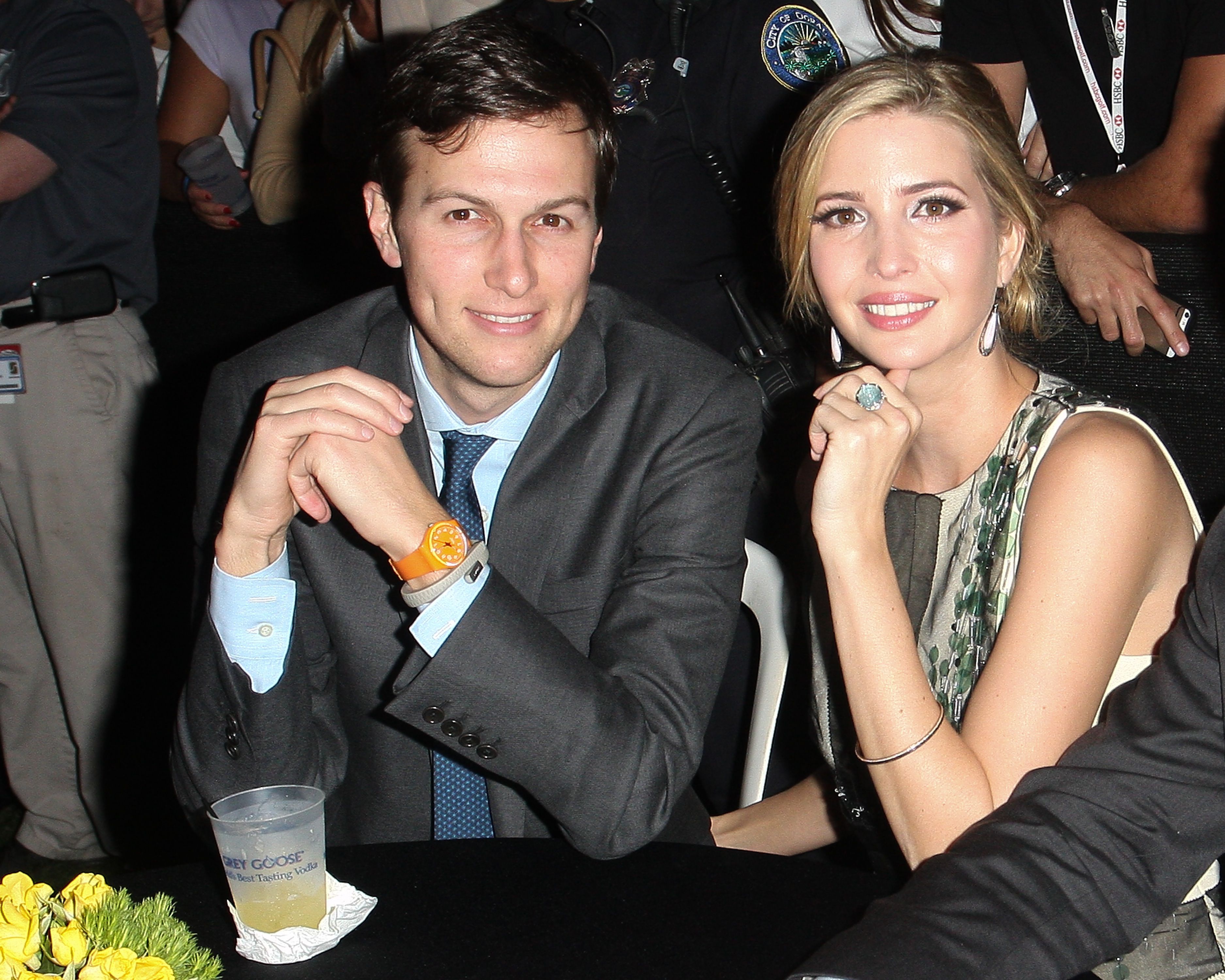

The White House on Friday released financial disclosure reports for about 180 of its top staffers, including details on the assets held by President Trump’s son-in-law and daughter, who both have advisory roles.

The Wall Street Journal Reported that Jared Kushner, a senior adviser, and Kushner’s wife Ivanka Trump held at least $240 million and as much as $700 million. The report said her business alone is valued at more than $50 million.

Kushner, Trump’s senior adviser, resigned from more than 260 entities and sold off 58 businesses or investments that lawyers identified as posing potential conflicts of interest, the documents show.

But his lawyers, in consultation with the Office of Government Ethics, determined that his real estate assets, many of them in New York City, are unlikely to pose the kinds of conflicts that would trigger a need to divest.

“The remaining conflicts, from a practical perspective, are pretty narrow and very manageable,” said Jamie Gorelick, an attorney who has been working on the ethics agreements for Kushner and Ivanka Trump.

Kushner began selling off the most problematic pieces of his portfolio shortly after Trump won the election, and some of those business deals predate what is required to be captured in the financial disclosure forms.

For example, Kushner sold his stake in a Manhattan skyscraper to a trust his mother oversees. Jared Kushner, Ivanka Trump and their three minor children have no financial interest in that trust, his lawyer said.

The Kushner Companies, now run by Jared Kushner’s relatives, are seeking investment partners for a massive redevelopment.

White House Press Secretary Sean Spicer described the business people who have joined the administration as “very blessed and very successful,” and said the disclosure forms will show that they have set aside “a lot” to go into public service.

The financial disclosures required by law to be made public usually give a snapshot of the employees’ finances as they entered the White House.

However, Office of Government Ethics agreements with those employees on what they must do to avoid potential conflicts of interest is not being provided for public perusal.

Those documents will never be made public, White House lawyers said, although the public will eventually have access to “certificates of divestiture” issued to employees who are seeking capital gains tax deferrals for selling off certain assets.

Kushner, for example, received certificates of divestitures for his financial interests in several assets, including several funds tied to Thrive Capital, his brother Joshua Kushner’s investment firm.

He and Ivanka Trump built up companies the documents show are worth at least $50 million each and have stepped away from their businesses while in government service. Like the president himself, however, they retain a financial interest in many of them. Ivanka Trump agreed this week to become a federal employee and will file her own financial disclosure at a later date.

Kushner’s disclosure shows he took on tens of millions of dollars of bank debt in 2015 and 2016, including liabilities with several international banks whose interests could come before the Trump administration.

Kushner has as much as $25 million in liabilities to Deutsche Bank, a prime lender to Kushner family real estate ventures as well as a major creditor for Trump Organization-branded real estate projects. Kushner and his father, Charles, also have liabilities worth much as $5 million to the U.S. unit of Israel Discount Bank. The Kushner Companies have separately acknowledged “long-standing” dealings with two other Israeli banks.

Financial information for members of Trump’s Cabinet who needed Senate confirmation has, in most cases, been available for weeks through the Office of Government Ethics.

The president must also file periodic financial disclosures, but he is not required to make another disclosure until next year.