The Financial Crimes Enforcement Network (FinCEN), an agency of the U.S. Department of Treasury, has placed former Nigerian Vice President Atiku Abubakar and his family members under surveillance.

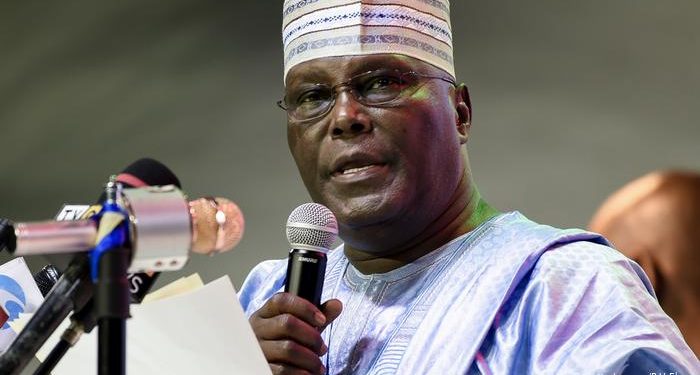

Ahead of Nigeria’s 2019 general elections, perennial presidential hopeful, Atiku Abubakar, mounted an intense campaign to untangle his candidacy from a public perception that he is corrupt. This is what his opponents have always latched on to. But in 2019, he decided to confront the question of corruption head-on.

“I have always said that if they have any evidence of corruption against Atiku, please come forward,” Atiku told a packed audience in Ado Ekiti, southwestern Nigeria. “But nobody has been able to come forward.”

As Atiku made media and public appearances daring detractors to provide evidence against him, American authorities were also busy poring through records to determine if the former vice president had engaged in any recent financial transaction that could be considered questionable or suspicious.

Read also: Hushpuppi: Protesters demand Atiku’s arrest at US Embassy in Abuja

As a Politically Exposed Person (PEP), the Financial Crimes Enforcement Network (FinCEN), an agency of the U.S. Department of Treasury, had placed Atiku and his family members under close watch.

New findings have now shown that FinCEN flagged some transactions linked to the senior politician as suspicious as it surveilled money movements within the international financial system.

These findings also offer fresh insight into how huge funds linked to Atiku may have been moved across international jurisdictions using shell companies.

FinCEN files, a new investigation by the International Consortium of Investigative Journalists, BuzzFeed and 108 media partners across the world, including PREMIUM TIMES, are a large volume of confidential financial reports relating to the transaction activities of world leaders, terrorists, drug dealers and money launderers.

The files included a large number of suspicious-activity reports, SARs, filed by banks and other financial institutions to the US Government as required by the Bank Secrecy Act., with the total amount in suspicious transactions reported being $2 trillion ($2, 099584, 477,415.49).

The SARS flagged subjects, including organisations and individuals, in more than 170 countries, and were obtained and shared by BuzzFeed.

In one of the reports, a $1,018,500 wire transfer on March 5, 2012, was flagged in daily monitoring by Habib Bank Limited New York, HBLNY.