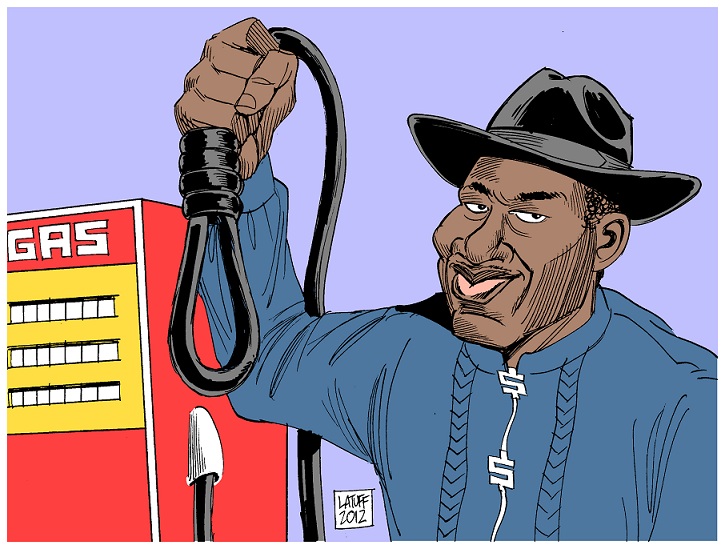

The International Monetary Fund (IMF) has urged the President Goodluck Jonathan-led administration to completely remove fuel subsidy in order to ensure fiscal adjustment.

This came from the IMF’s Senior Resident Representative/Mission Chief, Williams Scott Rogers, while speaking with the media on Thursday, who also insisted that Nigeria requires public sector reforms, stressing that it was necessary for planned savings in recurrent spending.

He also recommended that the Federal Government mobilise non-oil revenues and strengthen oil-price rule and oil savings mechanism, while pushing for the maintenance of tight monetary policy.

Rogers, however, commended the Nigerian banking sector and gave it a pass mark, disclosing that it had improved considerably, as credit to the private sector improved under fully capitalised banks.

Notwithstanding the improvement, the IMF Country Representative advised that more work on consolidated and cross-border supervision should be encouraged, stressing that there was an urgent need for structural reforms to enhance productivity and global competitiveness.

He said, “To this extent, power reform is a quick win for growth and competitiveness. Trade protection for “infant-industries” should be strictly time-bound, while focus should be on measures to improve competitiveness.”

He also said that export diversification was key to long-term growth and improvement in macro-economic statistics, especially in national income accounts.

On the declining oil price in the international market, Rogers called for caution on the part of the Federal Government, saying that although international reserves had been rebuilt and now stand at just over US$50 billion, a decline in international oil prices to US$97 per barrel (annual average) can erode Excess Crude Account (ECA) balances.

“A decline in international oil prices to $97 per barrel (annual average) would begin to erode ECA balances. A fall to $80 – $85 would wipe out ECA balances within a year,” he warned.