The Governor of Central Bank of Nigeria (CBN), Godwin Emefiele has incurred the wrath of some Nigerians, who demanded his sack, over new foreign exchange restrictions imposed on bank customers.

Under the new restrictions, majority of bank customers with domicilliary accounts are virtually barred from effecting direct FX transfers to third parties and/or withdrawing their own dollars over the counter.

An internal memo of one of the nation’s leading commercial banks dated September 18 which was sighted by the The Herald conveyed the new restrictions.

In the memo, third party transfers were “strictly prohibited” for internal account to account FX transfers.

Also, foreign exchange cash lodgment over the counter could be done by only account holders, who can have “unfettered access by telegraphic transfer up to a limit of $40,000 monthly for payment of medical bills, school fees, subscription to professiona bodies, etc, subject to existing CBN guidelines”.

For offshore FX inflows, customers could have unfettered access to no more than $50,000 monthly “upon confirmation of the legitimacy of the inflows”.

The Founder of financial advisory portal, The Money Africa, Oluwatosin Olaseinde, took to Twitter to lament the new restrictions on Tuesday afternoon.

She wrote, “We have just been informed that customers can no longer effect FX transfers directly to third parties. Customers can only sell such funds to the bank. Consequently, FX transfers will be disabled on internet banking.”

A journalist, David Hundeyin, also took to Twitter to lampoon the new restrictions.

Sharing a copy of the memo, he wrote:

Whenever I see any Nigerian legislative or regulatory document contain a vague and subjective phrase like "confirm legitimacy" or "to a reasonable extent," I immediately smell premium Nigerian govt okoto meow designed to create arbitrage opportunities within the system. https://t.co/vzW9j5XIk7

— David Hundeyin (@DavidHundeyin) September 22, 2020

He further recounted a 2019 incident in which a FX inflow to his domiciliary account from the US pitched him against his bank.

Hundeyin wrote:

Last year I did a one-off $250 writing gig for an American finance news website and they insisted on paying into a Nigerian account instead of via crypto, so I gave them a naira account (the bank will receive the USD and convert it to NGN and pay you).

Here's what happened.

— David Hundeyin (@DavidHundeyin) September 22, 2020

After getting my written mandate to convert the funds to NGN and pay out, my account officer called me. He said because the name of the entity that paid me had "cryptocurrency" in it, I'd have to "clarify the source of the funds."

A NEWS website paying for writing work!

— David Hundeyin (@DavidHundeyin) September 22, 2020

If not that I immediately threatened to hit the nuclear button, the bank might have seized my $250 under the stupid guide of "unclear source of funds" because one bright chap at the CBN gave them a regulatory code that can be interpreted subjectively.

This is dangerous nonsense!

— David Hundeyin (@DavidHundeyin) September 22, 2020

This newspaper recalls that the CBN on August 24 issued a circular removing buying agents/companies or any third parties from accessing its inter-bank retail Secondary Market Intervention Sales (SMIS) forex window through FORM M forex purchases.

In the circular, the apex bank instructed that “Authorised dealers are hereby directed to desist from opening of Form M whose payment are routed through a buying company/agent or any other third parties”.

The CBN hinged its decision on the need to “ensure prudent use of our foreign exchange resources and eliminate incidences of over invoicing, transfer pricing, double handling charges, and avoidable costs that are ultimately passed to the average Nigerian consumers”.

Reacting to, many Nigerians berated the CBN for constraining customer’s use of their hard-earned resources.

Read comments monitored on Twitter:

Who will call Emefiele to order?

— Attai 🇳🇬 (@Dacosta9110) September 22, 2020

There should be a background check of Goddy Emefiele 's certificates. I suspect they are "Oluwole".

— The Soaring Eagle (@Speak4ThemAll) September 22, 2020

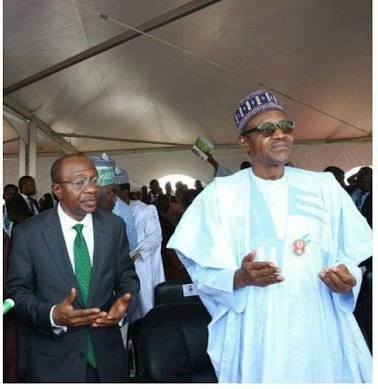

The damage Buhari and Emefiele have done and have continued to do might take 20 years to undo. https://t.co/xiUyJOYI1G

— Flo (@Folarin_AA) September 22, 2020

Restrictions on DOM accounts will only lead to major spikes in the Naira-Dollar rate. Unwise.

— Kamala Obama (@Ambrosia_Ijebu) September 22, 2020

One bank has already limited international transfers to $50,000 a month. All sorts of other bells and whistles introduced. It will end in tears.

— Kamala Obama (@Ambrosia_Ijebu) September 22, 2020

This talk about "confirm legitimacy" is prime Nigerian govt okoto meow. What is the objective standard for what is "legitimate" or not when the person deciding is Godwin Emefiele? If my remote job pays my salary and CBN decides to be foolish (as it inevitably will), what then?

— David Hundeyin (@DavidHundeyin) September 22, 2020

Who dash Emefiele morals to resign!

He's too selfish to do that, He doesn't even care anymore.

— Ezeamaka (@_ezeamaka) September 22, 2020

Hope they don't stop people from withdrawing their fx over the counter at this rate

— Olurotimi Oguntoye (@Bomfy) September 22, 2020

Read Also: