The International Finance Corp., the World Bank’s private-lending arm, plans a 25 percent boost in Nigeria investments to $2 billion by next year, said Solomon Adegbie-Quaynor, the country manager.

Funds to be raised directly by the IFC or mobilized from other sources will be targeted at industries that offer competitive advantage to the West African nation, Solomon Adegbie-Quaynor said in an Aug. 2 interview from Lagos, Nigeria’s commercial capital.

“We are partnering with the Nigerian Sovereign Investment Authority and also looking at institutions to work with for activities in banks, power, gas, transport and agriculture,” he said. Power will be an important industry for IFC investment “as it is identified as largest constraint to private-sector growth” inNigeria, he added. The Nigerian Sovereign Investment authority manages the country’s sovereign-wealth fund.

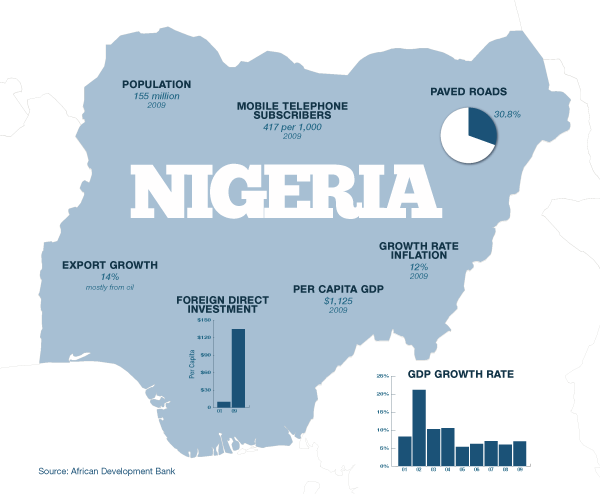

Africa’s most populous nation of more than 160 million people needs $10 billion of infrastructure investment a year to keep up with rising population and expanding economy, Finance Minister Ngozi Okonjo-Iweala said in May. The country’s sovereign-wealth fund, set up in October to invest savings made from the difference between budgeted oil prices and actual market prices, also has a brief to fund the country’s infrastructure needs.

More at Bloomberg