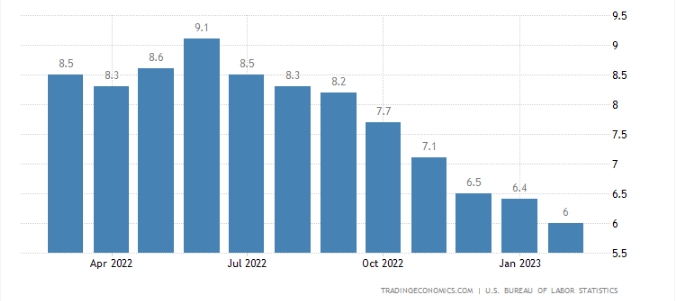

CPI measures a broad basket of goods and services and is one of several key measures the Fed uses when formulating monetary policy.

Inflation rose in February but was in line with expectations, providing an important clue into whether the Federal Reserve will continue to raise interest rates.

The consumer price index increased 0.4% for the month, putting the annual inflation rate at 6%, the Labor Department reported Tuesday. Both readings were exactly in line with Dow Jones estimates.

Core CPI increased 0.5% in February and 5.5% on a 12-month basis, excluding volatile food and energy prices, . The monthly reading was slightly ahead of the 0.4% estimate, but the year over year level was in line.

The price of food rose 0.4% and 9.5% respectively. Meat, poultry, fish and egg prices decreased 0.1% for the month, the first drop in that index in over two years.

A drop in energy costs added to the conditions required for the tame headline CPI reading. The sector fell 0.6% for the month, bringing the year-over-year increase down to 5.2%. A 7.9% decline in fuel oil prices was the biggest mover for energy.

Shelter costs rose 0.8%, bringing the annual gain up to 8.1%. Fed officials largely expect housing and related costs such as rent to slow over the course of the year.

Used vehicle prices, a key component when inflation first began surging in 2021, fell 2.8% in February and are now down 13.6% on a 12-month basis. Apparel rose 0.8% while medical care services costs decreased 0.7% for the month.

Heading into the release, markets had widely expected the Fed to approve another 0.25 percentage point increase to its benchmark federal funds rate. That probability increased following the CPI report, with traders now pricing in about an 85% chance that the Fed will increase the rate by a quarter point.

However, banking sector turmoil in recent days has kindled speculation that the central bank could signal that it soon will halt the rate hikes.

On Tuesday morning, the markets were pricing a peak rate of about 4.92%, which would mean the upcoming increase would be the last.

Given the CPI numbers and the Silicon Valley Bank bailout by the Fed, market sentiment has shifted dramatically.

However, the collapse of Silicon Valley Bank and Signature Bank over the past several days paved the way for a more restrained view for monetary policy.