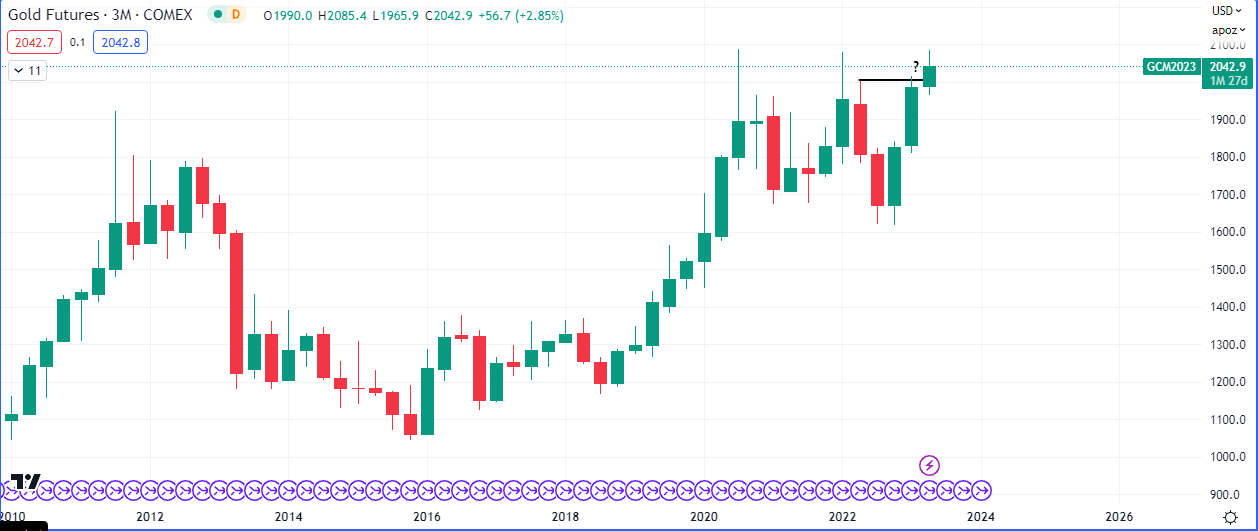

Gold retested its all time high of $2075.19/ounce during the Asian session today, a record set in July 2020.

The precious metal extended gains in the overnight session after the Federal Reserve hiked interest rates but flagged a more stringent approach to raising rates further amid worsening economic conditions.

Fed Chair Jerome Powell warned that economic growth was cooling, and that credit conditions were likely to tighten further amid growing pressure on U.S. banks. This outlook from the FOMC meeting on Wednesday increased demand for the safe haven instrument as risk aversion gripped the market.

It is worth noting that last quarter’s close was could not close above the high of Q3 2022, hence there may still be a pullback to the $1800 area before a continuation up. This narrative will however be dependent on how this quarter closes in June.

A bullish close takes price higher quicker while a bearish close could will cause a retracement.

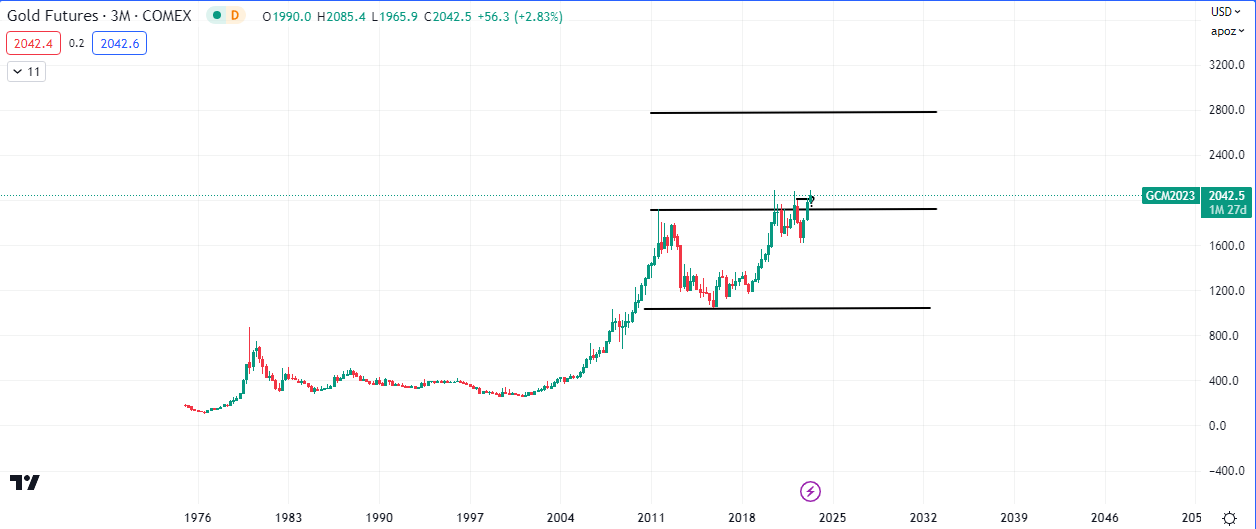

The break out of price from the balance area has a potential target of $2800, if the metal stays bid.

Other precious metals also made gains as Silver futures jumped 1.5%, while platinum futures added 0.4%.

Copper prices saw some relief from a weakening US dollar, but traded lower for the week amid fears that worsening economic growth will greatly crimp demand for the red metal. This coupled with hiccups in demand from China added to the downward pressure on the industrial metal.

Copper futures rose 0.2% to $3.8563 a pound.