On February 27th, a hotter than expected inflation number of 8.5% came out of the Euro bloc and ECB board member Joachim Nagel said the central bank might need significant rate hikes beyond March and should accelerate the rundown of its oversized bond portfolio.

Let us take a look at some of the price action on the EURUSD chart.

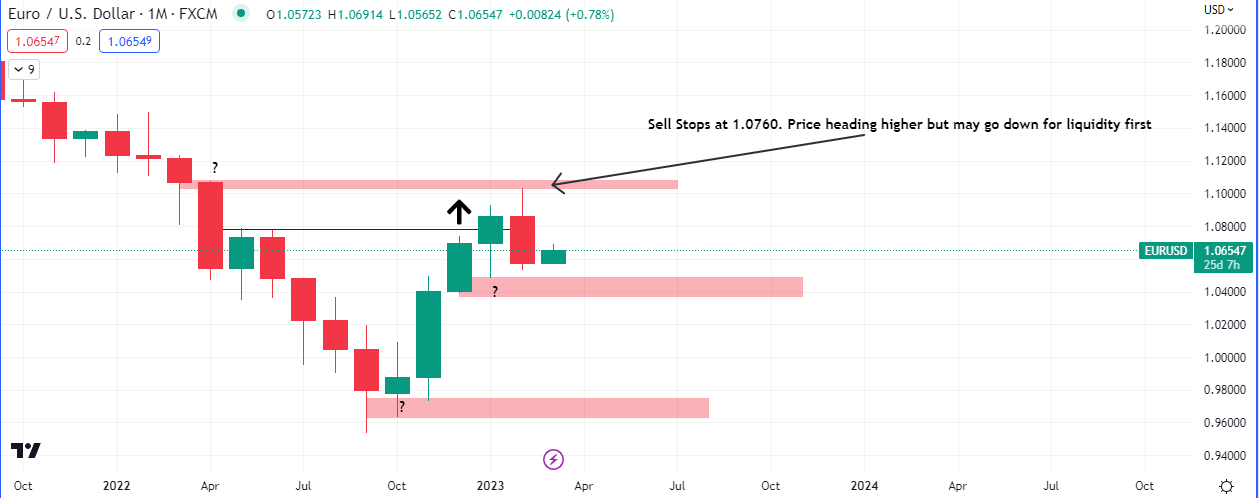

Monthly

The monthly chart looks quite bullish, however a retest of last week’s high could set up a reversal scenario depending on the close.

