Hawaiian Electric Industries ($HE) is currently speaking with restructuring advisory firms about financial and legal challenges over its potential liabilities in the wake of the Maui wildfires, the Wall Street Journal reported on Wednesday.

The utility firm, which has been public since 1968, is in discussions over the strategies it can pursue and to determine whether it needs to hire legal and financial advisers, the report said, citing people familiar with the matter.

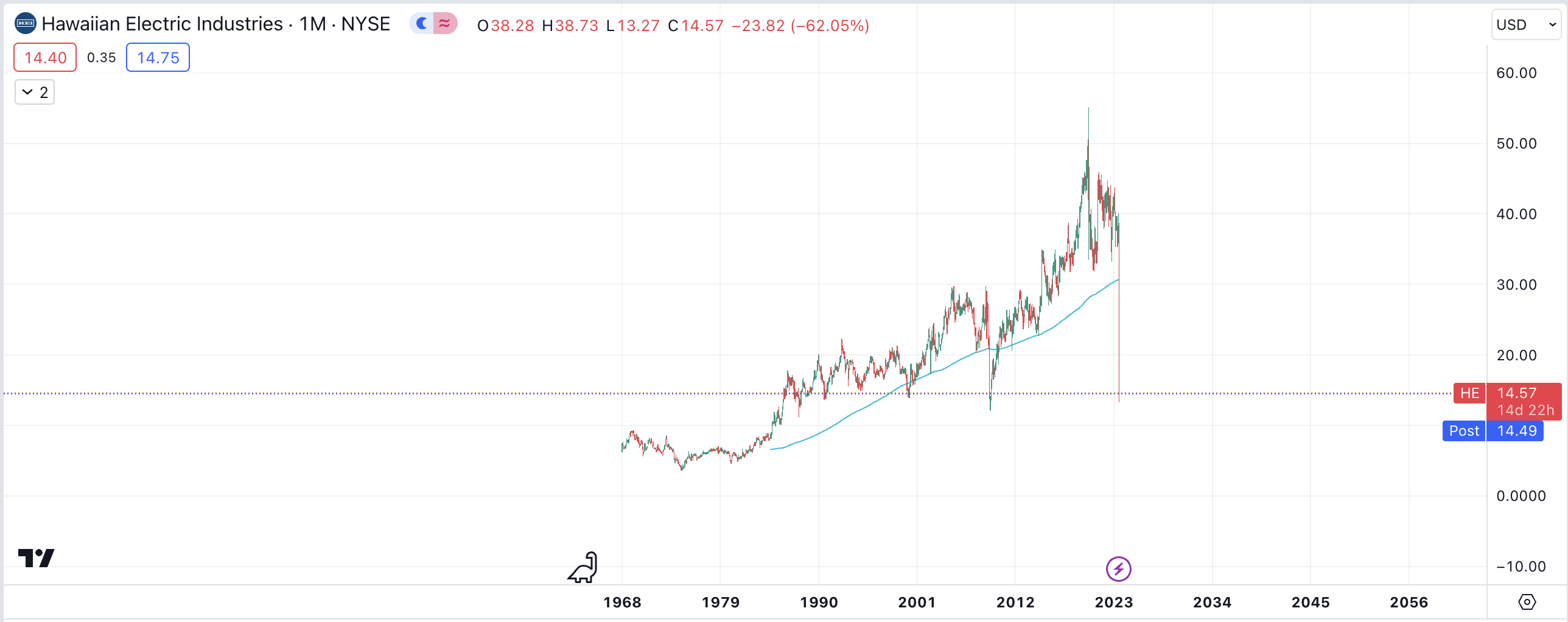

The stock is down about 55% so far this week amid increasing scrutiny over whether the utility company’s equipment might have played any role in the deadly wildfires.

This month’s drop is the largest in the company’s entire history and it is now trading below it’s 200MA.

It lost roughly $730 million in value on Tuesday, as the stock price hit its lowest level since 2009.

S&P Global Ratings downgraded Hawaiian Electric to “BB-” on Tuesday and placed it on watch for further downgrades, citing damage caused to its customer base and class-action lawsuits filed against the company alleging it was responsible for the fires.

The cause of the wildfires, which have killed about 100 people and destroyed the coastal Maui town of Lahaina, is still under investigation.

Premier League

Premier League