The Nasdaq continued to follow a risk-off narrative as Investors were waiting to hear what Jerome Powell had to say at the Jackson Hole Economic Policy Symposium, in Wyoming.

The Fed chairman called for more vigilance in the fight against inflation, warning that additional interest rate increases could be yet to come.

Although he acknowledged that progress has been made, he also pointed out that inflation is still above what policymakers feel comfortable with. He noted that the Fed will remain flexible as it contemplates further moves, but gave little indication that it’s ready to start easing anytime soon.

Fed’s Powell: We’re Prepared to Raise Rates Further if Appropriate

Fed’s Powell: We Intend to Hold Rates at Restrictive Level Until Confident Inflation’s Moving Sustainably Down to 2%

— *seven (@sevenloI) August 25, 2023

Fed’s Powell: Two Months of Good Data Are Only the Beginning of What We Need to Build Confidence on Inflation Path

Fed’s Powell: Policy Restrictive, but Fed Can’t Be Certain What Neutral Rate Level Is

Fed’s Powell: Signs Job Market Not Cooling Could Also Warrant More Fed Action

— *seven (@sevenloI) August 25, 2023

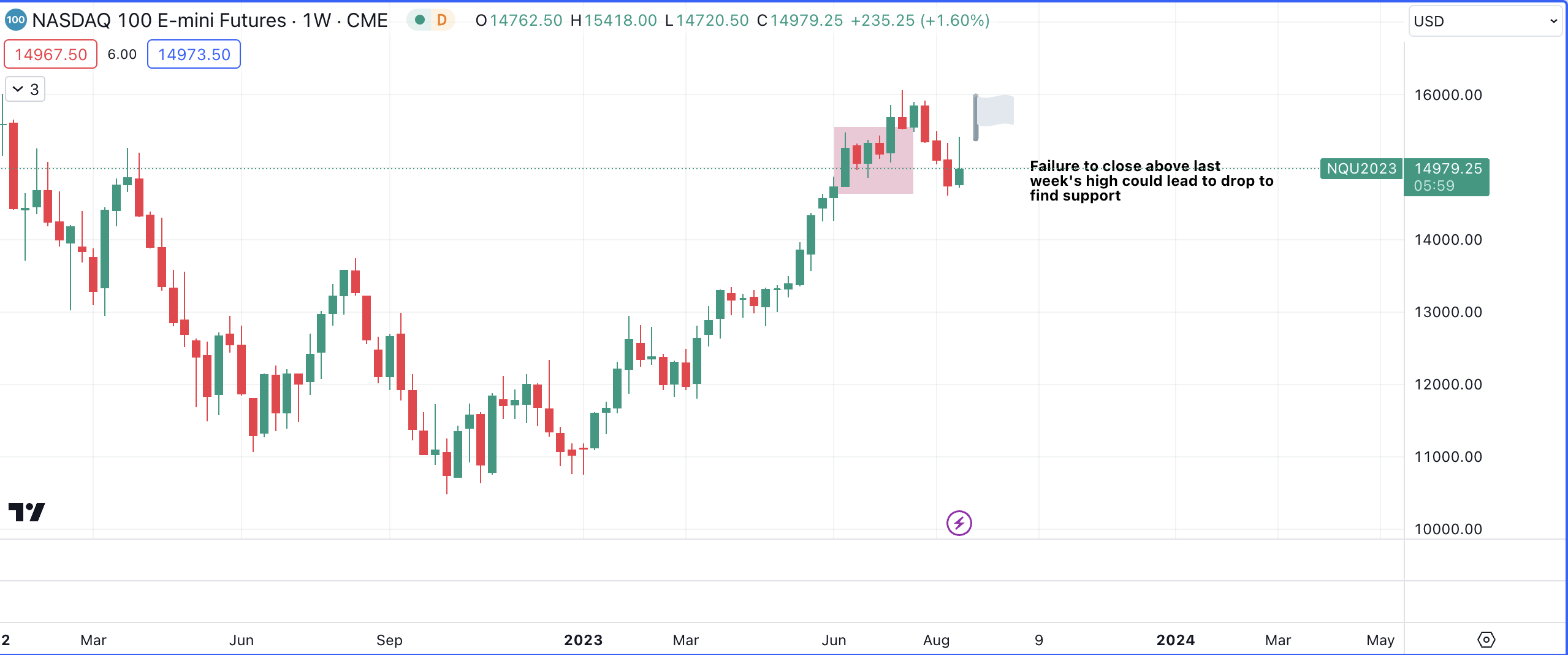

The risk-off sentiment that has gripped the market this month should not come as a surprise given the fact that August is typically a slow, sideways month at best, when seasonality is taken into consideration.

Price could not close above last week’s high after rallying into a point of supply. Although the position of this failed auction makes the possibility of a drop to the lows of 2023 likely, support may still be found at levels like 14000 and 13000 if the volume and price are right at those order blocks. The next thing the bears will need to see is a bearish week to wrap up the month of August.

The $VIX is down -9.37% on the week, $DXY strengthened by +0.73% and the US 10Y bond yield declined by 0.42%.

Premier League

Premier League