The Niger Government says it will start collecting taxes from shoe makers and other petty traders in the state as part of efforts to boost its Internally Generated Revenue (IGR).

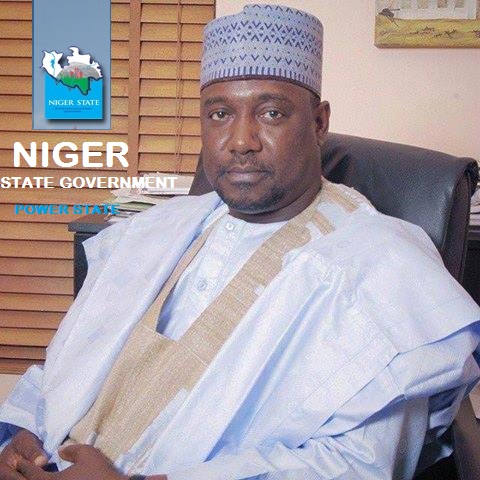

The Commissioner for Finance, Alhaji Ibrahim Balarabe, announced this on Thursday during his ministry’s budget defence at the state House of Assembly in Minna.

He said the state’s inability to meet its IGR targets had forced it to explore revenue windows which hitherto were ignored.

“We are concentrating on the informal sector now. As I speak, we have enumeration going on, trying to capture them into one platform.

“We will no longer turn a blind eye to shoe makers, vulcanisers, suya sellers and other little revenue sources in our bid to improve our IGR.

“We know that people like shoe makers move from one place to another but once we have their data, it makes it easier for us to access them.

“It is not about how much they make in a day but the idea is to generate from all sources because it is only when you draw from all sources that you have a bigger pool of resources,” he said.

Balarabe said that the state IGR stood at N4.81 billion in 2016 as against its target of N9.39 billion, adding that it was targeting an IGR of N9.5 billion in 2017.

On efforts to recover looted funds, the commissioner noted that investigations were still ongoing and some cases were already in court.

The Chairman of the House Committee on Finance, Alhaji Abdullahi Mamagi, urged the ministry to guard against unrealistic budget estimates and extra budgetary spending.

Mamagi urged the ministry to prioritise its projects and execute the necessary ones in view of the dwindling allocation from the Federal Government until the situation improved. (NAN)