Japan’s economy may be at an inflection point in its 25-year battle with deflation as price and wage rises show signs of broadening, the government said on Tuesday, signaling its view that the economy was nearing an end to prolonged stagnation.

Since its declaration that Japan was in a state of deflation in 2001, the government has made ending price falls a policy priority. The focus has led to years of big fiscal spending to ‘artificially’ prop the economy up, and kept pressure on the central bank to maintain ultra-loose monetary policy.

Corporate price- and wage-setting behaviour are changing, and could pave the way for phasing out the country’s prolonged massive fiscal and monetary support.

“Japan has seen price and wage rises broaden since the spring of 2022. Such changes suggest the economy is reaching a turning point in its 25-year battle with deflation,” the government said in its annual economic white paper.

“We shouldn’t dismiss the fact a window of opportunity may be opening to exit deflation,” as inflation perks up and public perceptions about persistent price declines abate, it said.

“In determining the trend of inflation, it’s important to look at services prices” as they reflect domestic demand and wages more vividly than goods prices, the report said.

In last year’s report, the government said inflation was modest except for a handful of food and energy-related goods.

This time around, the report stopped short of saying Japan has fully eradicated the risk of deflation returning, pointing to a “still moderate pace” of increase in services prices.

The change in tone on deflation risks underscore the government’s shifting priorities, as rising commodity costs and a tightening job market push up inflation and heighten public worries over higher living expenses.

Japan’s core inflation hit a four-decade high of 4.2 per cent in January and remained above the BOJ’s 2 per cent target for 16 straight months in July, as more firms pass on higher raw material costs.

