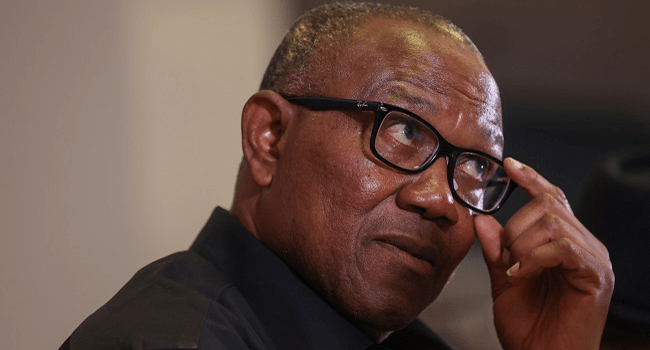

The 2023 presidential candidate of Labour Party (LP), Peter Obi, has said that the Monetary Policy Committee (MPC)’s decision to increase the Monetary Policy Rate (MPR) to 22.5% and the Cash Reserve Ratio (CRR) to 45% will have adverse economic effects.

Obi said this in a Thursday statement.

At a Tuesday press conference, Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso disclosed that the Monetary Policy Committee of the apex bank had decided to raise the Monetary Policy Rate (MPR), which benchmarks interest rates, from 18.75 percent to 22.75 percent.

According to Cardoso, who chairs the committee, the MPC raised the MPR by 400 basis points to 22.75 percent, and adjusted the asymmetric corridor at +100 and -700 basis points from +100 basis points and -300 basis points around the MPR.

He added that the committee equally increased the Cash Reserve Ratio (CRR) from 32.5 percent to 45 percent, while retaining the liquidity rate at 30 percent.

But reacting, Obi warned that this would worsen the economic situation of most Nigerian households as it is bound to cause more job losses in the productive sector, especially manufacturing and other sectors that rely on bank loans and credit facilities for their funding needs.

Obi stressed that tightening liquidity in the financial system does not improve productivity, ie food production, which is the major cause of inflation in Nigeria.

“Moreover, only about 12% of N3.6 trillion of the total money in circulation is in the banking system which means that 88%, about N3.2 trillion is outside the banking system.

“So, this measure would rather be counterproductive as it would not address the intended purpose of managing the money supply.

“These new measures will worsen the fragile economy as the supply of funds would dry up for the real sector, and the new MPR rate hike will push the interest rate on loans to above 30%, which would be very difficult for the real sector operators especially manufacturers and SMEs to repay; resulting, obviously, in increased bad loans, and worsening the nation’s economic situation,” the businessman-turned-politician stated.

He maintained that the most critical way to manage high rate of inflation and decline in production is for the government to address the issue of insecurity in the country, which would allow for increased food, and crude oil production, and an overall increase in production, which would make products, especially food, cheaper.

“This way we would increase our productivity as well as restore the confidence of FDIs and FPIs to come back to the country.

“I must caution that what the Nigerian economy needs now is hard headed practical originality and results. Tinkering with classical economic theories can only deepen our crisis,” Obi emphasised.