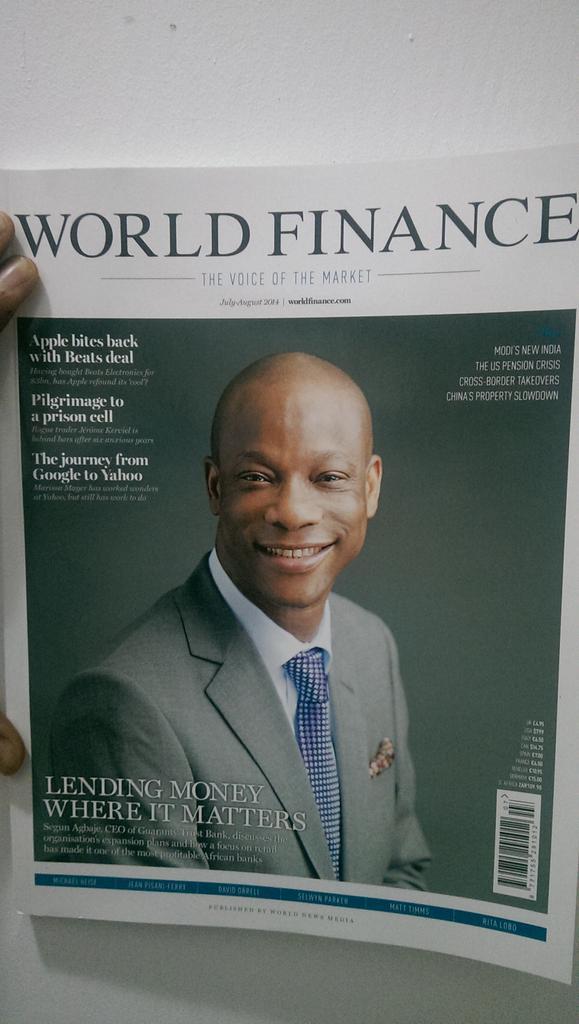

The CEO of Nigeria’s largest bank by market capitalization has graced the cover of World Finance magazine.

GTBank CEO, Segun Agbaje discusses the plans for the GTBank brand in Africa and says it may be one of the top three profitable banks on the continent in 2016.

Here are some excerpts from the publication:

“Right now we’re daring to dream,” Agbaje told World Finance in an exclusive interview. “In 2011, we were number 15 in Africa in terms of profit, today we’re number six, and our objective is to be number three… within the next two years. Once we’ve done that, it will give us some scale to develop across different economies, so we’ll be relevant in West Africa, East Africa and obviously be looking into Central Africa.”

“We’re trying to build a strongly African franchise and we started in Anglophone West Africa because we believe that ultimately there will be a West African economic zone. We went into Francophone Africa for that same reason. The three East African countries we’re in right now give us a client base of 87 million, and they’ve also discovered oil in a lot of these places. So in order to be a very profitable African institution we’re hoping to go into Mozambique and Angola next for the same reasons – reaching natural resources as well as a population size where we think we can help,” says Agbaje.

“In growing our retail [segment] we’re trying to use all other platforms, which is why we’re using mobile and social banking on Facebook as well as looking into using other social networks. Recently, we’ve also launched a virtual SME market hub, where we put SME-type companies on the platform, creating our own little marketplace for them,” says Agbaje.

“We’re not planning on making major business acquisitions, so one way for us to grow our retail base is through mobile phones. Five years ago we had a retail base of about 300,000. Today it’s 5.4 million and we’d like to get to about 10 million in the next two years,” says Agbaje. “In Nigeria, you have more than 100 million mobile subscribers today and even with people having two or three mobile phones, we’re still looking at 70-80 million potential customers so there really is a huge upside.”

Read the entire story on World Finance