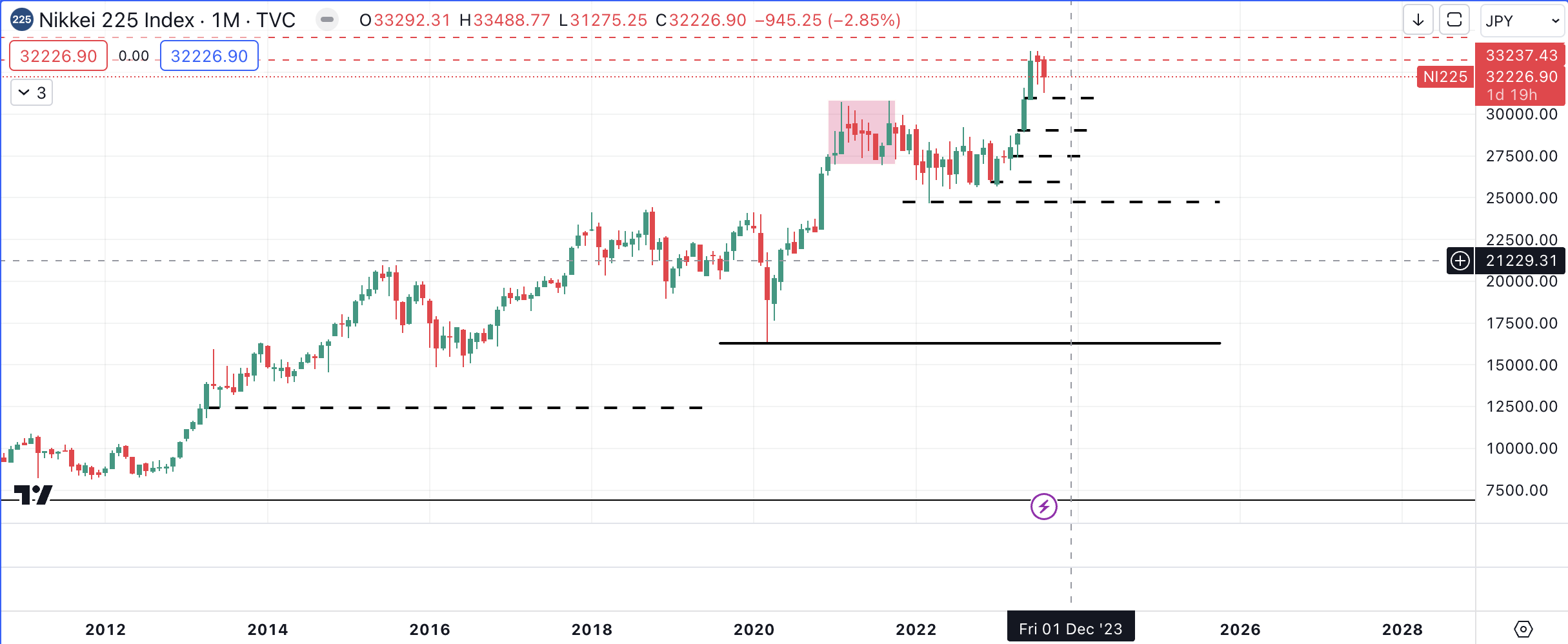

A more realistic scenario is depicted in the $NI225 chart above, showing possible buy levels for a trend continuation toward the all time high. Chief among these potential price points is 24782.49, a failed sellers auction at this level would probably reignite a rally.

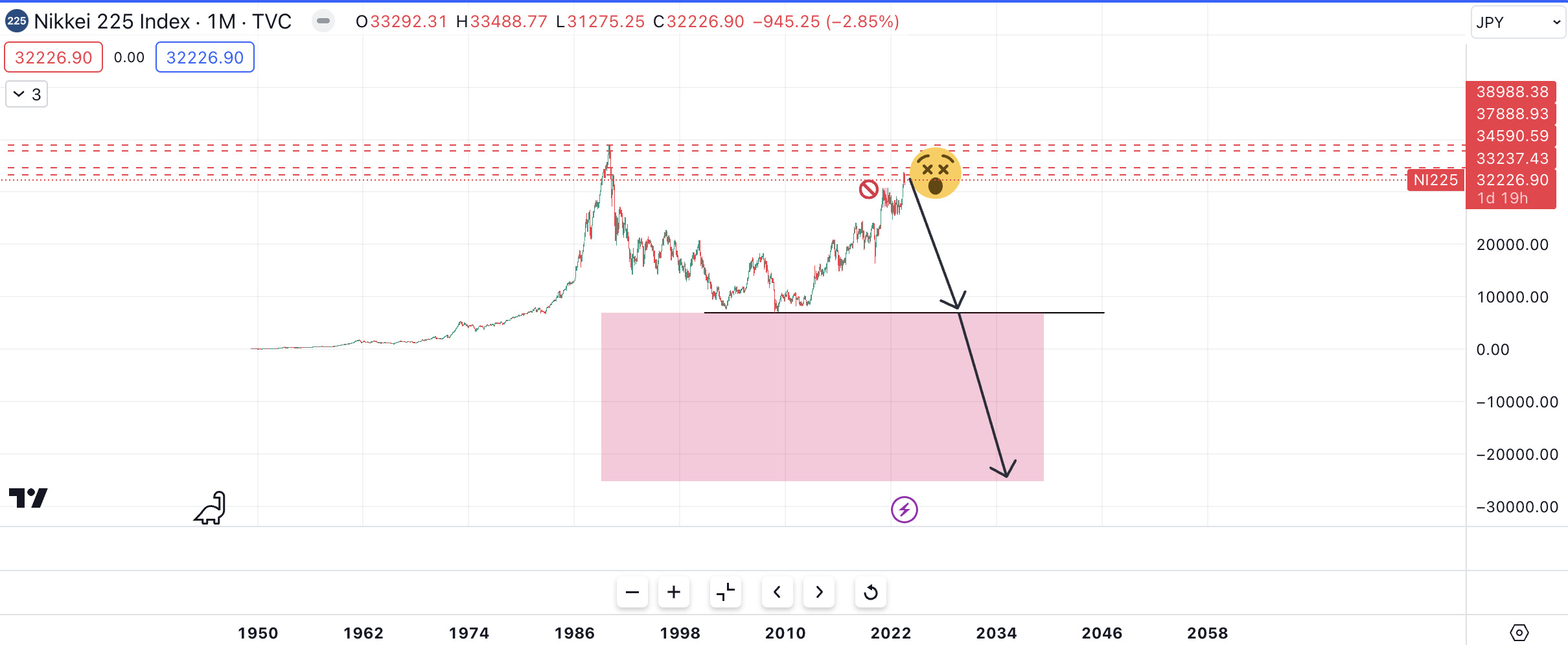

For now the Japanese stock market is in a bearish pullback that should continue for a while as the BOJ begins to consider a more hawkish policy plan.