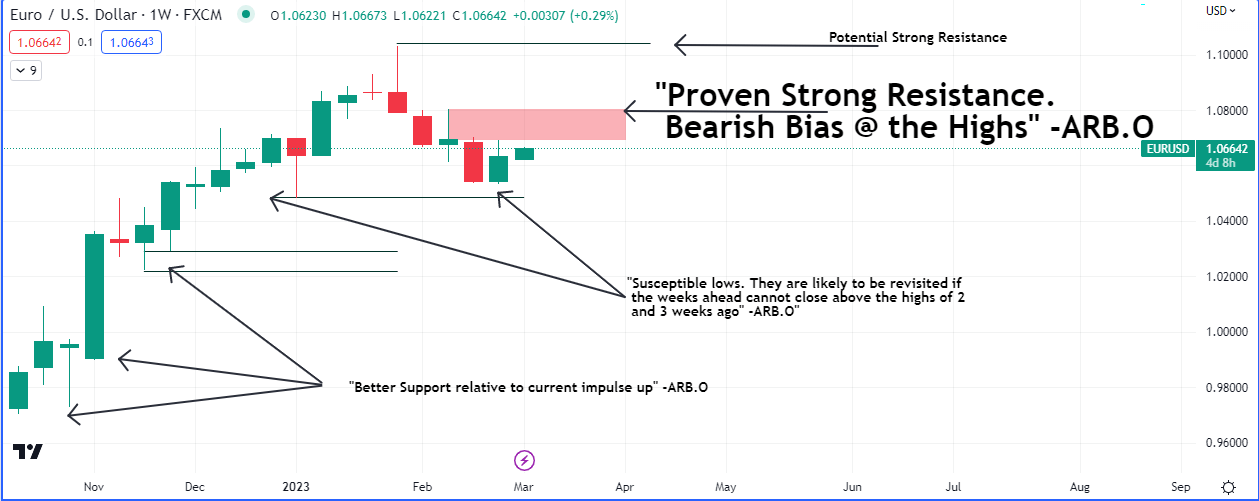

Weekly

The Weekly looks bearish, and the price action of the past 4 weeks have set up a resistance that could push price towards last week’s lows. How the weekly closes in the price area highlighted pink, could give us some clues as to the momentum.

Daily

The daily chart shows 2 failed auctions that could prove to be support, highlighted pink in the chart above.

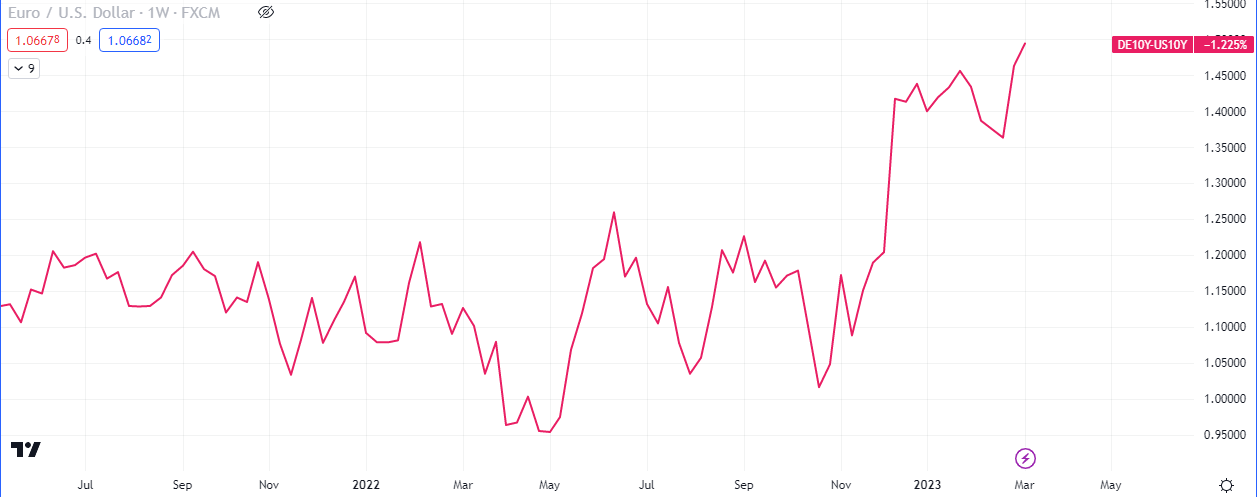

German Spreads (Bonds)

The yield spread for the German 10Y treasury bond and it’s US equivalent is currently making new highs, relative to the past couple of quarters. This is likely to bring in demand for the the Euro on the backs of the ECB’s talk of likely rate hikes around the corner, to curb inflation in Europe.

Outside Market Correlations

$VIX (Volatility) – Positive Correlation-

With the VIX under a resistance likely to take it down to the retest the last swing low, the ‘expectation’ is for $SPX, $NDAQ $DOW and $RUA to continue their recovery. However, the highs of the last two weeks are areas that price could reverse from, depending on the closes.

Oil (Positive Correlation)

Last week $WTI, $BRENT, the Refiner’s margin, the crack spread and the German spreads closed bullish. The benchmarks have pulled back in today’s trading session. Traders will be watching for possible continuations and watching to see what happens with the inventory numbers midweek as well as the Non-Farm Payrolls on Friday.

The recovery going on in China is bullish oil as well due to the massive demand from the second largest economy in the world. Premier Li Keqiang announced a GDP target of 5% for 2023. A disappointing number as traders were anticipating a higher number.

Premier League

Premier League