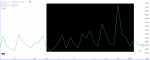

“Going back to the mid-1900s, there have been only six times Santa failed to show in December. January was lower five of those six times, and the full year had a solid gain only once.” -Ryan Detrick, LPL Financial Chief Market Strategist-

The Santa Claus rally is used to describe the tendency for the stock market to rise in the last five trading days of the current calendar year and the first two trading days of the new year.

It was first defined in The 1972 Stock Trader’s Almanac by Yale Hirsch and used to describe the phenomenon of a sustained increase in the stock market during the last trading week of December and the first two trading days of the new year.

According to The Wall Street Journal, historically, the S&P 500, the Dow Jones Industrial Average (DJIA), and the Nasdaq Composite have risen about 80% of the time during the Santa Claus rally period. The average returns for the S&P 500, the Dow, and the Nasdaq Composite over the period have been 1.3%, 1.4%, and 1.8%, respectively.

This information may be used as an extra indicator, not solely because there are more than one catalysts involved in moving markets.

There is no universally accepted reason for what causes the Santa Claus rally to occur. The most common reasons include:

- Optimism over a coming year

- A slowdown in tax-loss harvesting, which has a deadline of the last day of the year

- Investors/trading purchasing in anticipation of the January Effect, which is a hypothesis that there is a seasonal anomaly causing stock prices to increase in the month of January more than in any other month

- Holiday spending

- Institutional investors are holiday during the last week of December, resulting in generally more bullish oriented retail investors driving the stock market up

Let us first take a look at how December as a whole, not just the last week, has fared over a period of time. The gallery below shows the 18 years worth of outcomes of December, the last week of December and the first two days in January.

There is a seasonal tendency for the equity markets to appreciate in December, but that ‘appreciation’, in itself is only part of a bigger picture of causalities.

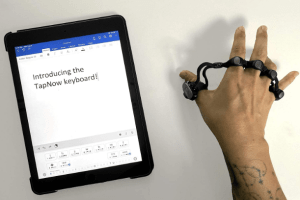

Upgrade your workstation with these cutting edge tools!